ROBUST US ECONOMY CAUSES RENEWED BOND SELL-OFF

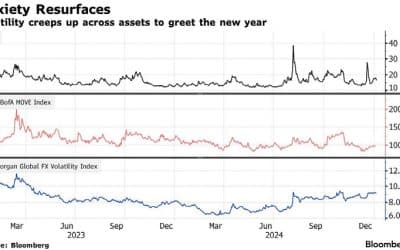

Stock markets took fright during February as US economic data came in much hotter than expected. The labour market showed continued strength while both inflation and retail sales were higher than expected. This raised the prospect that the Federal Reserve will keep interest rates higher for longer. The yield from 2-year US treasuries has risen to 4.8%, the highest since 2007. Consequently, the Global Aggregate Bond Index suffered its biggest monthly decline this century. Broad commodity indices suffered falls of around 5% while equity markets were mixed, with the S&P 500 notably weak.

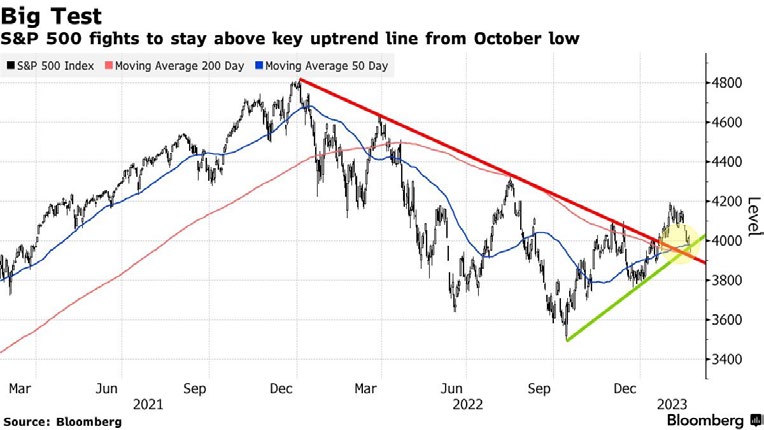

Markets no longer looking for big rate cuts later in 2023 US: Federal funds rate expectations

Source: CME/Federal Reserve/Oxford Economics

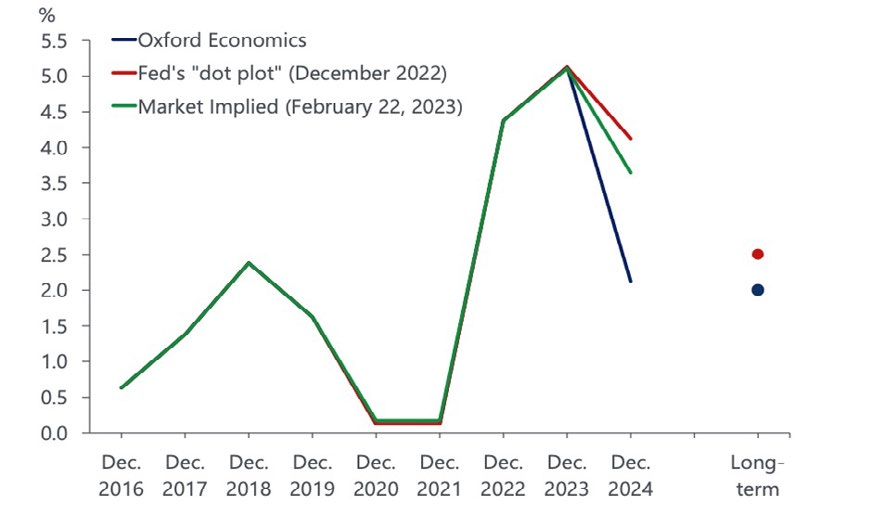

From a seasonal perspective, a weak month was not surprising given that over the past 25 years February has been a poor month for the S&P 500, averaging a loss of 0.4%.

February Flub

Month is third-worst for S&P 500 on average in past 25 years

Source: Bloomberg

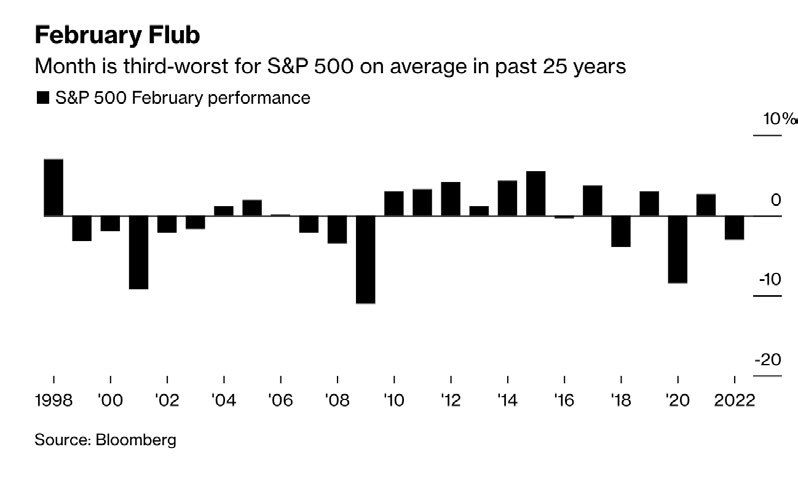

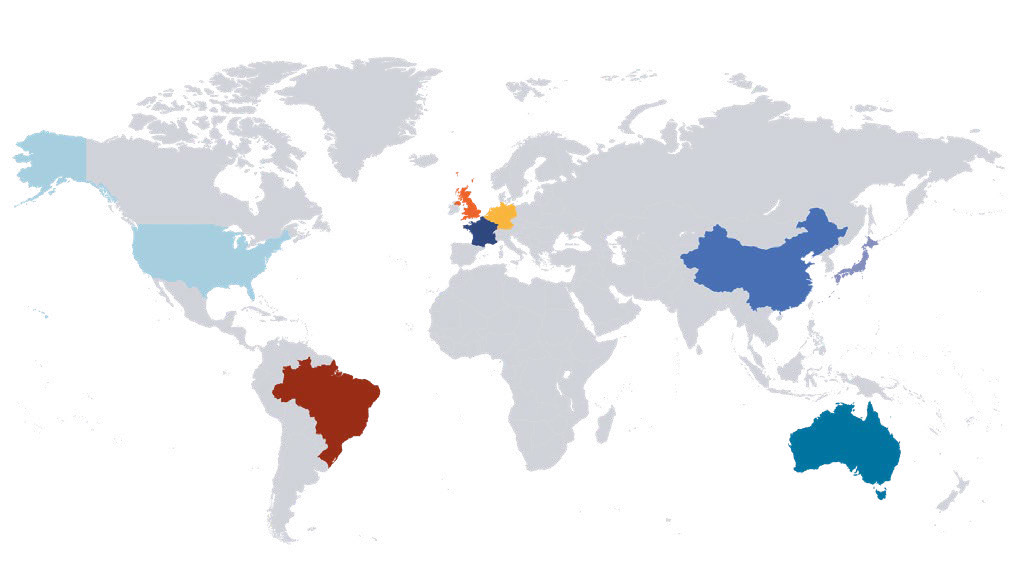

In light of recent stronger data, the global economic outlook has marginally improved. The IMF upgraded its growth forecasts in its latest World Economic Outlook (WEO) to 2.9% for 2023, 0.2 percentage points higher than predicted in the October 2022 WEO. Inflation is expected to come down in 2023 to 6.6%, still much higher than the pre-pandemic level of around 3%.

World Economic Outlook update January 2023 Growth Projections

Source: IMF

Rising expectations for terminal interest rates and impact on markets later this year

Will terminal rates trigger a soft or hard landing?

Rate expectations shifted up during February on the back of stronger economic data than the US Fed had to work with when it made its January decision to raise interest rates 25 basis points. As a result, global bond yields saw the gains they had made this year erased, hopes for a pivot waned, and the US 10-Year Treasury yield toyed with the 4% level.

Investors are currently pricing in an implied federal funds terminal rate of over 5.4% in July compared with the previous 4.9% peak factored in by financial markets when the Fed met. At the extreme, some analysts caution that the terminal rate could be as high as 6% to 6.5%, a level that would weigh heavily on stock markets and threaten to trigger an economic hard landing, which has been a worst-case scenario since last year.

A recent paper presented at a University of Chicago Booth School of Business conference by a combination of academics and private sector economists warned that policymakers would need to inflict economic pain to get inflation under control. The main takeaway from the paper was scepticism that the Fed would be able to engineer a soft landing (where inflation returns to the 2% target by the end of 2025) without a mild recession.

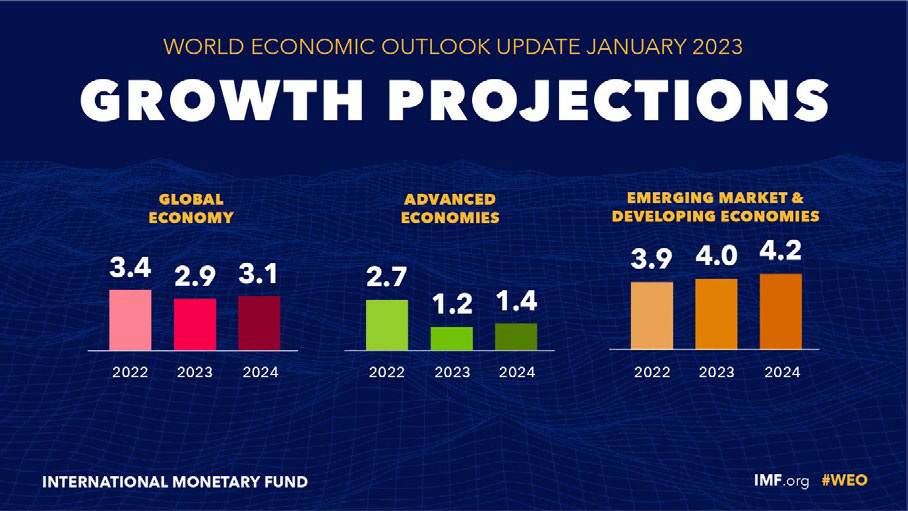

However, should the fed funds rate meet market expectations and result in a soft landing, investors believe that US equities would likely have a strong second half of the year. Although the S&P 500 Index may have fallen by some 3.3% this month, technical indicators suggest that the uptrend evident since September last year remains in place, as shown in the graph below.

Big test

S&P 500 fights to stay above key uptrend line from October low

Source: Bloomberg

Declining gas prices offer respite in Europe

The European and UK economies are set to benefit from the significant decline in gas prices as consumption declines and the gas supply remains steady. Consumption has reduced sharply in the industrial sector and households because winter temperatures have been above average so concerns surrounding gas shortages over a prolonged cold winter have not materialised.

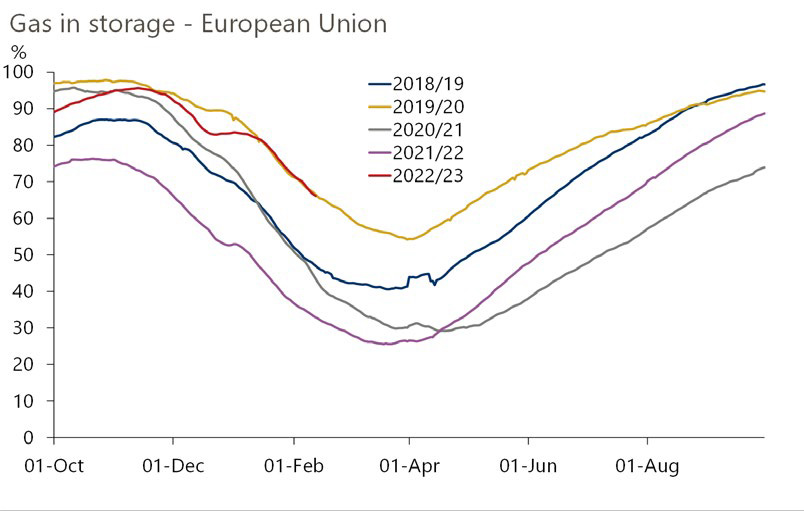

European gas inventories are in a very healthy position and, according to Oxford Economics, it is likely that the region will reach 95% storage levels by next winter.

Gas storage at near-record seasonal high Gas storage – European Union

Source: Gas Infrastructure Europe

The latest Eurozone PMIs (Purchasing Managers’ Indices) reflect the improvement in the region’s economic fortunes, reducing the likelihood of first-quarter contraction and the recession in Europe this year that has been much anticipated since last year.

The UK’s economic outlook has also brightened, with consumer confidence rising more than expected but still at historically low levels. Growth statistics showed that the UK had avoided recession at the end of last year while inflation fell for the third consecutive month.

GLOBAL MARKET RETURNS FEBRUARY 2023

HELPLINE:

HELPLINE: