A MIXED QUARTER FOR MARKETS AS RATE CUTS HOPES RECEDE

The second quarter was mixed for financial markets. Inflation during the first quarter proved concerningly sticky, and markets factored in a higher-for-longer inflation and interest rate outlook, which saw both equity and bond markets come under pressure. While the US economy seems now to be cooling, the economic outlook in the UK is being upgraded. The same is true of Europe although political risk is currently to the fore.

Nvidia again contributed the lion’s share of stock market performance, rising 150% in the first half of 2024, and 37% in the second quarter.

The extent to which AI mega-cap shares dominated the performance during the second quarter has become a cause for concern. Only five equity sectors gained ground, and the rest declined over the three months. The S&P500 hit a new high but the equal-weighted S&P500 ended the quarter 3% lower.

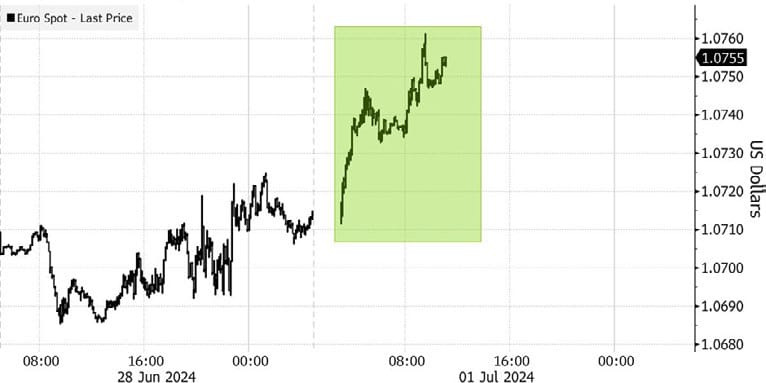

The valuation divergence between all things AI and the rest of the market has widened this year. The S&P500-ex AI shares trade at price-to-earnings ratios of around

17.5 compared with 15 in October last year. The same ratio for AI-related stocks has shown a much bigger increase over the same period rising from 22.5 times earnings to more than 27.5 times.

Beyond artificial intelligence, the S&P 500 has been unloved.

Source: FactSet, WSJ Calculations, Bespoke Investment Group

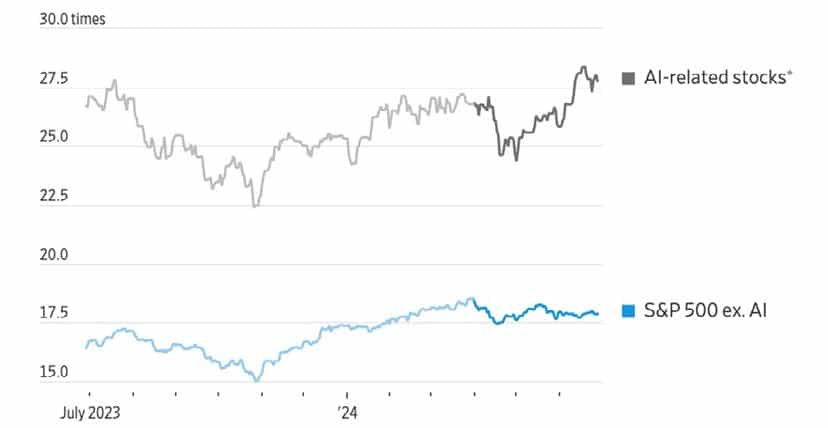

The general market’s sluggishness, excluding AI stocks, can be attributed to investors finally accepting that the US Federal Reserve will not reduce interest rates six times this yearas

previously expected. The prevailing view is that interest rates will decline once this year, with a less than 40% likelihood of US rates falling below 4.5% by March next year.

Implied market probability that U.S. interest rates will be 4.5% or lower by March 2025

Source: CME Group

The UK stock market has started to draw in investors. During the second quarter, the FTSE 100 gained 3.8%, and the index is 7.9% higher year-to-date. June was a negative month for UK equities however, with the benchmark index slipping 1.1% ahead of the election on July 4. A Labour Party win was widely expected.

As measured by the Bloomberg Commodity Index, commodity prices slipped 1.5% in June but gained 2.9% in the second quarter and 6.2% in the first half of the year. Gold outperformed, increasing 12.9% in the first six months and 5.5% in the second quarter.

New Horizon strategy highlights

Targeted exposure to the momentum factor and US tech continued to drive portfolio performance.

- The portfolio’s overweight exposure to Indian equities was buoyed by Modi’s election victory and rallied 10% over the quarter.

- The healthcare sector remains undervalued, but price momentum is improving. Exposure was added to an open-ended global healthcare fund subject to a tender offer next year which provides liquidity and a risk-free uplift to net asset value of around 8% in addition to any underlying asset performance from healthcare assets.

- Strength in the semiconductor sector produced a further 8% gain in ASML for the quarter. The semiconductor supplier is now up more than 40% year-to-date.

- After a strong end to 2023, emerging market bonds continue to suffer as expectations of multiple US rate cuts recede. Portfolio exposure is being reduced.

- Exposure to asset backed income through the GCP fund produced a gain as plans to realise value for shareholders by winding down the company progressed with an uplift anticipated as assets are valued ahead of the current share price.

Political risk puts Europe in the spotlight

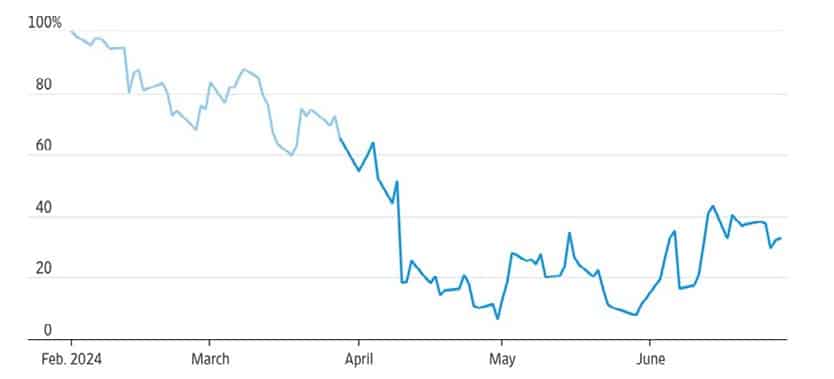

The Euro Stoxx 50 had a tough month in Europe, declining 1.8% in June. The cause was a rise in political uncertainty and French President Emmanuel Macron announcing

a snap election on June 30 after Marine Le Pen’s conservative party crushed his centrist party in the European vote on June 9.

France has brought political risk back to European markets Cumulative stock-market total returns

Source: FactSet

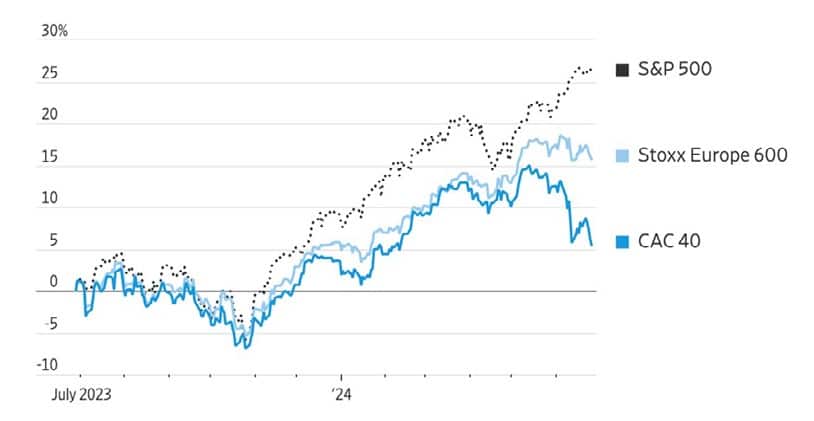

The election’s first-round results at the end of June showed Le Pen’s party winning but not as comprehensively as expected and, most significantly, not achieving a majority. The Euro currency rose suggesting the result was received favourably by markets.

The results alleviated financial market concerns of a radical policy shift in the

Eurozone’s second-largest economy that would see government debt continue to increase. Government debt to GDP is already at 110%, higher than the European Union’s allowable limit and a level that would weigh on already struggling economic growth. However, the second round of the elections remains a big risk event with multiple ultimate outcomes possible.

Euro heads higher in Asia after French elections

Source: Bloomberg

Outlook for earnings in H2 and into 2025. Corporate earnings likely to be back in focus

As equity markets come to terms with the likelihood that interest rate cuts in the major economies are likely to be no more than sporadic until next year, attention will return to the risk of the US economy slowing too fast and the impact on corporate earnings. The current earnings outlook is decent for the coming two years at least, even outside the mega-cap technology stocks. The S&P

500 forward 12-month PE ratio is 20.7, compared with the 10-year average of 17.2 times earnings, which indicates a favourable outlook for earnings.

This is reflected in analysts’ earnings expectations of a 9.5% increase in the second quarter, 8.7% in the third, and 14.3% in the fourth. The longer-term picture is also viewed as favourable with double-digit increases in S&P500 operating earnings anticipated through to 2026.

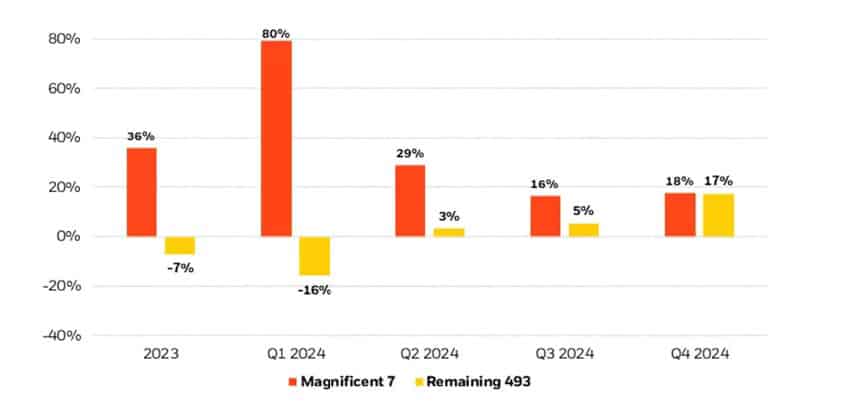

Relatively strong earnings have been led primarily by a small group of high-flying mega-cap stocks in the first quarter. However, the earnings-growth gap between these stocks and the rest of the market is anticipated by many, including BlackRock, to close later this year, offering opportunities for stock selection.

A narrowing gap and widening opportunity set

Consensus analyst expectations for year-over-year earnings growth, 2023-24

Source: Blackrock

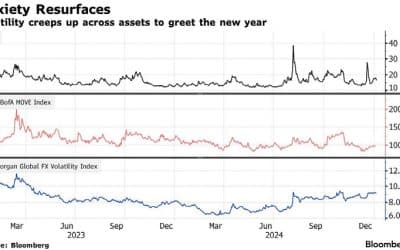

What now for interest rates?

During June, the European Central Bank cut its official interest rate by 25 basis points— the first time it has done this before the US Federal Reserve. It is the fourth to have reduced interest rates this cycle, following Switzerland, Sweden, and Canada.

The ECB’s rate cut doesn’t mean the central bank thinks inflation risks have disappeared. ECB President Christine Lagarde stressed that geopolitical tensions and the world growing more strongly than expected presented ongoing inflation risks. She expects inflation to fluctuate around current levels and then decline towards the target in the second half of 2025.

In the US, the Fed held the course, waiting to see inflation come down sustainably close to the target range. The central bank

may need to see at least three consecutive good inflation figures before it eases the reins on monetary policy. The Fed dot plot and the market expect one rate cut this year. There are signs of emerging stress in the economy, with credit card delinquencies rising and the labour market, though giving mixed signals, showing some evidence of relaxing. Unemployment has eased up, and there are concerns that it could rise sharply if the economy deteriorates.

Expectations remain that The Bank of England will ease rates and that they will reach 3% by the end of 2025. Michael Saunders, an MPC member, said he expects two to three cuts this year on the back of inflation slowing to the Bank’s target range of 2% in May, having peaked at 11.1% in October 2022.

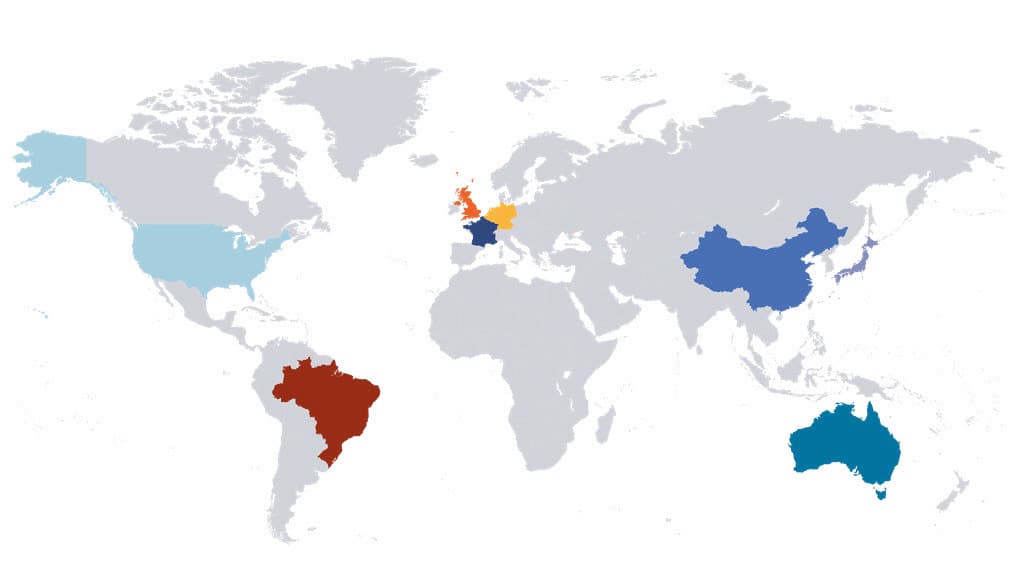

GLOBAL MARKET RETURNS Q2 2024

HELPLINE:

HELPLINE: