Financial Literacy

DTB WEALTH MANAGEMENT

Financial Literacy

MARKET UPDATE – AUGUST 2021 – FINANCIAL MARKETS BUFFETED BY CROSS-CURRENTS

The latest World Economic Outlook released by the IMF in late July highlighted the still growing divergence between advanced and emerging market economies. At a global scale, it maintained its forecast 6% growth rate for the world, while upping the rate of growth...

MARKET UPDATE – July 2021 – Inflation Sentiment Changes Continue to Dominate Financial Markets

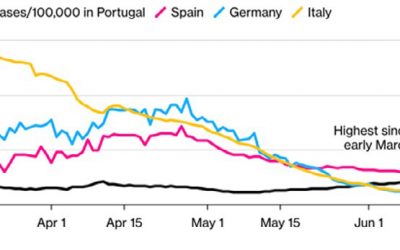

The path to full economic recovery continues apace. Around three billion doses of COVID-19 vaccines have now been administered in what has become a race against ever-emerging variants of the virus. The success of the vaccination campaign in the United States has...

MARKET UPDATE – Inflation Sentiment Changes Continue to Dominate Financial Markets

Stock markets, commodity prices and cryptocurrencies all experienced a volatile May, first climbing strongly and then selling off sharply as inflation fears surged and then subsided. Headline US consumer price inflation came in at 4.2%, well above the US Federal...

MARKET UPDATE – Earnings continue to outpace expectations

Investor sentiment in April was supported by the continued economic recovery. While estimates of 2021 GDP growth continue to rise, the US Central Bank maintains that it is in no hurry to withdraw monetary stimulus. Consequently, many major equity indices have climbed...

MARKET UPDATE – Growth Optimism & Stock Market Momentum Continue to Prevail

Now that spring has sprung, there is a palpable sense of optimism that global growth will surprise on the upside this year, buoyed by the promising pace of vaccine rollouts and economies opening up. The seasonality is no coincidence since the dark days of winter...

MARKET UPDATE – Mounting inflation fears play havoc with financial markets

Financial markets in February were predominantly driven by investor worries about inflation prospects as they ignored the continued assurances from central banks that they do not expect persistent inflation to become a problem. Benchmark US Treasury bond yields toyed...

MARKET UPDATE – Sector Divergence Remains in Focus

The past year has brought not only huge market swings between risk-on and risk-off phases but also a staggering divergence of returns between regions and investment styles. In equities, much of this can be explained by sector performance. The outlook for inflation is...

MARKET UPDATE – Cautious Optimism for 2021 after a Turbulent 2020

Describing 2020 as a roller coaster ride for investors does not do justice to the unprecedented series of events ushered in by the pandemic and the lockdowns across the world. Although many markets sold off steeply into bear market territory as the pandemic escalated...

HELPLINE:

HELPLINE: