WEAK END TO YEAR OF US LARGE-CAP EQUITY DOMINANCE

“BITCOIN MORE THAN DOUBLED, WHILE GOLD SHONE AS A SAFE HAVEN, RECORDING ITS STRONGEST ANNUAL GAIN SINCE 2010”

2024 delivered another impressive year for asset returns, buoyed by stronger than expected economic growth and a long-anticipated pivot in monetary policy as central banks began cutting rates. The S&P 500 surged 25%, marking the first time since the late 1990s that back-to-back annual returns above 20% were achieved. The index’s performance was powered by the “Magnificent Seven”, which soared 67%, alongside a broader rally across risk assets. Bitcoin more than doubled, while gold shone as a safe haven, recording its strongest annual gain since 2010. However, the resilience of US equity markets stood in contrast to mixed outcomes globally, with notable pockets of volatility and geopolitical uncertainty shaping the narrative. Fixed income markets were generally weak, and commodity markets were mixed.

The year began with a robust Q1, as global economic data consistently beat expectations and recession fears receded. The S&P 500 surpassed its January 2022 peak, and Japan’s Nikkei reached its highest level since 1989. Optimism was tempered by persistent inflation surprises as the US core CPI registered consistent monthly increases. This delayed rate cuts from the Federal Reserve and pushed 10-year Treasury yields up for a record fourth consecutive year. However, Q1 still delivered the year’s strongest equity returns, with the S&P 500 up over 10%.

By Q2 markets faced challenges as geopolitical tensions flared with Iran’s April missile attack on Israel and France’s snap elections weighing on European assets. The Franco-German 10-year spread widened sharply amid political instability. Despite these disruptions, easing inflation data and initial rate cuts by the ECB and Bank of Canada in June restored optimism and pushed the S&P 500 to new highs.

Summer brought the year’s most significant turmoil. Weak US data and a surprise rate hike by the Bank of Japan in late July disrupted the yen carry trade and led to a sharp selloff in Japanese markets. The TOPIX fell 12% in a single day, and volatility spiked globally. However, the Federal Reserve’s September rate cut, coupled with dovish reassurances from the BoJ, quickly stabilised markets.

Q4 delivered a mixed bag. While November saw a strong equity rally following Donald Trump’s election victory, December ended the year on a sour note. The Fed’s hawkish pivot and geopolitical concerns drove a cross- asset selloff.

The final month of 2024 proved challenging for most major markets, with the S&P 500 declining 2.5% and marking its longest year-end losing streak since 1966. The Nasdaq achieved a modest 0.5% gain, while the FTSE 100 shed 1.4%. In contrast, Europe’s Euro Stoxx 50 gained 1.9% in December. China’s CSI 300 Index showed resilience with a slight 0.5% increase in the last month of the year, though concerns about the country’s growth outlook persisted.

Meanwhile, the fourth quarter of 2024 painted a mixed picture across global markets, with the S&P 500 rising 2.1%, the Nasdaq 6.1% and the FTSE 100 slipping 0.8%, the Euro Stoxx 50 coming off 3.7% and the CSI 300 falling 2.1%.

For the year, the 24% increase in the S&P 500 and 30% rise in the Nasdaq saw the US stock markets deliver their best two-year stretch since 1998. The CSI 300 turned around its multi-year losses to gain 15% for the year and the FTSE 100 and Euro Stoxx 50 gained 5.7% and 8.3% respectively.

Fixed income markets

“OPTIMISM WAS TEMPERED BY PERSISTENT INFLATION SURPRISES AS THE US CORE CPI REGISTERED CONSISTENT MONTHLY INCREASES”

In 2024, the bond market faced challenges amid concerns about excessive government borrowing and inflation risks. The Federal Reserve has implemented a series of rate cuts totalling one percentage point since September, bringing the federal funds rate to a range of 4.25% to 4.5%. Despite these cuts, yields remained elevated, with the 10-year US Treasury staying above 4.5%.

The bond market outlook is mixed for 2025. While starting yields across both rates and credit are attractive, concerns about excessive government borrowing and potential Trump administration fiscal policies are creating headwinds.

In fixed-income markets, the 10-year Treasury yield retreated to 4.17%, reflecting growing investor confidence in the Fed’s policy trajectory. Markets are pricing in a greater than 50% probability of another quarter-point rate cut in December.

European markets faced challenges as the eurozone saw accelerating inflation in November, but analysts still expect ECB interest rate cuts due to anaemic demand in the economy. For the month, the German Dax finished 2.9% ahead but markets in France, Spain and Italy were all lower. The Euro Stoxx 50 index eased 0.5%, leaving it 6.8% ahead for the year to date.

The UK FTSE All-Share index reversed recent declines and ended the month 2.5% up. Chinese stocks finished broadly flat, but the FTSE emerging market index was 3.0% lower while Japan’s Nikkei 225 Index declined by 2.2%. The Japanese yen strengthened against the dollar following unexpectedly high Tokyo inflation data, which increased speculation about potential Bank of Japan rate hikes.

Bond yields ended the month slightly lower while the gold price succumbed to profit taking and ended 4.1% lower.

Cryptocurrency markets

Bitcoin dominated the cryptocurrency landscape, surpassing $100,000. The crypto market saw significant institutional adoption through the approval of Bitcoin and Ethereum

ETFs, drawing billions in institutional inflows. However, the sector also faced challenges, with cryptocurrency hacks increasing by 21%, resulting in $2.2 billion in losses.

Commodities

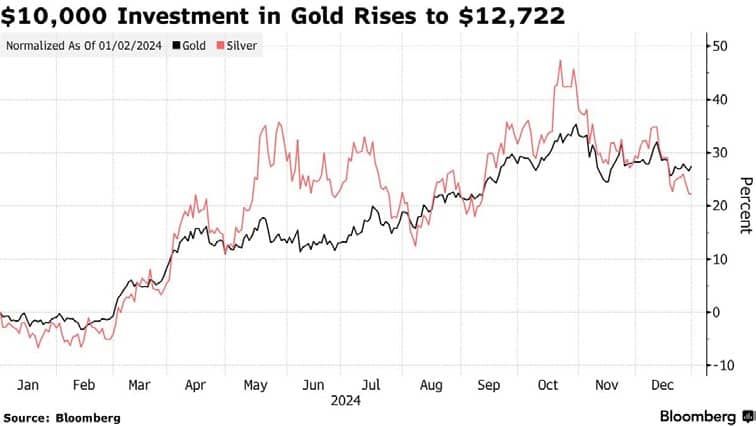

Gold was the standout performer in commodity markets in 2024, recording its best performance in 14 years with

a 25.5% gain. The precious metal set 40 new all-time highs during the year, reaching $2,777.80/oz in October.

“WHILE STARTING YIELDS ACROSS BOTH RATES AND CREDIT ARE ATTRACTIVE, CONCERNS ABOUT EXCESSIVE GOVERNMENT BORROWING AND POTENTIAL TRUMP ADMINISTRATION FISCAL POLICIES ARE CREATING HEADWINDS”

$10,000 investment in Gold rises to $12,722

Source: Bloomberg

The broader commodities landscape showed mixed results. Brent Crude Oil ended 4.5% lower and the WTI oil price 3% lower.

Several key factors, including geopolitical tensions, changing trade policies, and evolving energy dynamics, are shaping the commodities outlook for 2025. Factors supporting the continued strength in precious metals include the anticipated political uncertainty surrounding Trump’s presidency, ongoing geopolitical tensions, potential for a weaker dollar if the Fed begins its easing cycle and continued strong central bank buying, particularly from emerging markets.

The energy sector faces a complex landscape in 2025. Oil markets are likely to be influenced by the potential impact of Donald Trump’s energy policies (which have historically favoured domestic production), ongoing concerns about Chinese

demand amid structural economic changes, OPEC+ production decisions and compliance and geopolitical risks in key producing regions.

Natural gas markets, coming off a 65% gain in 2024, may see continued support from growing European demand as the region adapts to life without Russian pipeline supplies

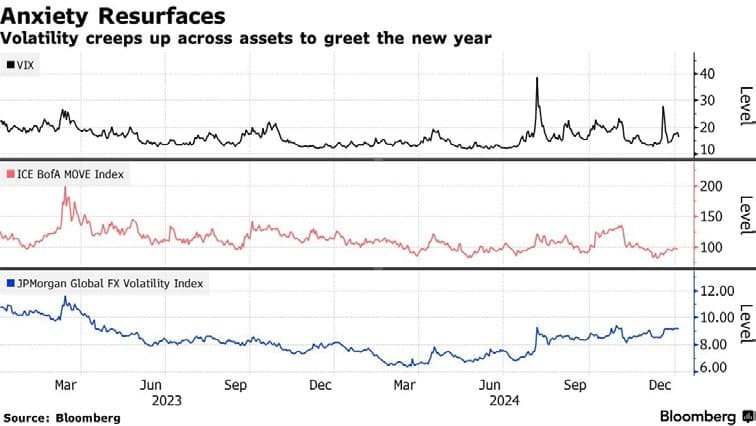

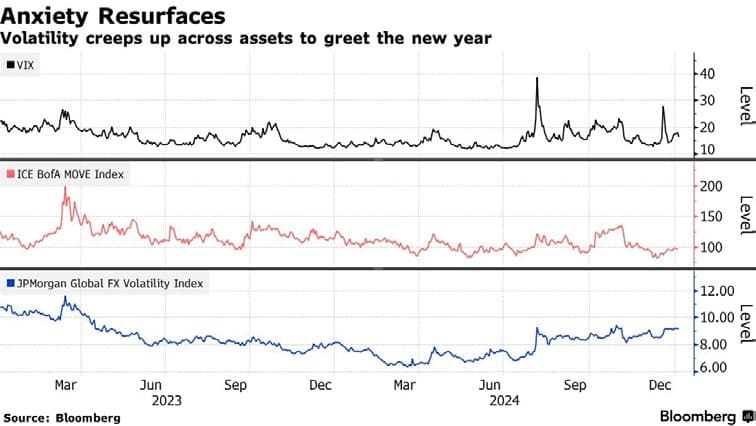

Volatility rising into 2025…

Moving into 2025, stock markets are dealing with geopolitical and domestic security concerns, economic policy uncertainty and company performance concerns.

Anxiety resurfaces – Volatility creeps up across assets to greet the new year

Source: Bloomberg

“THE BROADER COMMODITIES LANDSCAPE SHOWED MIXED RESULTS. BRENT CRUDE OIL ENDED 4.5% LOWER AND THE WTI OIL PRICE 3% LOWER”

Market concentration remains worryingly high, with the Magnificent Seven accounting for 32% of the S&P 500 market cap. Current market valuations are above historical norms and a Bloomberg model indicates that cross-asset valuations (adjusting the S&P 500 earnings yield and 10-year US Treasury rates for inflation) are higher than 88% of the time in data going back to 1962.

Federal Reserve interest rate policy is under the spotlight and markets are now pricing in a slower path of rate cuts.

Specific risk factors for equities, summarised by T. Rowe Price, include:

- Elevated valuations limiting price to earnings (P/E) expansion potential

- Expected deceleration in AI-related capital spending from 45% to 19% for major tech companies

- Potential negative impacts on inflation from government spending cuts, tariffs, and immigration reforms

- Risk of higher US Treasury yields due to deficits and inflation concerns

“INSTITUTIONAL INVOLVEMENT PROVIDES A MORE STABLE FOUNDATION FOR CRYPTO MARKETS THAN IN PREVIOUS CYCLES”

However, FactSet reports that analysts still expect S&P 500 earnings growth to be 15%, significantly above macro-implied levels. This optimistic outlook is based on continued strong performance from tech mega-caps, potential benefits from tax cuts and deregulation, accelerating earnings momentum and supportive monetary policy.

There is growing consensus that to sustain equity market gains, market leadership will need to broaden beyond the AI-driven tech sector that dominated returns in 2024. Furthermore, the elevated valuation environment gives reason for some caution. However, most commentators do expect another positive year for multi-asset portfolios.

Review of our 2024 Crystal Ball

Making 12-month predictions for markets is tricky, particularly with central banks, governments or regulators repeatedly muddying the waters with U-turns, inaction or outright policy error.

With this in mind, we will take a critical look at the outcomes from our predictions, some deliberately leftfield, made a year ago.

Sterling will end the year unchanged against the US dollar at $1.26.

Yes, for a while it looked like Sterling was running away with it at $1.34 but the exchange rate returned to where it started, ending the year at $1.252.

The Federal Reserve will not cut interest rates before the autumn.

Indeed, the Federal Reserve did not cut rates until 18th September.

Oil rises to $100 per barrel.

This started well with the price of oil racing to $92 per barrel by April. However, the ongoing geopolitics of the Middle East were not as bad as they could have been, and a stronger dollar helped pull the oil price lower.

FTSE 100 outperforms the S&P500.

This was wrong. The Magnificent Seven dominated the performance of the S&P500 which rose 26%. The FTSE performance was closer to the Russell Small Cap Completeness Index, arguably a better indicator of the rump of the US economy, which rose 11%.

Gold will finish the year almost unchanged at $2,000 per troy ounce.

No. Gold ended the year at $2,624. Interestingly, gold fell 8% to $2,560 following Trump’s election victory in early November. This was something that flew in the face of market pundits who saw gold as a “hedge against a Trump victory”—as they did in 2016.

Another difficult year for Chinese markets.

It was a difficult year, and Chinese stocks fell for the first three quarters of 2024. In late September, the Chinese index surged 25% in response to a raft of policy measures designed to support the ailing property market but has started to fall away again.

“AT THE TURN OF THE YEAR, BIDEN STEPPING BACK WAS NOT ON MOST PEOPLE’S RADAR”

Donald Trump wins the 2024 Presidential election. The US economy typically does well in election years and markets may well take the result favourably, as they did in 2016. A bigger call would be to predict that President Biden stands down before the election, for any number of reasons. This would create a lot of uncertainty for markets, as well as short-term volatility, but which one might expect them to recover by year- end. So as this is supposed to be a year-end prediction, the forecast is that the US presidential election will either be neutral or positive for the S&P500 and the US dollar.

Spot on. At the turn of the year, Biden stepping back was not on most people’s radar. The bookies were offering 40/1 on Harris to win.

Small and mid-caps outperform large cap stocks.

Small cap investors are still waiting for their reward and may take little comfort from their 11% gain which, in any other year, would be more than satisfactory. No, the Magnificent Seven continued their charge and, despite their volatility, pushed the S&P500 to a 26% gain. There is a very strong case for US small caps under a Trump presidency.

A member of the EU will announce a referendum on exiting the bloc in 2025.

There was no call for a referendum in 2024 but there was a rise of political parties across the EU standing on a platform for one. The EU is undeniably now doing everything it can to support a new vision to unify a fragile and fractious union and the fall in the Euro to near parity with the US dollar is but one barometer of the political problems facing the EU.

Instead of forecasting that a major cryptocurrency will blow up, this year it is possible that they are supported by growing fears of the introduction of a Central Bank Digital Currency (CBDC). Paradoxically, this could stoke greater interest in an established cryptocurrency like Bitcoin rather than a new CBDC introduced by a government or large bank/corporate. Finishing the year at $93,311, Bitcoin certainly was supported and the price more than doubled. The President-elect is planning a strategic cryptocurrency/ Bitcoin stockpile.

So, on the whole, less impressive than some previous years, but certainly more right than wrong. Moving onto 2025, our crystal ball comes up with the following….

Ten Predictions for 2025

Sterling will weaken against the US dollar but recover to $1.25 by year end.

Sentiment in the UK, both at the corporate and household level, could hardly be worse and there is little expectation that the UK Government can do much about it without some major policy U-turns. But if the Bank of England is bold enough to cut interest rates to boost growth, asset allocators may be minded to view investment into the UK more favourably.

The European Central Bank will get off the fence and cut interest rates.

In a bold move to stoke growth whilst simultaneously doing the heavy lifting for flailing European governments unable to do it themselves. They will be mindful of inflation remaining stubbornly above 2% but will opt to address the greater danger of stagnating GDP.

A member of the European Union will announce a referendum on exiting the bloc in 2025.

Politics is difficult to quantify but the fragility of the EU will surely be tested further as member states are increasingly pulling in different directions both economically and politically. Furthermore, they are now missing the familiar leadership of France and Germany, both dealing with their not inconsiderable challenges.

“THERE IS A VERY STRONG CASE FOR US SMALL CAPS UNDER A TRUMP PRESIDENCY”

Oil will rise to $95 per barrel.

If the incoming Trump administration is successful in implementing lower taxes and a raft of other pro-growth initiatives, a buoyant economy will tolerate a higher oil price.

The Russell 2000 Index hits 2,600.

This leads from the previous prediction that this could be the year that US small caps get their place in the sun. Protectionist policies, such as tariffs, import restrictions, and initiatives aimed at bolstering domestic industries, tend to create a more favourable environment for smaller companies focused primarily on the domestic market. Smaller companies are also less vulnerable to disruptions to global supply chains, trade wars or tariffs. For once, we will not link this prediction to the Magnificent Seven by predicting their bull run will end. Evidently, they are in a world of their own.

Yet another difficult year for Chinese markets.

The raft of policy measures designed to support the ailing property market are now baked into expectations. In addition to the headwinds China faced in 2024, there is now the prospect of tariffs from the Trump administration. The stock market remains in limbo, reliant as it is on policy for support; something which makes it a challenging call for investment.

“MODEST BUT CONSISTENT WAGE GROWTH COULD UNDERPIN GROWTH IN THE JAPANESE ECONOMY WITHOUT DERAILING EXPORTS”

Gold will recapture its highs of around $2,800 per ounce.

Not with standing dollar strength, which is but one determinant for the price of gold, other factors, such as monetary easing and low mining growth, will combine to support gold following its rise from $2,000 last year.

The Bank of Japan will raise interest rates without collapsing its own stock market.

There are early signs that the Bank of Japan has finally pulled off the impossible. Inflation has picked up and the yen appears to have regained its composure following BoJ interest rate hikes in 2024. Modest but consistent wage growth could underpin growth in the domestic economy without derailing exports brought about by a stronger yen.

A major company, like BP, will de-list from the FTSE and move to New York.

Given that £27 billion construction rental giant, Ashtead, quit in December, this isn’t unthinkable. Like Ashtead, over 95% of BP’s revenues come from outside the UK and so the rationale is compelling. Nevertheless, the company’s departure from the FTSE would be a devastating blow to the London Stock Exchange and would surely force a top-down overhaul of taxation and the rules and regulations to rebuild the attractiveness of the City of London as a place to list.

Bitcoin reaches $150,000.

Love it or hate it, the bull market in Bitcoin is now supported by the interest being shown by sovereign states, such as Switzerland, Germany and Hong Kong, to build strategic Bitcoin reserves. In addition, the United States is also looking to do the same with a view to safeguarding the dominance of the US dollar as the world’s reserve currency. All of this would encourage corporations and financial institutions to adopt some crypto-currencies to diversify and strengthen their portfolios.

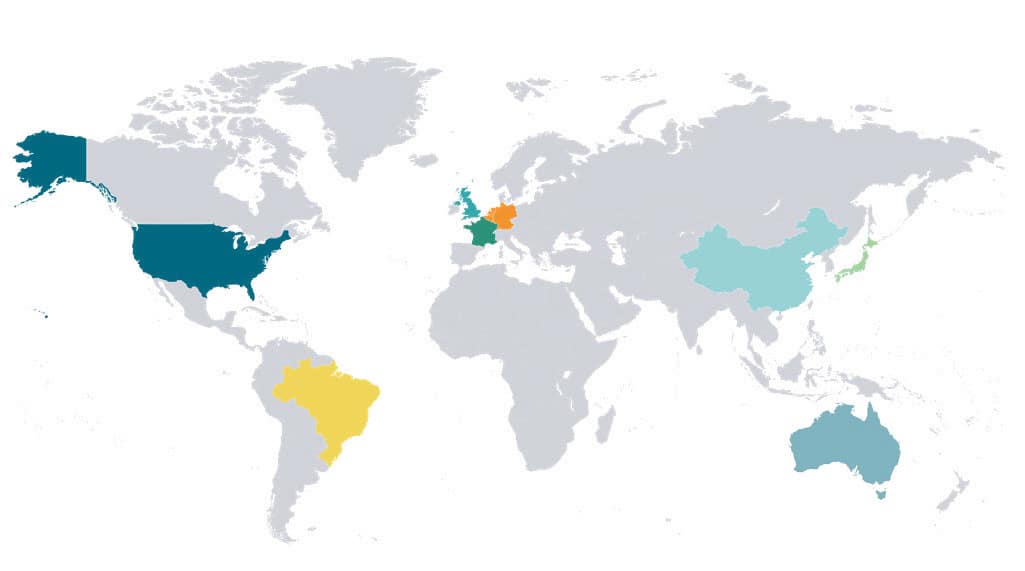

GLOBAL MARKET RETURNS Q4 2024

HELPLINE:

HELPLINE: