MARKETS MIXED WITH INVESTORS WAITING ON INTEREST RATE CUTS

May was a mixed month for stock markets. Hopes prevailed earlier this year that inflation would already have fallen convincingly enough by now to have paved the way for interest rate cuts in the US. As the year has progressed, however, these have been quashed and surpassed by the growing acceptance that there may be no cuts at all this year.

Most of the impetus in the equity market in May again came from the tech sector. Nvidia dominated the US stock market action, with investors responding enthusiastically to its strong results and both the S&P 500 and Nasdaq recovered the declines suffered in April. In the UK, the FTSE 100 rose to a record high on optimism that the Bank of England will soon reduce rates, before falling back and ending less than 2% ahead. The Euro Stoxx 50 registered a similar gain, supported by expectations of an interest rate cut in June.

Other major stock markets were lacklustre, and the Chinese SSE Composite declined despite a strong performance from the Chinese technology sector early in the month.

Commodity indices registered a positive month and the gold price rose 2%. Bond markets recovered a little but remain in negative territory this year for longer maturity issues.

UK election called earlier than expected

The prospect of a UK change of guard after 14 years of Conservative Party leadership is unlikely to cause volatility in financial markets because a Labour Party victory in the election on July 4 is already widely anticipated.

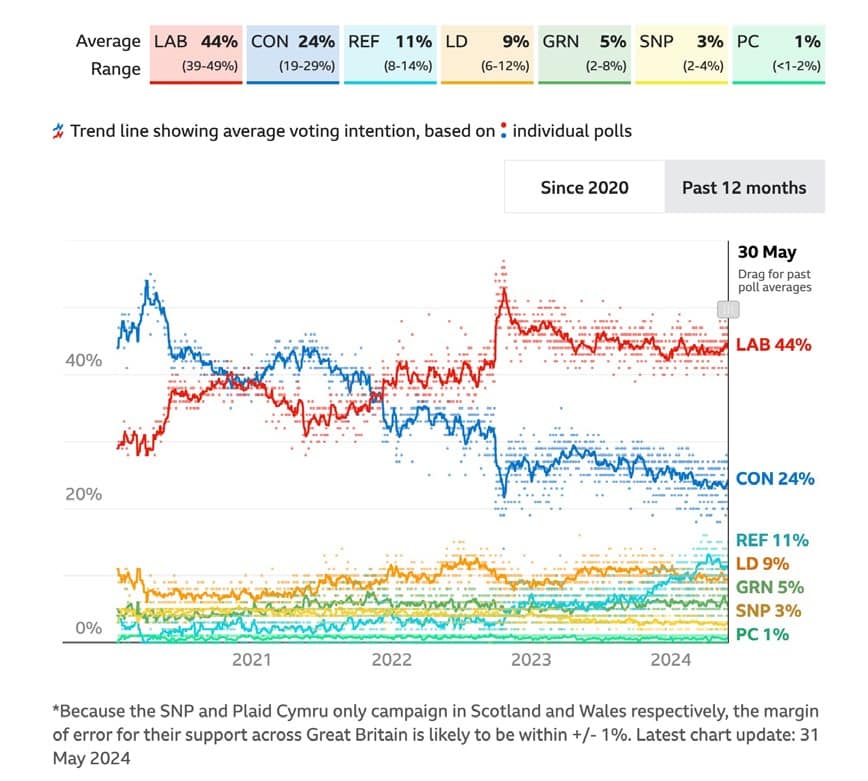

Labour has been consistently 20% ahead in the polls for over 18 months and even if there is no majority vote, investors expect the party to form a coalition government.

Trend line showing average voting intention, based on individual polls

Source: BBC News

In the polls, Labour scores better than the Conservatives on the economy and there is optimism it will keep a steady ship while overseeing fiscal restraint. It is expected to maintain the government’s rule which requires debt as a percentage of GDP to fall in the fifth year of forecasts. There should be no change in the path of monetary policy or inflation as the latter remains on track to fall to the targeted 2% level. A sense of stability would be welcomed by investors after recent periods of turbulence.

The Labour Party favours a slightly more collaborative relationship with the EU, including further co-operation on security and trade, while accepting the fundamentals of the post-Brexit settlement. A Labour government may extend some of the moves made on this front by the Conservatives more recently, which would make UK markets more attractive, particularly for foreign investors.

The biggest business gainers from a Labour government may be those involved in a greener economy, businesses struggling to trade with the EU and house builders benefiting from looser planning regulation. Losers would likely be the oil and gas industry and businesses that rely on zero-hour contracts.

Research produced by Citibank shows the impact UK elections have historically had on financial markets. Since 1979, the MSCI UK index of large- to mid-cap stocks has increased by about 6% six months after Labour victories and been down about 5% following Conservative Party wins.

Capital Economics notes, however, that the UK stock market lost ground during five periods when Labour was in power, but these included the Great Depression, the post-war period following the oil price shock, the dot.com crash, and the global financial crisis of 2007-2008.

The elections will take place against a much better market backdrop than at the start of the year. For the past three years, volatility has endured, and the UK stock market has missed out on the bull market rally elsewhere which has taken it to a deep discount relative to US equities.

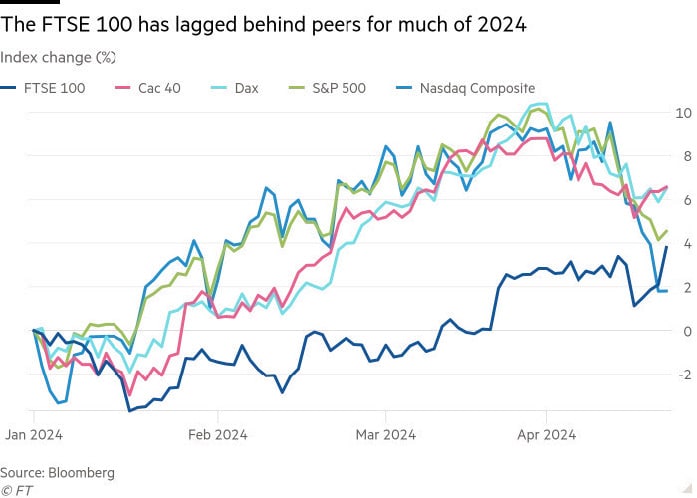

The FTSE 100 has lagged behind peers for much of 2024

Source: Bloomberg

Since mid-April, however, the FTSE 100 has Europe, and more encouraging economic risen to an all-time high on improving market growth statistics.

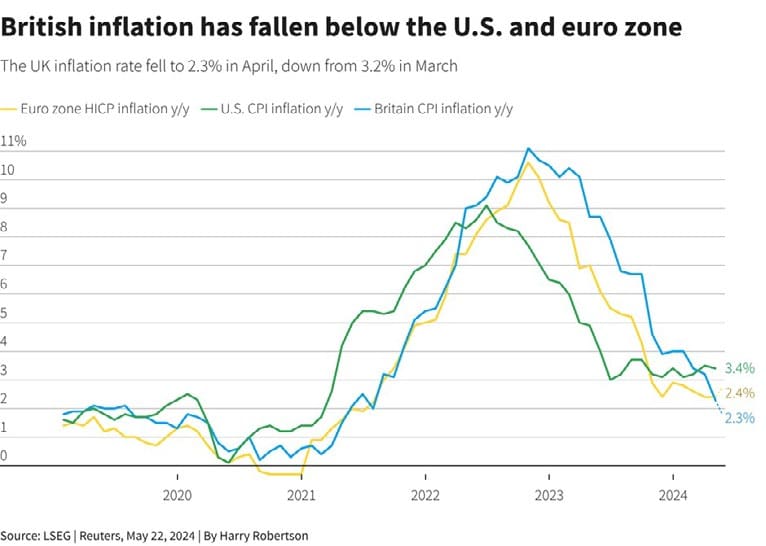

British inflation has fallen below U.S. and euro zone

The UK inflation rate fell to 2.3% in April, down from 3.2% in March

Source: LSEG; Reuters

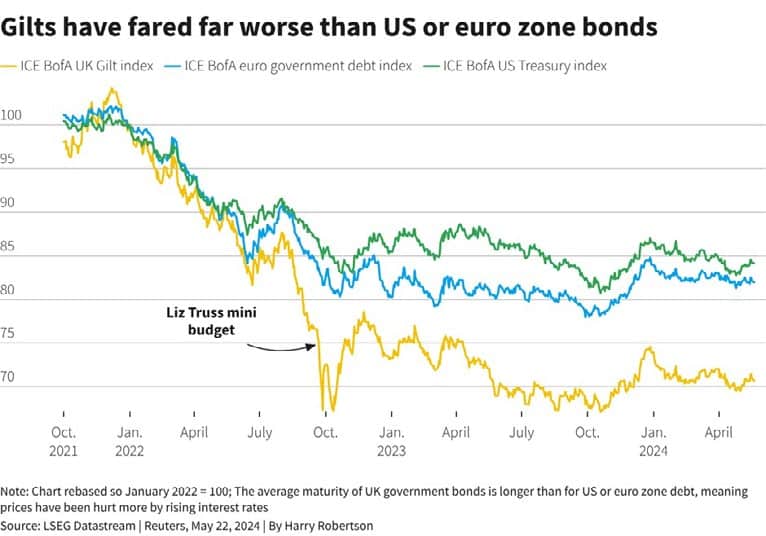

The outlook for UK gilts and sterling is unlikely to change dramatically after the election and bonds remain depressed relative to US and European bonds, having yet to fully recover since the disastrous autumn 2022 mini-budget. With the Office for Budget Responsibility indicating that debt/ GDP could rise from around 100% to 300% by 2070, there is a tough balancing act between taxation and spending ahead for whichever party is victorious.

Gilts have fared far worse than U.S. or euro zone bonds

Source: LSEG Datastream; Reuters

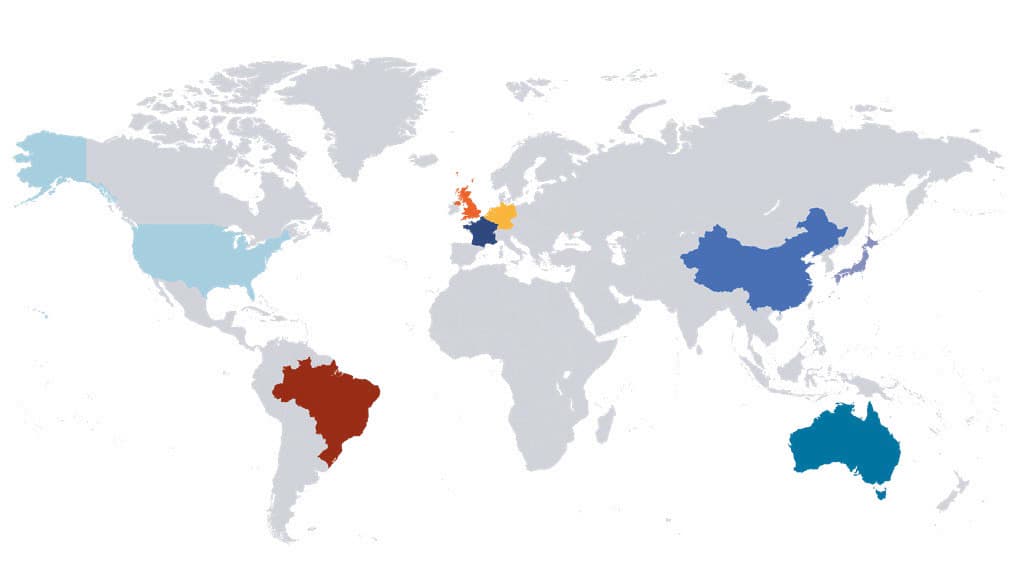

GLOBAL MARKET RETURNS MAY 2024

HELPLINE:

HELPLINE: