UK POLITICS TAKES CENTRE STAGE

Markets remained volatile during October and generally in bear market territory. Central banks are still vocally hawkish though a growing number of investors seem optimistic that the pace and extent of rate rises will be less dramatic than the path currently flagged.

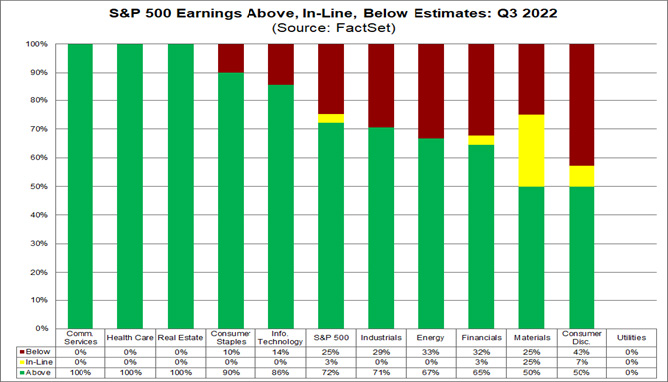

The corporate earnings season in the US got off on a good note but towards the end of the month evidence came through of how significantly the strong dollar was impacting companies like Microsoft, Meta (Facebook) and Amazon, which earn most of their revenues in global markets.

S&P 500 earnings above, in-line, below estimates: Q3 2022

Source: Factset

RECENT DISAPPOINTMENT AT THE US FEDERAL RESERVE’S DOUBLING DOWN ON ITS HAWKISH INTEREST RATE STANCE HAS CAUSED THE DECLINE IN EQUITY MARKETS TO GATHER PACE

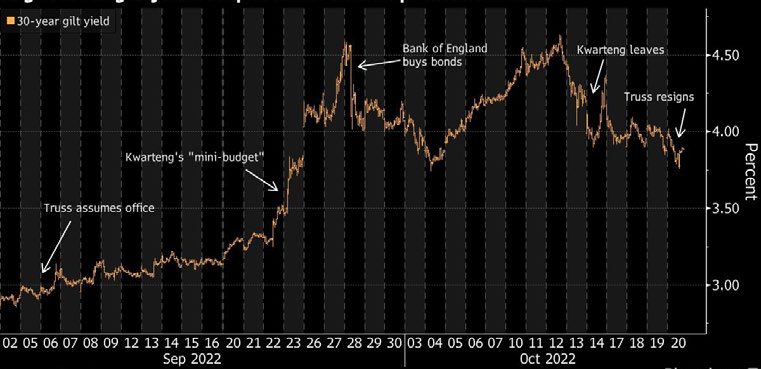

For a change, the UK, rather than the US, dominated the financial headlines, but for all the wrong reasons as bond markets reacted to the government announcing an unfunded £45 bn tax package.

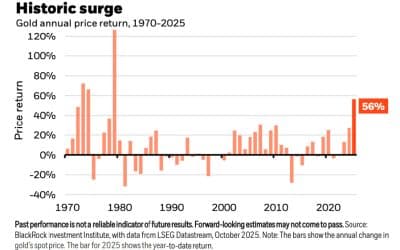

Ruled by markets – Huge rise in gilt yields helped make Truss’s position untenable

Source: Bloomberg

UK gilts tanked, with demand for the 30-year gilt drying up and the 10-year yield rising to more than 4.5%. The pound barrelled towards parity with the dollar, and the Bank of England was forced to step in to prevent a full- scale market collapse by supporting the bond market for two weeks—which was extended given the scale of the fallout—and putting its quantitative tightening programme on hold.

UK defined-benefit pension funds, which rely on liability-driven investment strategies, came under intense pressure as yields soared, setting in motion a series of margin calls that, if not met, stood to shake the foundations of the pension fund industry.

THE EXTENT OF THE FINANCIAL FALLOUT FROM THE UK MINI-BUDGET ANNOUNCEMENT HIGHLIGHTS HOW PRECARIOUS INVESTOR SENTIMENT IS.

The new Prime Minister Liz Truss had little option but to replace her chief finance minister and oversee a complete U-turn of her economic policy initiatives. The extent to which the plan had undermined her own and the government’s credibility led to her stepping down and paving the way for Rishi Sunak to take her place at the helm. Sunak is viewed as a more cautious steward of the government’s fiscal resources and has been welcomed by the financial markets which have recovered much of the recent ground lost.

What next for USD?

The relentless strength of the US dollar eased slightly at the end of October on expectations that the Federal Reserve might slow the pace of rate hikes given signs of a slowing US

economy. The pound appreciated to $1.16, the highest level in more than a month, and the euro moved back above parity.

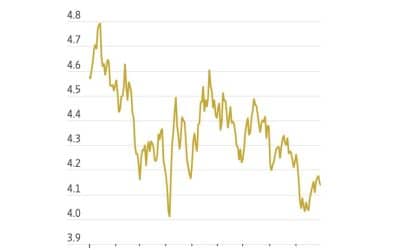

Back up – Euro back above parity for first time in over a month amid broad dollar retreat

Source: Bloomberg

The euro, depressed by energy challenges at home, may struggle to remain above parity unless the dollar experiences significant weakness. Energy support levels have probably been exhausted and the ECB is unlikely to raise rates by more than the Fed, given the likely recession in Europe that lies ahead.

Meanwhile, the Chinese yuan weakened in the wake of the Communist Party’s conference, during which Xi Jinping managed to secure another five-year term and significantly tightened his grip on power. This has global ramifications, but there are no signs of any changes in economic policy. The People’s Bank of China has been fixing the currency at about 7.11 to the USD, but it weakened to trade as high as 7.24 in the last days of October, which indicates the PBOC may be happy to allow market forces to dominate for now.

THE NEW HORIZON STRATEGIES DELIBERATELY TARGET LIQUIDITY IN TERMS OF BOTH THE SELECTED INSTRUMENT AND UNDERLYING EXPOSURE.

While comparisons of global purchasing power may make the dollar seem overvalued, any increased geopolitical turbulence, or evidence that inflation is remaining stubbornly high, is likely to prompt renewed risk aversion and provide further short-term dollar support.

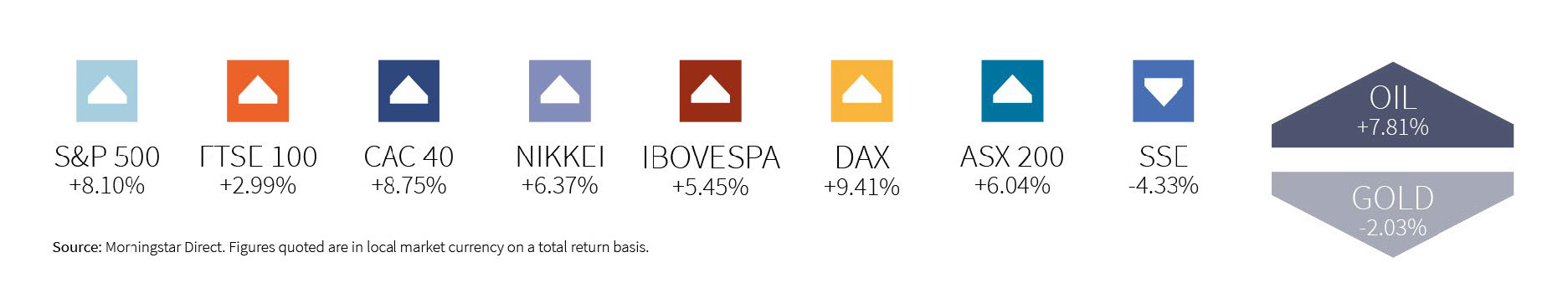

GLOBAL MARKET RETURNS OCTOBER 2022

HELPLINE:

HELPLINE: