CONTINUED DECLINES IN GLOBAL EQUITY MARKETS

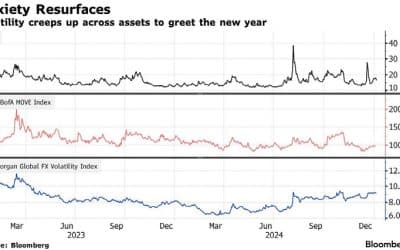

Stock markets struggled for a third consecutive month as concerns persisted regarding the potential impact on the global economy from interest rates remaining higher for longer in the face of still strong activity in the US. In particular, rising yields from longer-dated bonds made it a tough month for both equity and bond investors.

The situation for markets became more complex due to the hostilities between Hamas and Israel and apprehension about the conflict spreading further if Lebanon’s

Hezbollah and Iran become involved. An initial rally in the oil price faded as the month progressed but the gold price more than recovered the 5% fall suffered in the fortnight prior to the initial attack on 7 October.

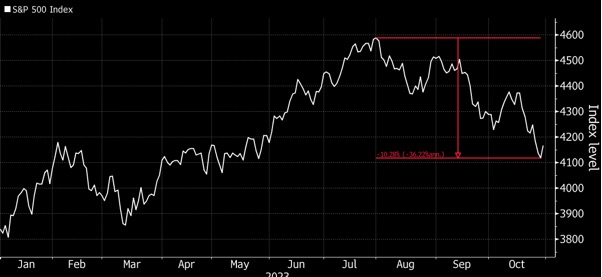

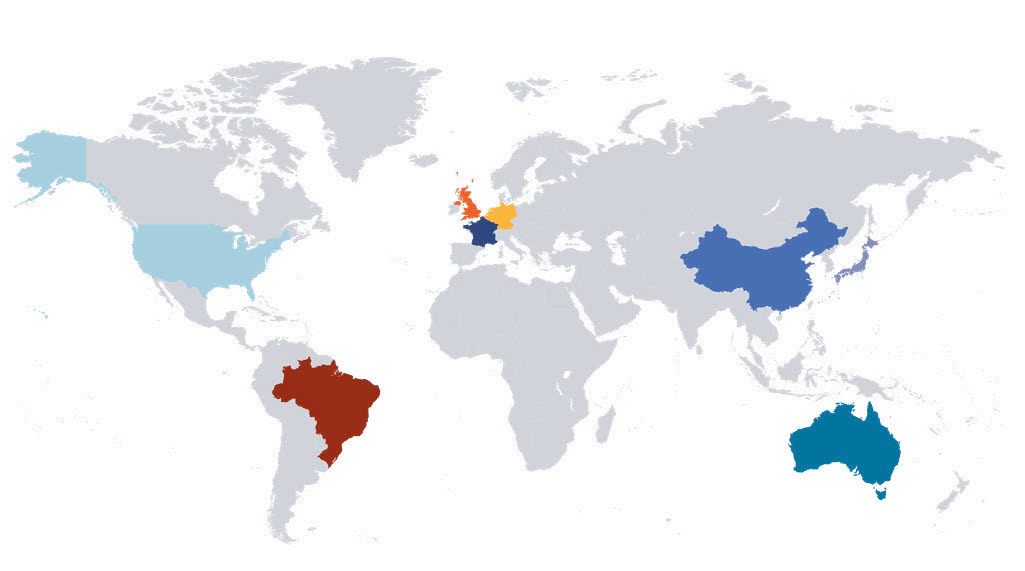

Most developed-country stock markets, including the S&P500 and Nasdaq, declined by around 3% before making a minor late- month rally. Both indices had previously moved into correction territory, down 10% from their July intra-day highs.

S&P 500 Rebounds after entering correction.

US stocks rise after closing down 10% from July peak

Source: Bloomberg

The UK’s FTSE 100 declined more than its other developed-country counterparts, falling 3.7% during October. The decline pushed the index into negative territory for the year. The UK’s economic performance has been lacklustre, with growing concerns about a recession exacerbated by a significant cost-of-living crisis. The good news during the month was that shop prices, as measured by the British Retail Council, showed a slight improvement, with an annual increase of 5.2% compared to the previous month’s 6.2%. Additionally, consumers received a welcome reprieve when the Bank of England announced at its latest meeting that it would maintain the official interest rate at 5.25%. This decision provides some stability in an otherwise uncertain economic climate.

Europe’s challenging economic conditions continued to weigh on the region’s equity markets, resulting in a 3% to 4% decline in most of its major markets.

China equity investors had another rough ride, even as there were emerging indications that the government’s measures to bolster the economy were beginning to bear fruit. Towards the end of the month, the Ministry of Finance announced measures aimed at providing more impetus to financial markets. This included extending the assessment horizon for insurers’ investments allowing them to make longer-term investments in shares.

US earnings positive though market reaction variable

So far, the US third-quarter earnings season has demonstrated resilience in the US economy with expectations that the trend will continue into the early part of next year.

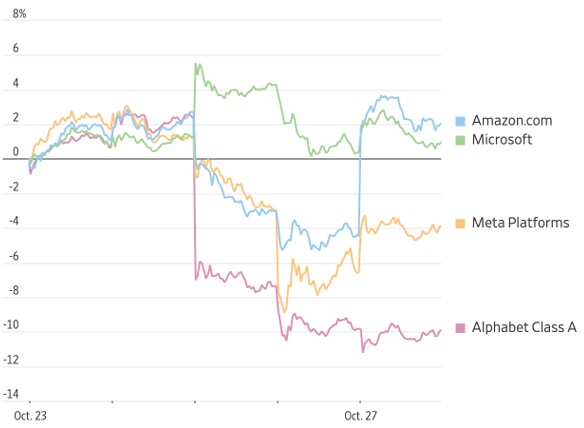

However, while almost 80% of companies have reported earnings ahead of Wall Street estimates, positive results have not generally been reflected in improved share prices.

Even some of the prominent tech stocks saw price declines despite respectable results. For instance, Alphabet’s shares dropped by around 10% and Meta lost $30bn of its market capitalisation following its results announcement despite achieving its highest quarterly revenue since going public in 2012. Investor concerns primarily revolved around Meta’s advertising spend and increasing operating losses attributed to product development in its Reality Labs division.

Share-price performance

Source: Factset

Meanwhile, Amazon’s results were welcomed by investors, with its share price gaining 6.8% in response to a tripling in its profit growth and strong sales in cloud computing, advertising and retail. Similarly, Microsoft shares rose, with its 3.1% bump on 25 October marking its best day since July. The results showcased growing sales in Cloud computing services, contributing to the upward movement in its share price.

Notwithstanding the knock the tech sector has taken since August, share price valuations remain above historical averages. For instance, Microsoft’s price-earnings ratio stands at 28 times, which is above its 10- year average of 23. Likewise, Apple’s price- earnings ratio is trading at approximately 25 times compared to its 10-year average of 19. In contrast, the S&P500 price-earnings ratio is trading at approximately 17 times, indicating that tech stocks continue to trade at higher valuations than the broader market.

Elections on the horizon

It’s almost a year until the US 2024 elections – 12 months in which much attention will be paid to political campaigning and the chances of Donald Trump returning to the presidency. The economic outlook is still uncertain and investors are on edge about the prospect of stock market declines this year and the significant rise in bond yields, reaching 5% for the first time in 16 years.

Election prospects are likely to contribute to financial market volatility throughout the next year.

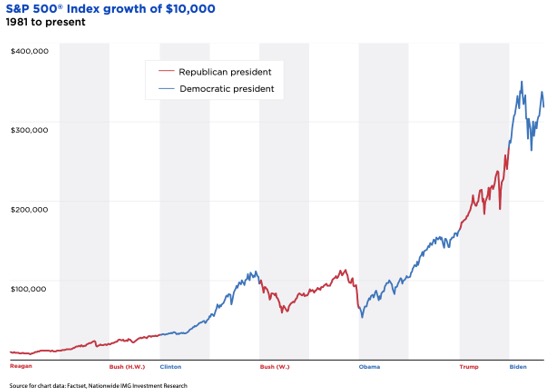

However, contrary to perception, historical data suggests equity performance tends to be largely consistent, regardless of election outcome.

Stock returns and election results – no contest

59% of investors believe that the outcome of a presidential election has a direct immediate and lasting impact on stock market performance. However, stock performance has been largely the same no matter how both political parties split control in Washington, D.C.

Source: Factset

A recent Nationwide Advisor Authority survey highlighted that investors generally hold pessimistic views regarding the influence of elections on their retirement prospects where the political party with which they least align gains more power. About a third of respondents believed that the economy would enter a recession within 12 months, their financial future would be negatively affected and taxes would increase.

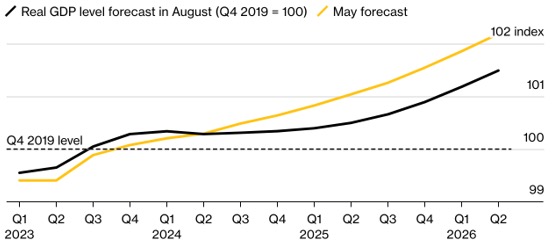

In the UK, the Bank of England expects the economy to stagnate next year, creating a challenging backdrop for the ruling party in the build-up to elections.

The BOE sees the UK economy stagnating next year

GDP is forecast to top pre-pandemic levels by 3Q 2023 but then stagnate

Source: Bank of England

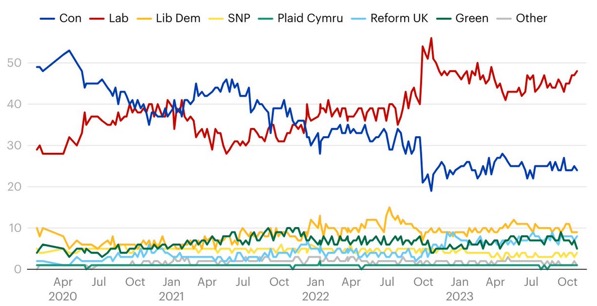

Recent by-election results have left the Conservative Party trailing Labour in the polls, with Rishi Sunak’s popularity still low despite attempts to bolster the economy by cutting government spending and easing business costs.

YouGov Westminster voting intention tracker

If there were a general election held tomorrow, which party would you vote for?

Source: YouGov

Chief concerns are high interest rates, government debt-servicing costs and lingering inflation. These stand in the way of the government being able to make the changes needed to stimulate the economy and stock market after a tough few years, and thereby win favour with the electorate before the elections.

GLOBAL MARKET RETURNS OCTOBER 2023

HELPLINE:

HELPLINE: