SEASONAL FALLS FOR EQUITIES AND BONDS

Financial markets had a tough third quarter, with September yet again weak as equity and bond prices tumbled. Optimism regarding interest rate declines in Q4 and further reductions early in 2024 was dispelled as the US economy demonstrated unexpected resilience. This firmly embedded a higher- for-longer interest rate narrative in investors’ minds during September.

The “Magnificent Seven” tech giants, namely Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms, experienced notable share price dips in September. However, their remarkable gains earlier in the year have kept these stocks significantly ahead of the broader market. An index of these seven stocks has surged by over 50% this year whereas an equally weighted S&P500 is up just 1.8%.

In the third quarter, the S&P 500 declined by 3.7% and September saw both the S&P 500 and the Nasdaq decline by 5%.

Across the Atlantic, the FTSE 100 was the standout performer, gaining 2.1% in the quarter and 2.4% in September. In contrast, MSCI Europe (ex UK) fell 3.0% in the quarter and 2.5% in the month, weighed down by recession fears and hawkish signals from the European Central Bank. These came despite hints from ECB President Christine Lagarde that interest rates may have peaked.

China faced persistent economic challenges in September, contributing to the overall quarterly losses. The CSI 300 index lost 2.9% in the quarter. Sentiment remained pessimistic, particularly concerning the property market’s woes. Japan’s Nikkei index lost 3.3% in the quarter and 1.5% in September due to concerns that a rise in inflation may prompt the Bank of Japan to tighten policy through a combination of higher rates and lifting or removing its yield curve control.

Will the Fed achieve a soft landing in the US?

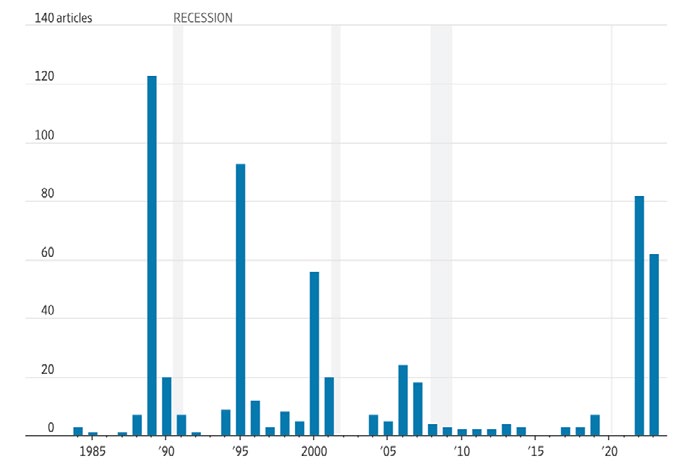

Debate continues as to whether the Federal Reserve can achieve a soft landing in the US. Opinions are divided between those who believe in the Fed’s ability to navigate a task that has historically been extremely challenging and those who anticipate

the economically damaging impact of high interest rates has yet to be fully felt. Commentators have referenced a range of historical templates (notably Wall Street Journal articles) for managed declines, soft landings and recessions.

Number of Wall Street Journal articles that reference a ‘soft landing’

Source: WSJ archives

The weight of opinion seems to be settling on the likelihood of a mild recession, particularly since consumers appear to be coming under increasing pressure. Covid support package savings are dwindling and students are resuming loan payments, affecting disposable income. Decreased consumer demand indicators in September, such as a shift towards cheaper purchases

and reduced leisure bookings, have raised concerns. Higher gas prices present additional challenges and smaller company bankruptcies are on the rise.

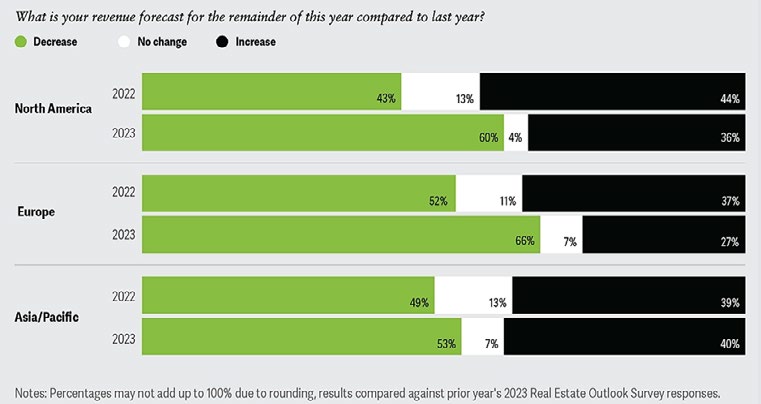

This has translated into a decline in the S&P Consumer Discretionary Index, which fell 8.4% in the last half of September. The S&P 500 declined by 4.8% over the same period.

Consumer discretionary stocks retreat from a recent high

Source: Bloomberg

Bank of America remains optimistic, citing the resilience of the labour market and rising wages. However, others, including a former Powell adviser, express scepticism, emphasising the need for luck in achieving a soft landing.

The prospect of a government shutdown has also increased risk aversion and highlighted the dysfunctional state of US politics. The term premium applied by investors to longer-dated debt has risen on concerns over disruption and the medium-term trajectory of US fiscal policy. The expectation of higher interest rates in the long term, slower foreign investment and China reducing holdings are all contributing to the bond sell-off.

In the New Horizon strategies, US exposure remains spread across the range for market cap and style. Targeted exposure to US companies paying a high dividend performed well with a 9% quarterly gain while most of the US technology exposure ended lower.

Can the UK and Europe avoid recession?

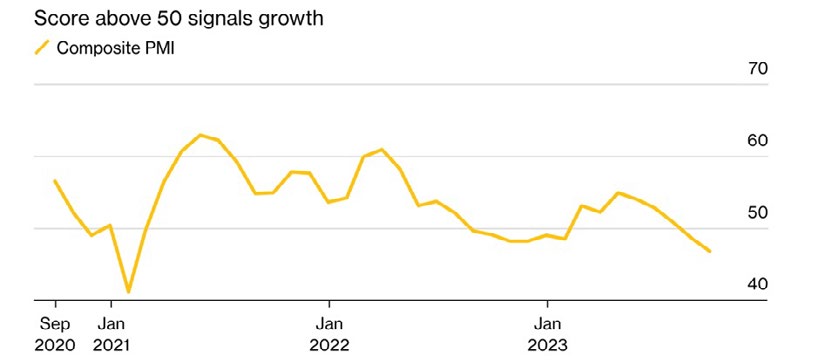

The UK does appear poised for a recession with economic indicators signalling a rough fourth quarter. Purchasing managers’ indices are in contraction territory – below 50, unemployment is expected to rise, and the Bank of England may halt interest rate rises. Central bank officials are not envisaging a recession to set in this year but have reduced their growth forecast for the quarter to 0.1% versus 0.4% previously.

PMIs

The UK PMI fell deeper into contraction territory in September

Source: S&P Global

On a positive note, UK inflation has continued declining to its lowest level since February 2022, coming in at 6.7% in August, which was well below an expected 7% – easing earlier concerns that the UK economy was facing down the prospect of entrenched stagflation.

Exposure to UK equities within the New Horizon strategies has been reduced further while bond exposure has increased slightly, taking advantage of the higher yields available.

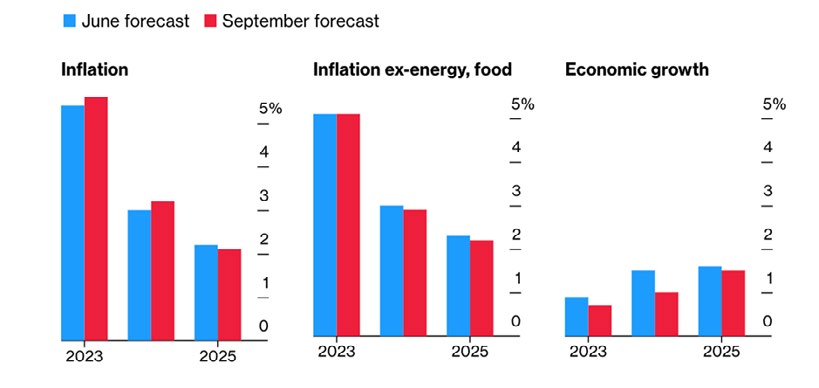

In Europe, marginal improvements in PMIs time”. New Horizon European exposure is are unlikely to signify that recession risk tilted to smaller capitalisation equities which is averted. The IMF suggested that the outperformed their larger cap equivalents European Central Bank should delay interest in the third quarter, reversing the trend of rate cuts to achieve its inflation target. The recent years.

ECB, which raised interest rates for the 10th

time in September, is expected to keep The ECB has downgraded its growth outlook, interest rates elevated for “a sufficiently long with sluggish growth noted since 2022.

ECB’s revised economic outlook

Source: ECB

Investors await further stimulus to the Chinese economy

China continues to grapple with economic challenges stemming from the property sector. Government stimulus measures have fallen short of some market expectations as investors await more comprehensive fiscal and monetary accommodation and the transfer of non-performing property-related debt from overly indebted local governments to the central government.

Reticence to bring out the big guns signals that China’s president, Xi Jinping, is unwilling to implement more aggressive stimulus measures until there is further deterioration in the economy. That does look likely, with the IMF predicting that Chinese growth will come in under 4% this year, a significant departure from earlier projections of a growth rate at 5.5% or higher.

Although the World Bank left its 2023 economic growth forecast for China unchanged at 5.1%, it lowered its 2024 estimate to 4.4% from 4.8%, attributing the lower growth forecast to elevated debt levels and property sector weakness.

In China, consumption contributes only 37% to GDP in contrast to more than 60% of GDP in advanced economies. A far higher proportion of its GDP stems from investment (42% of GDP) which has contributed to excess debt being tied to projects where returns do not cover the cost of borrowing.

Russell Investments, however, suggests it would be unwise to underestimate China’s long-term prospects given its manageable debt levels, ongoing urbanisation and educational advantages.

New Horizon exposure to China comes predominantly from large, broad-based technology companies where there is growing awareness of potential benefit from AI initiatives. Performance over the quarter was volatile but ended with small gains.

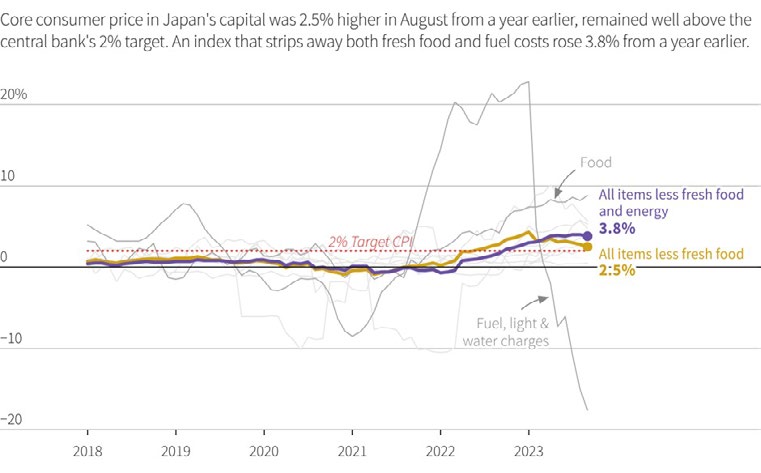

A novelty for Japan

Continued inflationary pressures introduce the possibility that the Bank of Japan may raise its negative benchmark short-term interest rate, which has been in place since 2016. A weak yen is putting upward pressure on import prices and inflationary pressure may be emerging in an economy where consumers have for decades become accustomed to prices remaining flat or declining.

However, Bank of Japan Governor Kazuo Ueda remains cautious, indicating the Bank awaits sustained inflation near its 2% target and emphasising the need to consider the impact on economic growth. Tokyo consumer inflation, excluding food and energy, came in at 3.8% for August, while food and services prices remain stubbornly high. Although core inflation (excluding food prices) has declined for three consecutive months, it is doing so less quickly than anticipated by the central bank.

Tokyo’s core inflation slows for a third straight month

Source: LSEG Datastream; Reuters

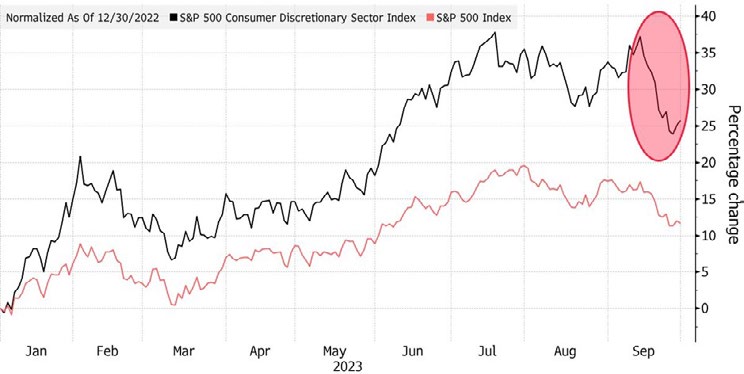

High interest rates, rising expenses and diminishing revenue expectations – at their lowest level since 2018 – are prolonging the challenges faced by the global property sector. Difficulties in raising capital and its high cost are expected to continue through 2024.

Across regions, most respondents are bracing for even lower revenues in 2023

Source: Deloitte

Property sales volumes so far in 2023 have declined by around 60% globally, by 63% in the US, 62% in Europe and 50% in Asia- Pacific. Nearly a trillion dollars of debt is set to mature over the next two years in the US posing refinancing difficulties in the current lending environment of high borrowing costs and risk-averse lenders. Within the New Horizon strategies, property exposure has been reduced further, particularly to Real Estate investment trusts predominantly linked to office and retail space.

Despite these many headwinds, Deloitte suggests the sector may stabilise in 2024 and identifies data centres as an area of growth while the office sector continues to grapple with weak conditions from hybrid working. More diverse sectors such as care homes and self-storage properties show greater promise, and these are areas that remain targeted by the New Horizon strategies.

GLOBAL MARKET RETURNS Q3 2023

HELPLINE:

HELPLINE: