Financial Literacy

DTB WEALTH MANAGEMENT

Financial Literacy

MARKET UPDATE – JANUARY 2023

ANNUS HORRIBILIS FOR EQUITIES AND BONDS Stock markets ended 2022 notching up their worst year since 2008. In the US, the S&P 500 fell almost 20% and the Nasdaq ended a full one-third lower while in Europe most indices registered double-digit declines. The large...

MARKET UPDATE – NOVEMBER 2022

UK POLITICS TAKES CENTRE STAGE Markets remained volatile during October and generally in bear market territory. Central banks are still vocally hawkish though a growing number of investors seem optimistic that the pace and extent of rate rises will be less dramatic...

MARKET UPDATE – SEPTEMBER 2022

AUGUST STOCK MARKET RECOVERY KNOCKED BY HAWKISH JACKSON HOLE MESSAGING Developed stock markets sank again at the end of August in the wake of the Jackson Hole central bank get together where it became clear that central bankers were still firmly focused on tackling...

MARKET UPDATE – AUGUST 2022

INFLATION FEARS LEAD TO RALLY IN EQUITIES AND BONDS Equity and bond markets regained some ground during July after the worst first half year for decades. The graph below demonstrates how turbulent this year has been for the global economy and markets. The latest...

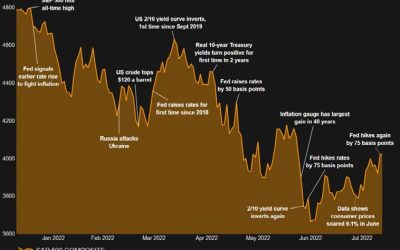

MARKET UPDATE – JULY 2022

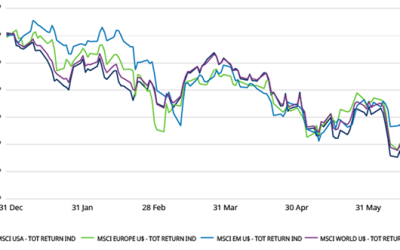

Worst first-half market performance for half a century Stock markets notched up their worst first-half performance since 1970 in the face of fears that tackling sky-high inflation may come at the cost of the global economy’s post-Covid recovery. Recession has become...

MARKET UPDATE – JUNE 2022

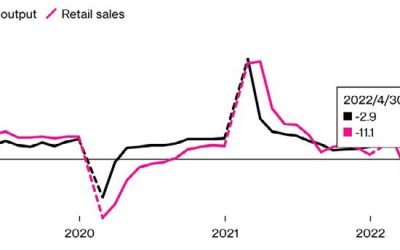

MARKETS VOLATILE BUT CHINA STIMULUS LIFTS MOOD It was an exceptionally volatile month for stock markets with the main developed market indices losing substantial ground before experiencing a bear market rally in the closing days of May. A trifecta of factors was...

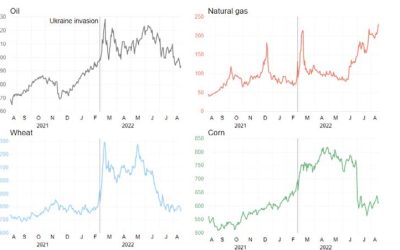

MARKET UPDATE – MARCH 2022 – Ukraine conflict causes equities to decline while oil price surges

The anticipation of Russia invading Ukraine knocked stock markets towards the end of February. Share indices fell between 4% and 8% in the days leading up to the invasion on February 24, but then recovered as the initial sanctions announced were seen as being less...

MARKET UPDATE – FEBRUARY 2022 – EXPECTATION OF MULTIPLE RATE RISES KNOCKS FROTH OFF MARKETS…. BUT OVERALL OUTLOOK REMAINS FAVOURABLE

It’s been a rough start to the year. Geopolitical tensions between the US and Russia have become increasingly acute but it is nervous anticipation of the US Federal Reserve withdrawing monetary policy support that has been the main cause of a spike in financial market...

MARKET UPDATE – NOVEMBER 2021 – Third quarter ends with equity and bond sell-off

During September, the New Horizon strategies gave up gains made earlier in the quarter as turbulent equity and bond markets suffered declines due to a broad range of factors. These included concerns about global growth waning due to the highly infectious Delta Covid...

HELPLINE:

HELPLINE: