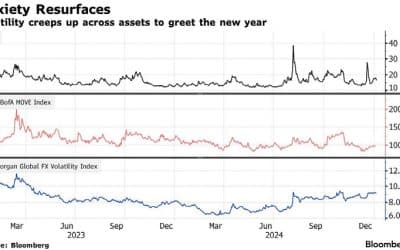

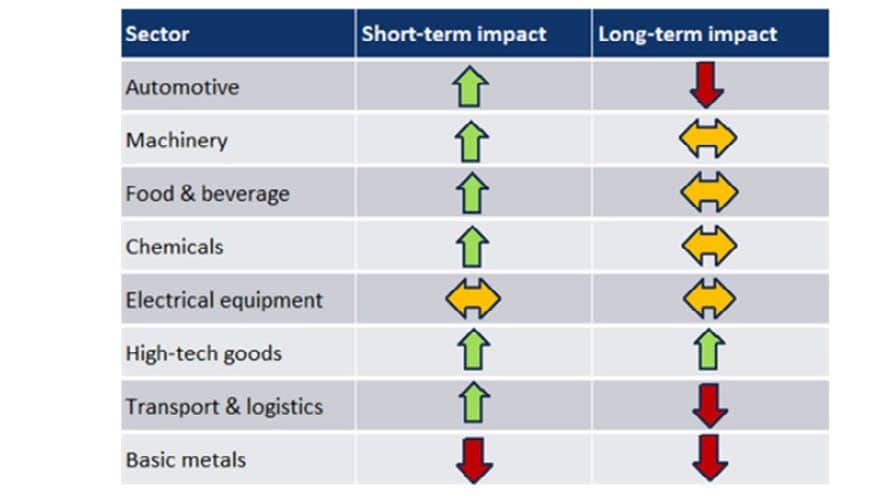

US AND JAPANESE EQUITIES STRUGGLE WHILE EUROPEAN SHARES RISE

“THE US EQUITY MARKETS HAVE NOW SHED THEIR POST-ELECTION GAINS.”

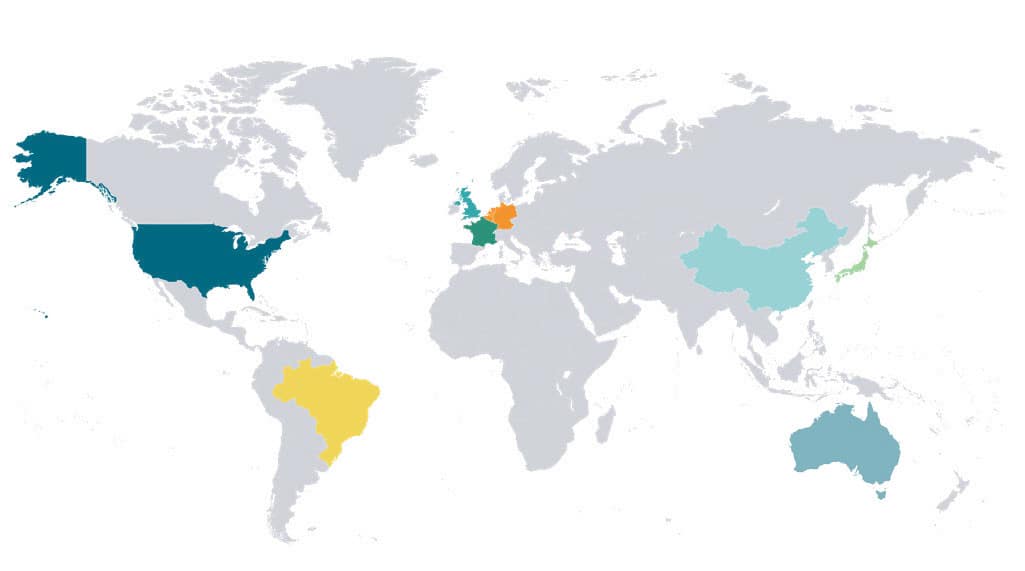

Europe and the UK outperformed in February, with the MSCI Europe (ex UK) index rising by 3.7% and the FTSE All Share index by 1.3%. China’s equities also gained, with the SSE Composite up 2.1%. In contrast, US stocks lagged. The S&P 500 declined 1.3% over the month and is now only 0.9% up year-to-date. The Nasdaq 100 also struggled, down 2.7% in February and over 1% lower yearto-date, driven by weakness in the tech sector. Japanese stocks fared poorly as well, with the Nikkei down almost 6% amid concerns over the impact of Trump’s tariffs.

US equity markets have now shed their post-election gains, and the S&P 500 has registered two consecutive weeks of losses for the first time since October. The looming tariff policies—particularly the 25% tariff on Mexican and Canadian imports—are a primary concern.

Defensive sectors like consumer staples, healthcare, and real estate have outperformed, while tech giants such as Nvidia entered correction territory.

Investor sentiment has turned negative, with bearishness indicators the highest since September 2022. The Federal Reserve is concerned that tariffs could disrupt progress on inflation. While recent data showed inflation moving closer to the Fed’s 2% target, rising import costs could reverse this trend, and inflation expectations are rising.

In response to these uncertainties, many investors are repositioning their portfolios, in some cases increasing exposure to the industrial and material sectors, anticipating that tariffs could accelerate the reshoring of manufacturing to the US.

“WHILE RECENT DATA SHOWED INFLATION MOVING CLOSER TO THE FED’S 2% TARGET, RISING IMPORT COSTS COULD REVERSE THIS TREND, AND INFLATION EXPECTATIONS ARE RISING.”

Change in stock indexes since Inauguration Day

Source: LSEG Data & Analytics

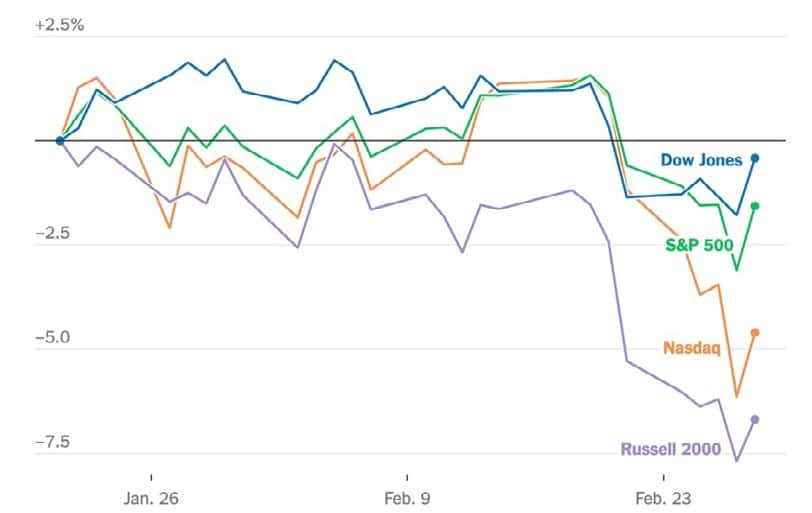

US Tariffs Increasing Uncertainty for Japan’s Economy

Japan is facing growing uncertainty due to US trade policies under President Trump, particularly the aggressive tariff strategy targeting key sectors like automotive and electronics. A recent survey showed 86% of Japanese companies expect Trump’s policies to harm their business, with tariffs being the most signifcant concern.

Despite these challenges, Japan may beneft from higher US demand driven by fscal policies, which could help offset some tariff impacts. However, Japan’s position remains precarious, caught between its US security ally and China, its largest trading partner.

Tensions over military base control and increasing pressure for Japan to raise its defence spending—potentially to 3% of GDP—could strain fscal resources. In response, many Japanese companies are diversifying supply chains away from China and preparing for potential US tariffs. Oxford Economics suggests

that Japan’s machinery sector, known for its technological edge, could beneft, but sectors like automotive and basic metals remain vulnerable. Additionally, Japan is pursuing opportunities in the semiconductor industry through initiatives like Rapidus and TSMC’s new plant in Japan.

Most Sectors will benefit from Trump policies, with a few exceptions

Source: Oxford Economics/Haver Analytics

The Bank of Japan faces the challenge of balancing monetary policy, recently raising interest rates to 0.5% from 0.25%. However, future rate hikes remain uncertain due to concerns about their impact on capital spending. While rate hikes are needed to address the yen’s weakness and control inflation, further tightening could create additional headwinds for Japanese companies dealing with protectionist policies and the need to adjust supply chains and production strategies.

“JAPAN’S POSITION REMAINS PRECARIOUS, CAUGHT BETWEEN ITS US SECURITY ALLY AND CHINA, ITS LARGEST TRADING PARTNER.”

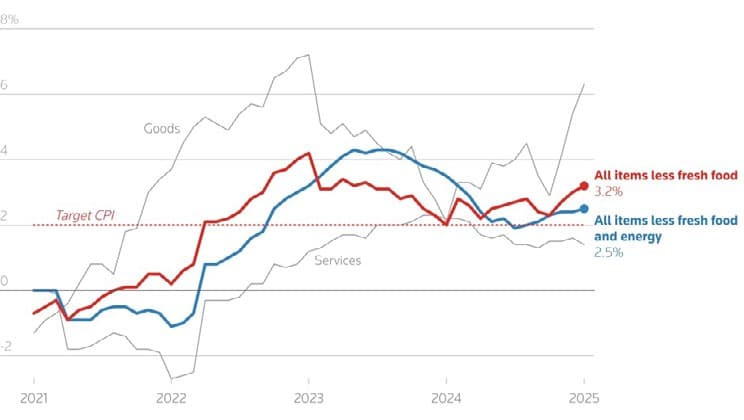

Japan’s core inflation hits 19-month high

Japan’s core inflation rose 3.2% in January to hit 19-month high, and the “core core” index, which excludes fresh food and energy costs, rose 2.5%. The inforced expectations the central bank will continue to raise interest rates from still-low levels.

Source: LSEG Datastream

“WITHOUT REFORM, GERMANY’S ABILITY TO ADDRESS INFRASTRUCTURE UNDER INVESTMENT REMAINS CONSTRAINED.”

Germany’s Election Results Boost Market Confidence, But Fiscal Reform is Key

Germany’s recent election results eased concerns about political gridlock, with a conservative CDU/CSU alliance potentially forming a coalition with the Social Democrats (SPD). This outcome boosted the equity market, with domestically focused stocks rising, particularly in the mid- and small-cap indices.

The market is cautiously optimistic about business-friendly policies under Friedrich Merz, whose pro-business background could benefit sectors like automotive and utilities. However, investor caution remains due to Germany’s structural challenges, including the restrictive “debt brake” that limits government spending. Without reform, Germany’s ability to address infrastructure underinvestment remains constrained.

While the election results temporarily lifted market sentiment, analysts remain sceptical about robust economic growth before 2026, given fiscal constraints and the challenges of securing cross-party support for reform.

GLOBAL MARKET RETURNS FEBRUARY 2025

HELPLINE:

HELPLINE: