MARKETS TURN NEGATIVE ON FURTHER RATE RISE FEARS

August turned into a poor month for both equities and bonds as surging US rate expectations and weaker growth in Europe and China challenged the Goldilocks scenario. Erratic price action was exacerbated by thin summer liquidity although markets did stage a modest comeback in the final few days.

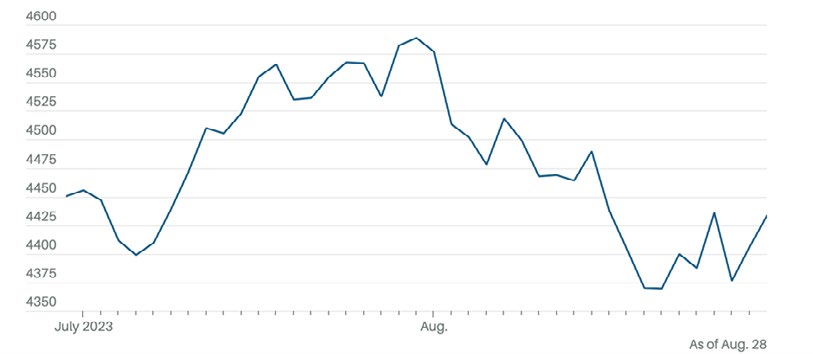

The S&P500 fell 1.6% during the month while the Nasdaq was bolstered by positive news that Nvidia had partnered with Google, giving Google Cloud users greater access to Nvidia’s powerful graphics processing units. For the month, however, the Nasdaq index declined 1.5%..

The S&P 500 notched its first back-to-back daily gains since the end of July

Source: Factset

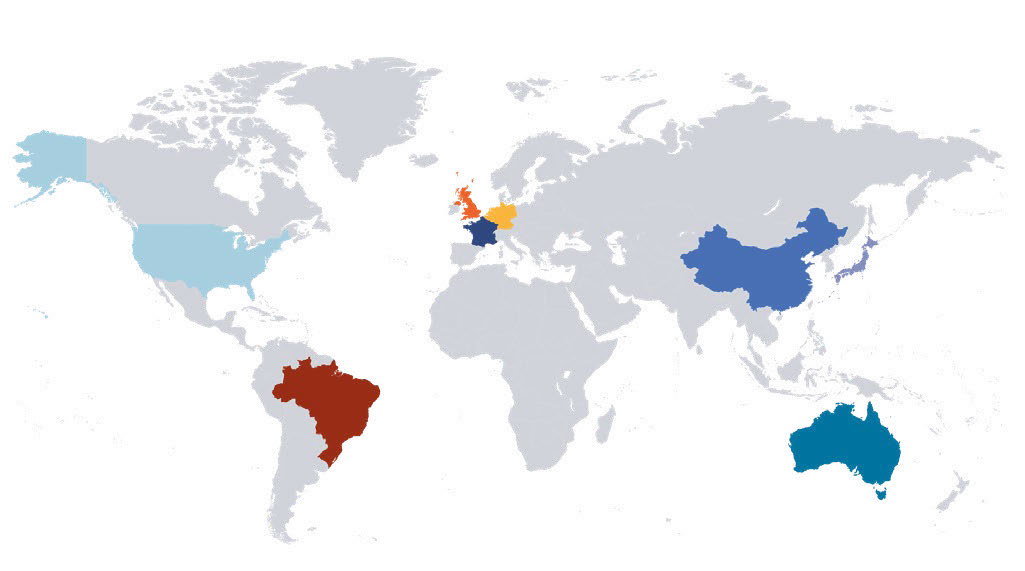

In the UK, the FTSE 100 has been the poorest- performing developed stock market this year and fell 2.5% in August while challenging economic conditions in Europe, particularly Germany, the Netherlands and Italy, led to a similar fall for the Euro Stoxx 500 Index. The FTSE Emerging Market index ended the month more than 5% lower.

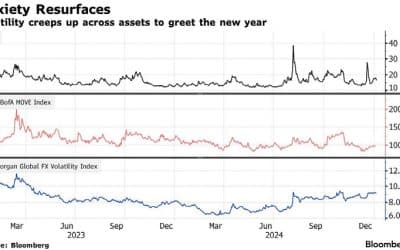

More positive was the easing of volatility at the end of the month, suggesting that investors may be in for a smoother ride in September. The Cboe Volatility Index (VIX), viewed as the world’s “fear gauge”, was trading at less than 15 by month end. Another more forward-looking index, the VVIX, was at its lowest levels since before the Silicon Valley Bank collapse in March.

US Federal Reserve re-iterates data-driven interest rate stance at Jackson Hole summit

Earlier in August, sentiment was buoyant as investors welcomed the disinflation becoming evident in the headline and core inflation indices. Headline inflation in the US grew by a mere 0.2% in June, which was lower than expected, and came in at 3% year on year. Core inflation, which has proved stickier, also rose a less-than-expected 0.2% – down on the previous 0.4% monthly increase. Annual core inflation was 4.8%.

However, with US economic data coming in hot ahead of the Jackson Hole event, there was a significant swing in expectations to the downside as reality settled in that the US Federal Reserve, whose actions tend to lead the world’s other central banks, may not reduce interest rates as soon as expected.

In essence, Federal Reserve chair Jerome Powell indicated that rate moves would continue to be determined by whether the Fed had confidence in the inflation rate “moving sustainably down toward our objective”. He believed that would only be possible if there were a period of below- trend growth and softer labour market conditions. He reiterated that, for now at least, the inflation target would remain at two per cent.

The unique challenges now facing central banks in effectively managing inflation also came through strongly at the event. The tectonic shifts underway include the scars left by the Covid pandemic, geopolitical fragmentation – which will have a long-lasting impact on global supply chains – ageing demographics and the climate transition, all of which contribute to monetary policy becoming a less effective tool to manage economic forces.

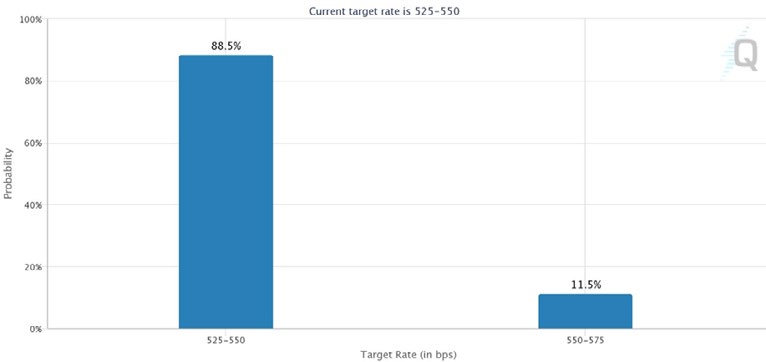

In the wake of Jackson Hole, the proportion of contributors to the CME Fedwatch Tool who believe the Fed will keep interest rates unchanged at its next meeting increased to 88.5%. They also expect:

- Another 25-basis point hike is likely in Q4 2023

- The Fed to gradually begin to ease rates as inflation continues to abate; and

- That rates will remain in restrictive territory until at least the end of 2024 as inflation slowly falls to its 2% annual target.

Target rate probabilities for 20 Sep 2023 Fed Meeting

Source: CME Group

Crypto products based on spot prices look set for launch

In August, the crypto market was full of surprises after the US Court of Appeals ruled against the SEC’s denial of Grayscale’s application to convert its trust into a spot bitcoin ETF (exchange-traded fund).

Investment industry interest in setting up spot-based ETFs came under the spotlight during the month and looked set to be thwarted when the SEC rejected these products. Industry stalwarts Blackrock, Fidelity and Invesco have been eagerly awaiting the outcome of the Grayscale appeal, which paves the way for them to also set up spot bitcoin products trading off the current spot price of the cryptocurrency rather than bitcoin futures.

Understanding Bitcoin’s Price Movement

Source: Trading-Education / Yahoo Finance

There are, however, some concerns that these products will add to already significant speculation in the cryptocurrency. The SEC has been loath to give the go ahead based on liquidity and manipulation concerns and the belief that individual investors may not be sufficiently prepared for the volatility of the cryptocurrency, which gained 305% in 2020 and lost 64% in 2022.

GLOBAL MARKET RETURNS AUGUST 2023

HELPLINE:

HELPLINE: