VOLATILE THIRD QUARTER ENDS WITH BOOST FROM US INTEREST RATE CUT AND CHINA STIMULUS

The third quarter ended positively for both equity and bond markets. The heightened volatility of early August – due to fears of a US recession, the unwinding of the yen carry trade (that is, buying yen to exchange and invest in other countries) and tumbling tech valuations – dissipated as quickly as it arose. Easing monetary policy, including a 50 basis point (bp) interest rate cut in the US and a significant stimulus package in China, was enough to ensure most assets ended the quarter in the black. Commodity price movements were mixed but the gold price rallied by 14%. A weakening US dollar meant performance of gold and other assets when denominated in other major currencies appeared lower.

“THE MSCI EUROPE INDEX ENDED THE MONTH SLIGHTLY LOWER ON GROWING CONCERNS ABOUT THE HEALTH OF THE REGION’S ECONOMY”

In September, the US S&P 500 rose by another 2.1% but European markets struggled. The MSCI Europe Index ended the month slightly lower on growing concerns about the health of the region’s economy, while the UK FTSE All-Share Index declined by 1.3%.

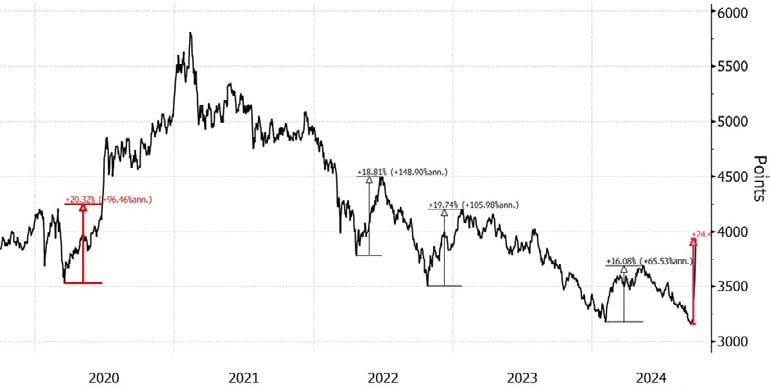

A far-reaching, and long-awaited, government stimulus package in China saw the CSI 300 skyrocket 7.7% in a single day – its largest gain since 2015. The surge in the closing days of September came after Beijing’s latest measures to tackle its property crisis, including relaxed rules for homebuyers in major cities and cuts to mortgage rates. By month-end, the index had soared over 20% from its mid-September lows, technically entering bull market territory.

The ripple effects of China’s stimulus investors bet on improved demand were felt globally. Mining and materials from the world’s top consumer of steel-firms saw increased interest as making ingredients.

China CSI 300 Index is headed for bull market

Source: Bloomberg

“US INFLATION MODERATED TO 2.5% IN AUGUST, DOWN SIGNIFICANTLY FROM ITS 9.1% PEAK IN JUNE 2022”

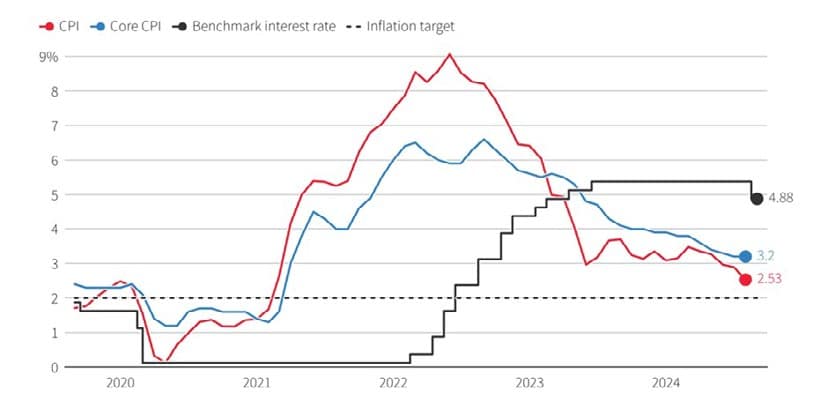

Interest rates set to fall as inflation nears targets

The global focus has remained firmly on inflation and interest rates. In the US, the Federal Reserve announced a 50 bp reduction in the repo rate based on the progress made in inflation and emerging labour market concerns.

US inflation moderated to 2.5% in August, down significantly from its 9.1% peak in June 2022. The Fed’s preferred measure came in at 2.2%, lower than expected. This progress has fuelled expectations of further monetary easing, with markets pricing in up to a full percentage point of rate cuts by the year end.

US inflation and interest rates Benchmark interest rate and year-on-year change in CPI inflation

Source: Bureau of Labor Statistics; LSEG

Analysts remain positive regarding corporate earnings for 2025, forecasting 15.2% earnings growth and 5.9% revenue growth for S&P 500 companies. However, these projections may prove optimistic in an environment of weakening inflation and ongoing debate about the possibility of recession versus a soft landing in the US economy.

The gap between projected earnings growth and revenue growth is one of the widest in at least 13 years, implying a need for exceptionally high margins to meet expectations. At 21.4, the forward 12-month P/E ratio is also above the 5-year average of 19.5 and the 10-year average of 18.0.

“THE GAP BETWEEN PROJECTED EARNINGS GROWTH AND REVENUE GROWTH IS ONE OF THE WIDEST IN AT LEAST 13 YEARS”

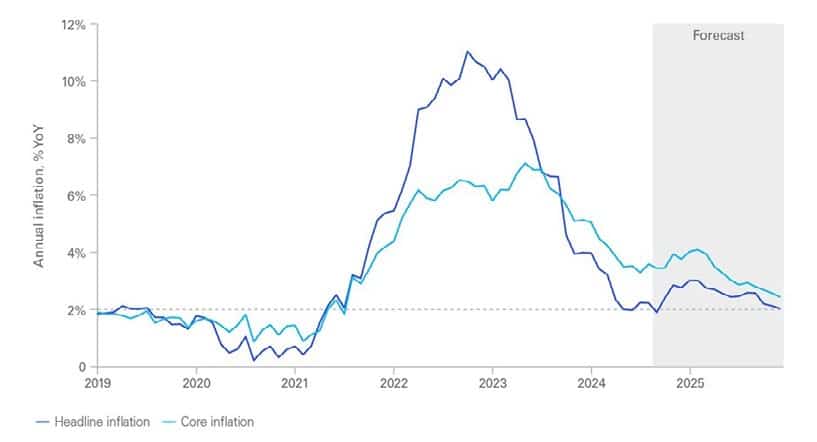

In Europe, the region’s economic challenges, including stagnation in Germany and rising unemployment, means the ECB is expected to embark on a more aggressive easing cycle than the Fed and Bank of England. A sharp drop in inflation -with France reporting 1.5% and Spain 1.7% in September – strengthens the argument for further rate cuts.

The Bank of England is expected to take a more cautious approach to monetary easing. Inflation in the UK is projected to fall below 2% in September. However, some forecasts indicate it surpassing 3% again in early 2025, due to higher energy prices and persistent services inflation, before moderating and returning to target by the end of 2025.

Inflation has risen above target again

Source: ONS; KPMG projections

The labour market in the UK continues in the unemployment rate. Despite to loosen, with expectations of slowing improvements in household incomes, pay growth and a modest increase this could impact consumer spending.

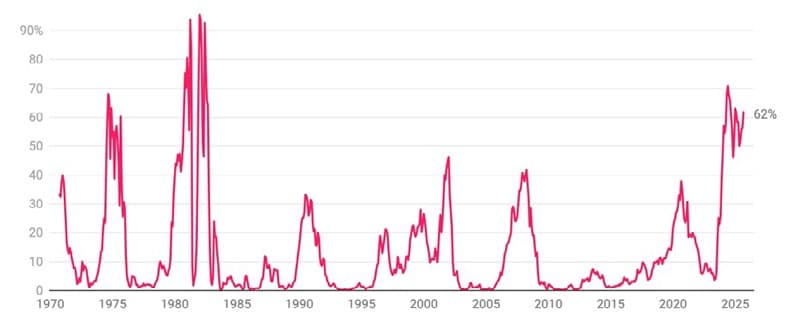

Recession: a fading spectre or lurking threat?

The probability of a US recession 25% chance of recession in the next remains a topic of heated debate. 12 months, the New York Fed’s model While S&P Global Ratings suggests a gives a more alarming 62% likelihood.

“A SHARP DROP IN INFLATION WITH FRANCE REPORTING 1.5% AND SPAIN 1.7% IN SEPTEMBER – STRENGTHENS THE ARGUMENT FOR FURTHER RATE CUTS”

New York Fed sees 63% chance of a recession A recession probability of over 60% has not been suggested since the early 1980s

Source: Federal Reserve Bank of New York

Arguments supporting a potential recession include:

- The Sahm rule, a previously foolproof recession indicator, at 0.57% has crossed its 0.5% recession threshold. This is notwithstanding the creator of the rule having dismissed its relevance in the current circumstances

- Rising unemployment, though primarily due to labour force growth rather than job losses

- Increasing credit card and auto loan delinquencies

Factors suggesting the US may avoid a recession include:

- Continued strength in consumer spending

- Solid corporate profit margins keeping layoffs relatively low

- The Fed’s willingness and capacity to cut rates pre-emptively to support growth

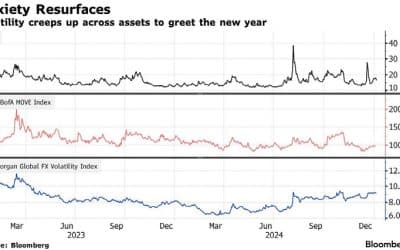

US election: markets brace for volatility

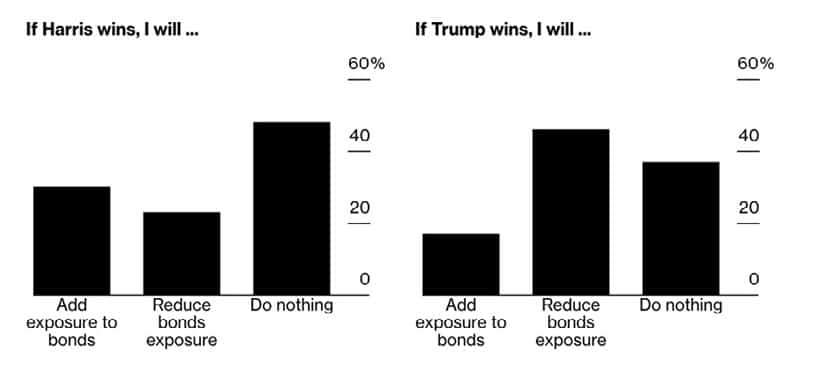

With the US presidential election looming, investors have begun positioning for potential market impacts. A Bloomberg survey has revealed stark differences in investor sentiment depending on the outcome:

- 50% of respondents plan to increase equity exposure if Trump wins, compared to only 28% for a Harris victory

- Nearly half would reduce bond exposure under a Trump presidency, versus 23% for Harris

Traders plan to cut bond exposure under Trump Institutional investors polled by Bloomberg said:

Source: Bloomberg MLIV Pulse survey

As September drew to a close, the financial markets stood at a crossroads. China’s stimulus-driven rally provided a bright spot in an otherwise cautious global landscape. Investors remain on high alert, balancing optimism about potential rate cuts against concerns over earnings growth and recession risks. With the US election on the horizon, market participants are braced for a potentially volatile year end.

“THE LABOUR MARKET IN THE UK CONTINUES TO LOOSEN, WITH EXPECTATIONS OF SLOWING PAY GROWTH AND A MODEST INCREASE IN THE UNEMPLOYMENT RATE”

HELPLINE:

HELPLINE: