AUGUST STOCK MARKET RECOVERY KNOCKED BY HAWKISH JACKSON HOLE MESSAGING

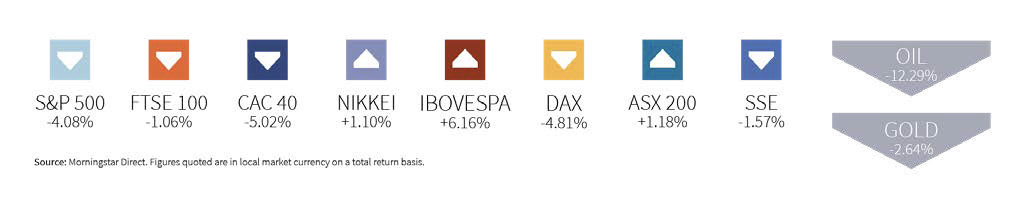

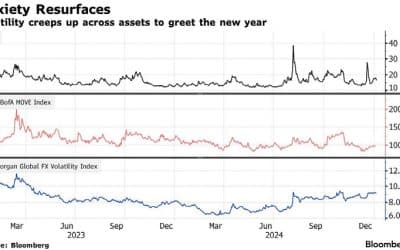

Developed stock markets sank again at the end of August in the wake of the Jackson Hole central bank get together where it became clear that central bankers were still firmly focused on tackling high inflation with further higher interest rate rises, despite the negative knock-on effects. As a result, broad US and European markets reversed gains made earlier in the month and most ended it over 4% lower. It was also a weak month for fixed income investments and the value of longer-dated bonds in the UK and Europe registered double-digit declines in August alone. The recent fall in most stock markets cut short a recovery in equities that had been underway since mid-June.

The war, inflation, hefty central bank interest rate hikes and the prospect of recession continue to weigh on investor sentiment. The S&P 500 has lost 16% year-to-date and the MSCI Europe (ex-UK) Index has fallen by 15%. Larger companies in the UK are broadly unchanged, supported by the resilience of oil and pharmaceutical stocks but outside of those, declines are similar to those in the US and mainland Europe.

“THE WAR, INFLATION, HEFTY CENTRAL BANK INTEREST RATE HIKES AND THE PROSPECT OF RECESSION CONTINUE TO WEIGH ON INVESTOR SENTIMENT”

The Eurozone faces the toughest headwinds into the winter. The region faces acute energy uncertainty and shortages. Although countries have managed to stock up on gas reserves, the prospect of Russia completely turning off the taps still looms large. To date, Gazprom has reduced gas supplies via the Nord Stream 1 pipeline by 75%. At time of writing, it has switched off supply again and has warned that it may have to engage in further “maintenance” before the end of the year. Gas prices have risen to 270 euros/MWh from under 50 euros/MWh this time last year.

Optimism that inflation may have peaked in July in the US gave investors a temporary reprieve, with consumer price inflation falling to 8.5% from 9.1% the previous month as a result of lower fuel prices, airline fares, clothing and education costs. However, while food and energy prices are well off their highs, labour markets remain tight and the ongoing war and growth challenges facing China contribute to an uncertain macro-economic outlook and possible future upward pressure on prices.

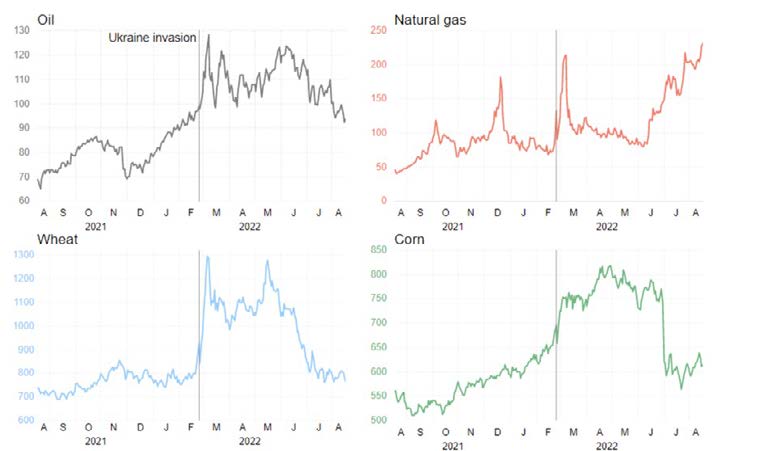

Six months of war – Oil, gas, wheat and corn costs soared following Russia’s invasion, but only gas is still spiking

Source: Refinitiv Datastream

Emerging markets offer opportunities amid the uncertainty

China’s State Council has surprised markets with the extent of its huge stimulus programme to get the economy back on track and deliver its targeted 5.5% growth rate. To date, that has seemed a tall order for the world’s second largest economy as it has contended with the government’s zero- Covid strategy and property market woes. The stimulus programme will be targeted at reviving infrastructure investment, the property sector and private business.

“GAS PRICES HAVE RISEN TO 270 EUROS/MWH FROM UNDER 50 EUROS/MWH THIS TIME LAST YEAR”

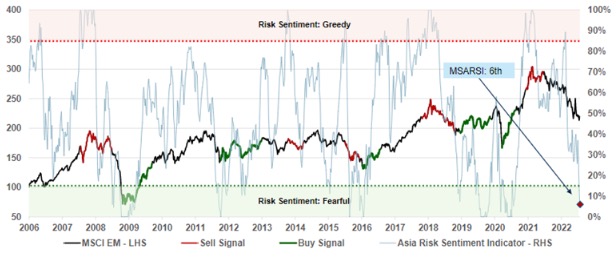

Emerging markets have had a tough time of it this year, with risk-off sentiment prevailing and a strong dollar weighing on their currencies. However, periods of such extreme risk-off sentiment have proved to be an excellent time to buy. In particular, Q2 2020, Q3 2019, Q1 2016, Q4 2011 and Q1 2009 all saw high risk-off sentiment indicators followed by strong equity performance as shown in the chart below.

Opportunities amid extreme bearishness

Source: Morgan Stanley.

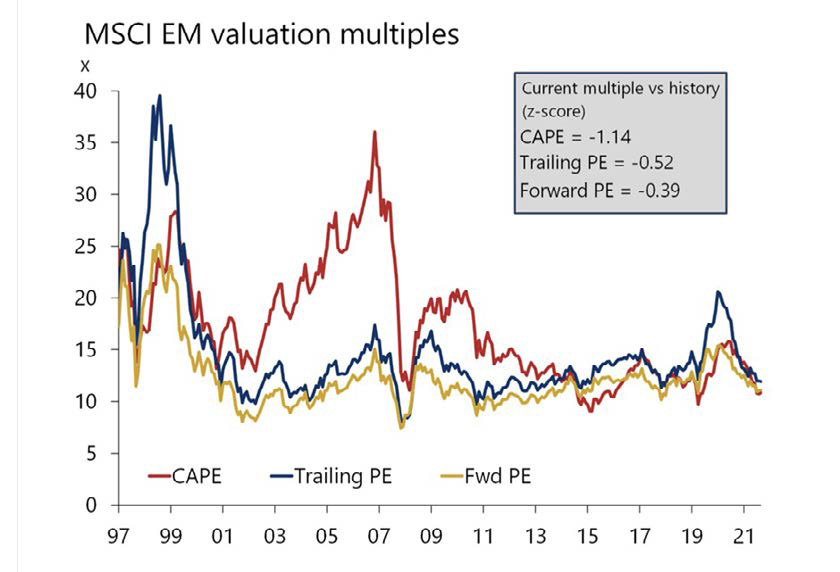

With emerging market (EM) equities harder hit than developed market (DM) equities over the past few years, valuations have become more compelling. Economic growth should remain resilient as a result of higher commodity prices and a likely softening in some of the punitive measures being taken against Chinese technology companies.

“WHILE FOOD AND ENERGY PRICES ARE WELL OFF THEIR HIGHS, LABOUR MARKETS REMAIN TIGHT”

In many EMs, interest rates were hiked earlier than in DMs and there is more policy room to counteract a global economic downturn. If inflation has indeed peaked in the US, it would give cause for some optimism as, historically, periods of high but falling inflation have been extremely positive for EM equities.

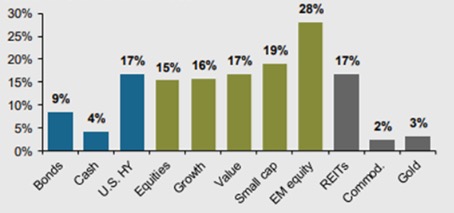

High and falling inflation Occurred six times since 1988

Source: JP Morgan

Emerging markets offer access to higher economic growth and are trading at about a 30% valuation (price to earnings) discount to developed markets. They offer a higher dividend yield, a higher free cash flow yield and a return on equity profile that has been improving since the end of 2020.

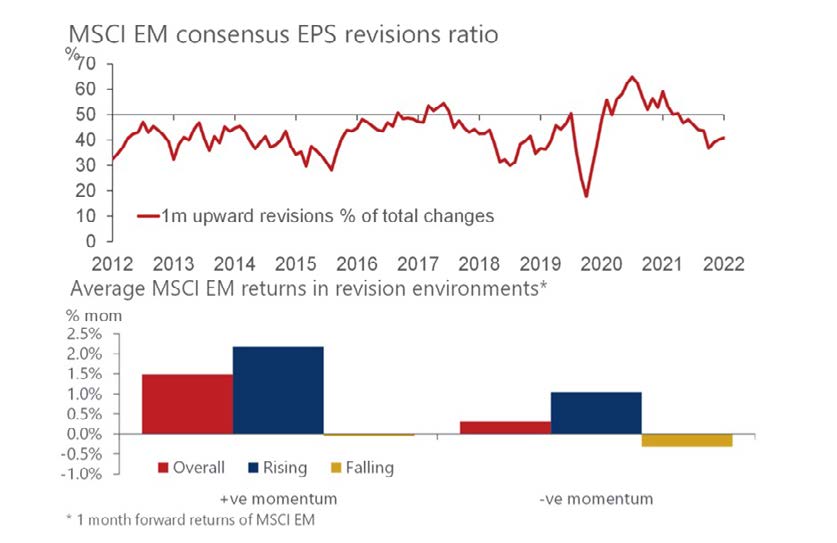

There is also the potential for an ongoing recovery in earning per share (EPS) momentum, led by China, with signs that the prolonged profit downgrade cycle may be coming to end, as evidenced in the relatively encouraging second quarter reporting season. The graph below from Oxford Economics shows that while the aggregate EM earnings per share revisions ratio is still below 50 (signalling more downward than upward revisions), it has begun rising. This trend has also typically represented a shift to a positive environment for EM equity returns. This contrasts with DMs, and in particular the US, where EPS revisions are still deteriorating.

The EM EPS downgrade cycle is moderating, usually positive for returns

Source: Oxford Economics

“EMERGING MARKETS OFFER ACCESS TO HIGHER ECONOMIC GROWTH AND ARE TRADING AT ABOUT A 30% VALUATION DISCOUNT TO DEVELOPED MARKETS”

Valuations appear to offer some cushion to downside risks

Source: Oxford Economics

Equity exposure, particularly to Europe, was reduced in the New Horizon strategies at the start of August in anticipation of the volatility we are now seeing. Once the outlook improves again, it may be that certain emerging markets provide the most compelling case for re-investment.

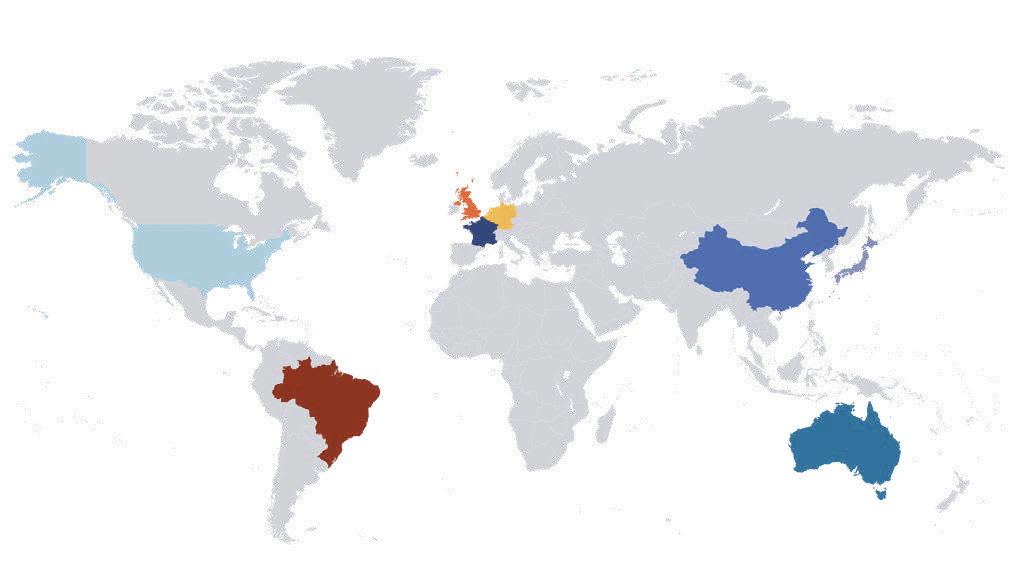

GLOBAL MARKET RETURNS – AUGUST 2022

HELPLINE:

HELPLINE: