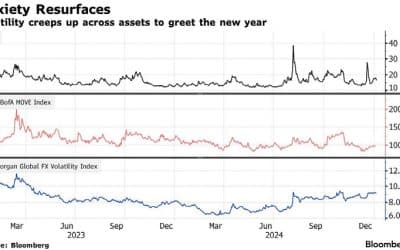

MAJOR EQUITY AND BOND MARKETS WEAKEN ON STICKY INFLATION AND WEAKER GROWTH

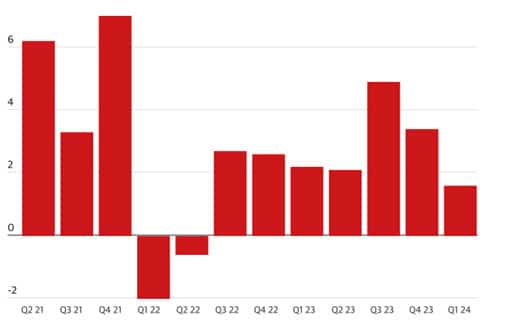

April was a more challenging month for stock markets with US equities having a particularly bumpy ride. Investor concerns centred on signs of vulnerability in the US growth outlook and inflation coming in higher than expected.

US economic growth GDP by quarter

Source: Guardian graphic; Bureau of Economic Analysis

All signs are pointing to US inflation taking longer to be tamed than anticipated, pushing out the timing of the first expected interest rate cut. Even the trimmed expectation of three US rate cuts in the second half of the year now looks optimistic, with little chance of a cut in June and potentially no change until after the US election.

“ALL SIGNS ARE POINTING TO US INFLATION TAKING LONGER TO BE TAMED THAN ANTICIPATED”

The geopolitical landscape deteriorated too, with military action from Iran and Israel adding to the market jitters. The market reaction was muted as the attacks were viewed as largely symbolic, but they have elevated the risks of a broader war breaking out in the Middle East.

Meanwhile, the UK FTSE 100 reached an all-time high after years of post-Brexit underperformance, suggesting that the value it offers is starting to attract investors.

For the month, the S&P500 Index fell 4.1% and the Nasdaq 100 by 4.4%. It was the second-worst month for US equities since 2022. The MSCI Europe ex UK index fell 1.8% while the UK’s FTSE All Share Index gained 2.5%. China’s SSE Composite eked out a 2.1% gain.

US government bonds suffered their worst monthly performance since September 2022, while the gold price reached an all-time high.

“US GOVERNMENT BONDS SUFFERED THEIR WORST MONTHLY PERFORMANCE SINCE SEPTEMBER 2022”

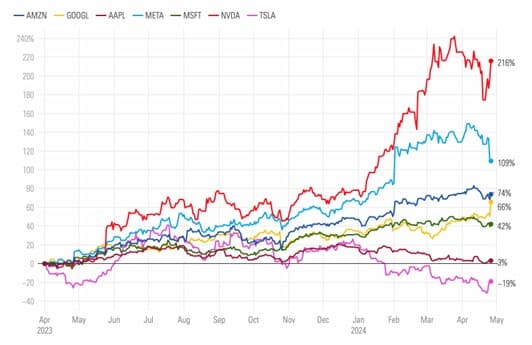

Beneficiaries from AI developments are expected to broaden

The ‘Magnificent 7’ had a tough April. Meta Nvidia experienced a 10% drawdown on one delivered a 27% increase in revenue but day, which was its worst performance since was penalised by the market for not being March 2020, but then rebounded. Some transparent about when it expects to deliver analysts are predicting that the outlook for profits on the big AI spend in the pipeline. six of the seven AI-favoured big tech stocks is not likely to be as rosy as it has been over the past year.

Magnificent seven stocks – Those earnings in full Growth of Magnificent 7 since April 2023

Source: Morningstar Direct

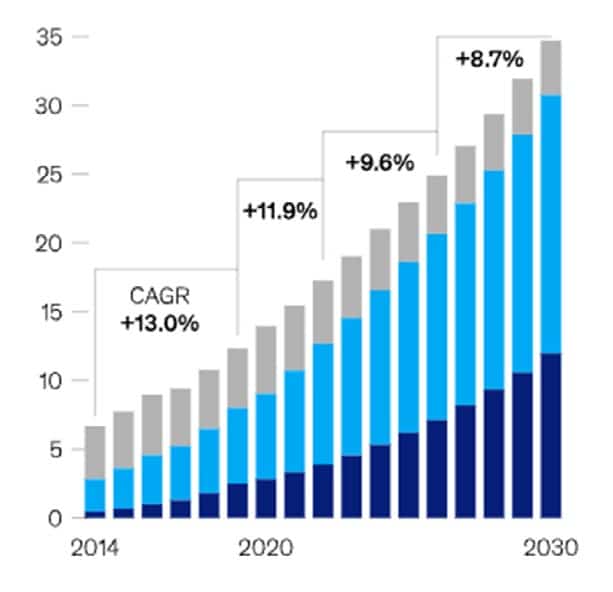

Outside of these seven companies, industries that are expected to reap the benefit of advances in AI include data centre infrastructure, Open AI, cybersecurity and energy utilities.

Companies providing data centre infrastructure that are expected to benefit include Arista Networks, a competitor of Nvidia’s which listed on March 20 and makes data centre chips and software. Cloud computing giant Salesforce has launched Einstein 1 Studio, which will embed AI in Salesforce Apps while Now, Adobe and Workday are all exploring ways to exploit the potential of AI. Cloud giants Amazon, Microsoft and Google dominate the business customer base.

“ONE UNEXPECTED SECTOR LIKELY TO BENEFIT FROM THE UPSWELL IN AI IS THE POWER SECTOR”

Companies embracing open AI and developing the Large Language Models that help AI to understand how humans think and speak include start-ups AI21 Labs, Anthropic, the developer of Claude 3 chatGPT software, and Cohere. Hugging Face also recently raised $235 billion – a fundraising round that was backed by many industry heavyweights.

Cybersecurity companies giving investors access to the AI boom include Palo Alto Networks, CrowdStrike and Cloudfare.

One unexpected sector likely to benefit from the upswell in AI is the power sector based on the expected explosion in demand for energy to power the data centres and AI systems.

Data centre power consumption by providers/enterprises Gigawatts

Source: Bloomberg

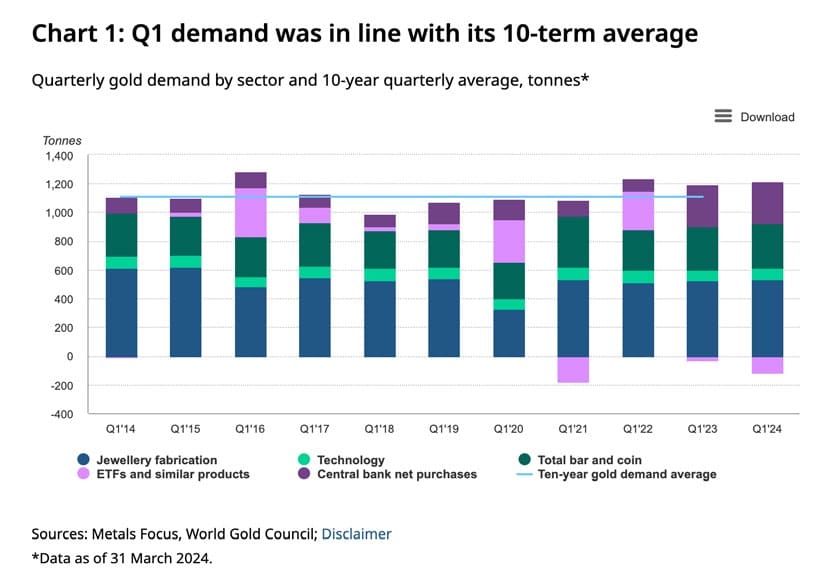

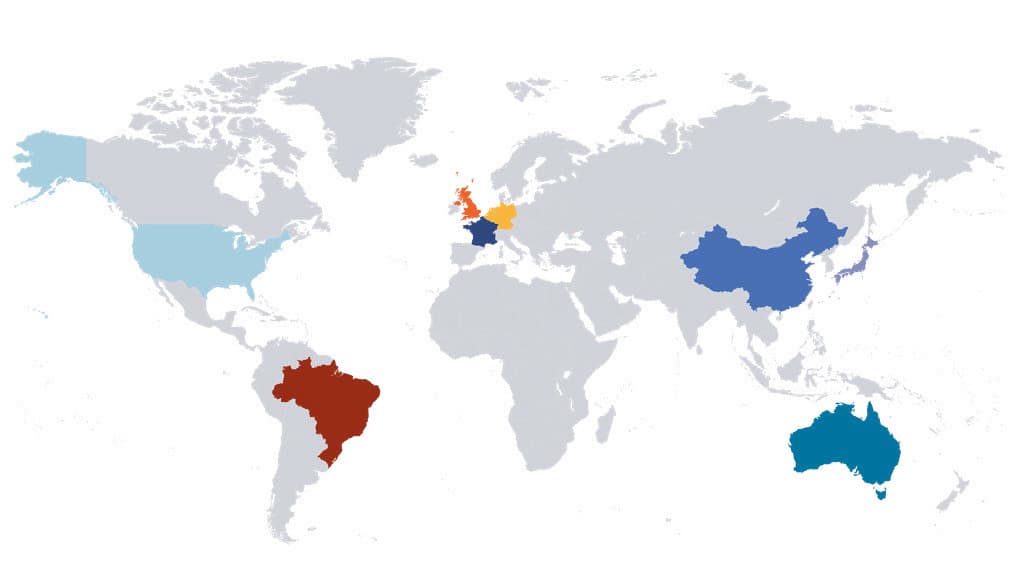

The gold price increased almost 4% during the month to $2,300 an ounce, driven by its haven status and ongoing purchasing by central banks to add to their reserves. The latest data released by the World Gold Council shows that there was no slowdown in the pace of central bank gold buying, with 290 net tonnes added to official holdings. The depleted trust in US fixed income assets and the rise of non-reserve currencies may encourage a continuation of the trend.

Q1 demand was in line with its 10-term average

Quarterly gold demand by sector and 10-year quarterly average, tonnes

Source: Metals Focus; World Gold Council

“LAST YEAR, CHINA’S CENTRAL BANK BOUGHT THE MOST GOLD OF ALL CENTRAL BANKS”

Central banks have been accumulating gold since 2010, with emerging markets the biggest buyers. Last year, China’s central bank bought the most gold of all central banks and last month continued buying for the 17th month in a row, according to the World Gold Council.

Other regular buyers include the National Bank of Kazakhstan, Reserve Bank of India, Central Bank of Turkey, Monetary Authority of Singapore, Czech National Bank and Qatar Central Bank.

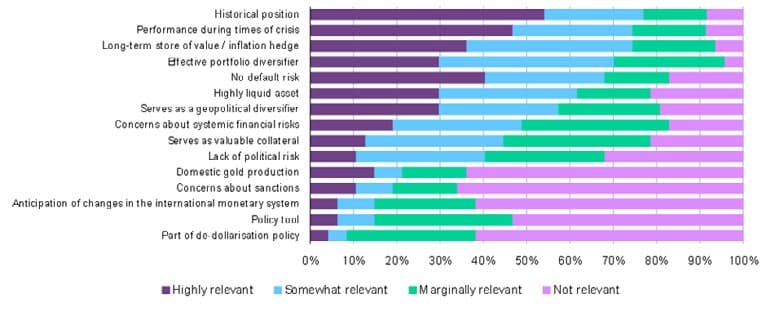

According to the council’s Central Bank Gold Survey, central banks cite gold’s historical performance during a crisis and long-term value retention as important reasons to hold the metal.

How relevant are the following factors in your organisation’s decision to hold gold?

Source: FX Street

GLOBAL MARKET RETURNS APRIL 2024

HELPLINE:

HELPLINE: