Financial Literacy

DTB WEALTH MANAGEMENT

Financial Literacy

MARKET UPDATE – MAY 2024

MAJOR EQUITY AND BOND MARKETS WEAKEN ON STICKY INFLATION AND WEAKER GROWTH April was a more challenging month for stock markets with US equities having a particularly bumpy ride. Investor concerns centred on signs of vulnerability in the US growth outlook and...

MARKET UPDATE – APRIL 2024

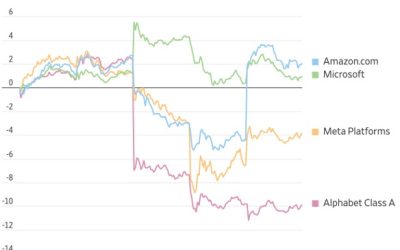

EQUITY MARKETS REACH NEW HIGHS DESPITE CAUTION OVER RATE CUTS The first quarter of the year was characterised by several stock markets hitting all-time highs but with the Magnificent Seven tech stocks no longer driving market performance to the same extent as in 2023....

MARKET UPDATE – JANUARY 2024

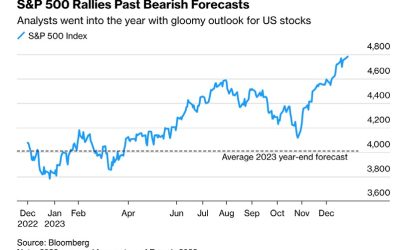

SANTA RALLY FOR STOCKS AND BONDS AS OIL PRICE RETREATS FURTHER The year ended on a high note for stock markets and a ‘Santa Claus rally’ lifted stocks close to record highs. The S&P 500 Index soared 11.7% during the third quarter while MSCI Europe (ex UK) rallied...

MARKET UPDATE – DECEMBER 2023

MARKETS TURN HIGHER ON SOFTER INFLATION DATA Investor sentiment suddenly became positive in November, based on expectations that central banks are winning their fight against inflation and are likely to start reducing interest rates as early as the second quarter of...

MARKET UPDATE – NOVEMBER 2023

CONTINUED DECLINES IN GLOBAL EQUITY MARKETS Stock markets struggled for a third consecutive month as concerns persisted regarding the potential impact on the global economy from interest rates remaining higher for longer in the face of still strong activity in the US....

MARKET UPDATE – OCTOBER 2023

SEASONAL FALLS FOR EQUITIES AND BONDS Financial markets had a tough third quarter, with September yet again weak as equity and bond prices tumbled. Optimism regarding interest rate declines in Q4 and further reductions early in 2024 was dispelled as the US economy...

MARKET UPDATE – SEPTEMBER 2023

MARKETS TURN NEGATIVE ON FURTHER RATE RISE FEARS August turned into a poor month for both equities and bonds as surging US rate expectations and weaker growth in Europe and China challenged the Goldilocks scenario. Erratic price action was exacerbated by thin summer...

MARKET UPDATE – JUNE 2023

COMMODITIES, BONDS AND EQUITIES LOWER DESPITE TECH ADVANCES It was a month when this year’s acute focus on US Fed interest rate moves shifted to the possibility of a US government debt default as the debt ceiling threatened to be breached in early June. As expected,...

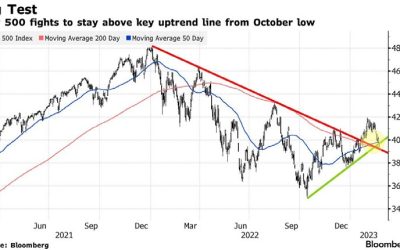

MARKET UPDATE – MARCH 2023

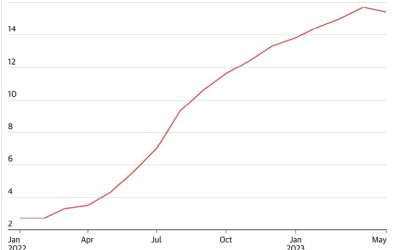

ROBUST US ECONOMY CAUSES RENEWED BOND SELL-OFF Stock markets took fright during February as US economic data came in much hotter than expected. The labour market showed continued strength while both inflation and retail sales were higher than expected. This raised the...

HELPLINE:

HELPLINE: