SANTA RALLY FOR STOCKS AND BONDS AS OIL PRICE RETREATS FURTHER

The year ended on a high note for stock markets and a ‘Santa Claus rally’ lifted stocks close to record highs. The S&P 500 Index soared 11.7% during the third quarter while MSCI Europe (ex UK) rallied 7.7%. The UK FTSE index appreciated by a more modest 2.3%. Emerging markets were generally less positive, and the China SSE composite ended the quarter down 4.4%.

Bonds also recovered ground, particularly longer-dated issues, while commodities were generally weak. Brent Crude ended the quarter 19% lower.

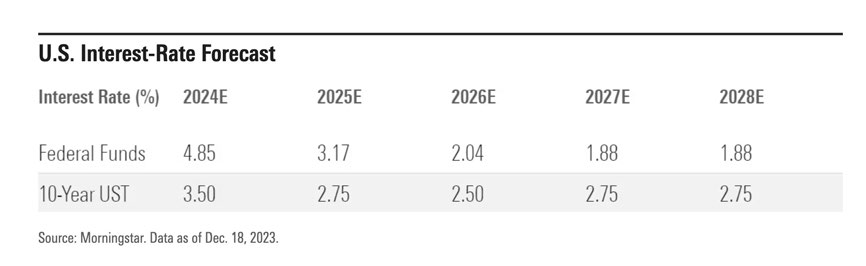

A sharp increase in investor optimism was spurred on by dovish interest rate expectations for 2024, with the market pricing in some six interest rate cuts during 2024 and the Fed giving a strong indication that it would begin reducing interest rates during the coming year – although not by as much as the market is factoring in.

Overall, 2023 brought many challenges for investors to navigate. The collapse of Silicon Valley Bank in March led to spectacular swings in the price of bonds and excitement about the impact of AI led to huge increases in the valuations of a handful of technology stocks. While investors during the late summer anticipated interest rates remaining higher for longer, bond prices collapsed further, and 10-year US treasury bonds yielded over 5% for the first time in over a decade. A change of sentiment in the final couple of months of the year (with increased optimism about incoming rate cuts) brought a broad market rally.

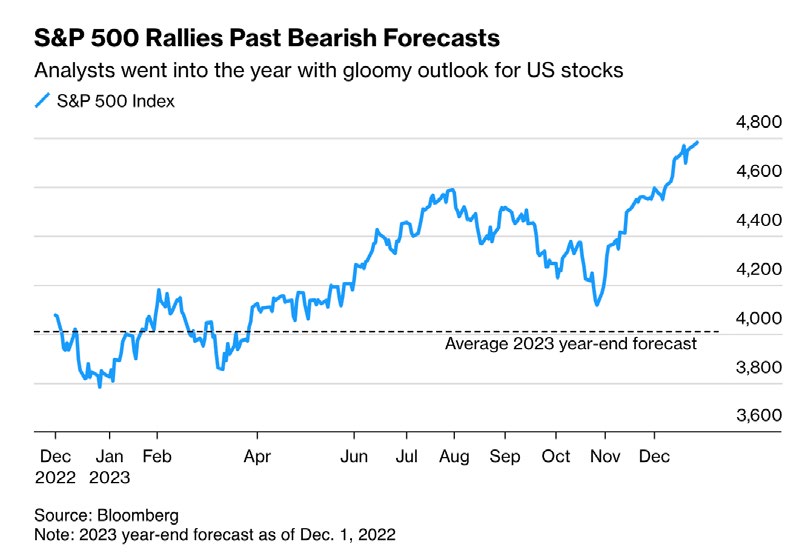

For the year as a whole, large cap US equities staged a strong recovery and the S&P 500 produced a 26% return while MSCI Europe (ex UK) rose by almost 19%. The UK FTSE 100 produced a total return of 7.9%. Returns from Asian equities were dampened after currency conversion, but Japanese equities were nonetheless strong. Asia (ex-Japan) was positive overall but China negative, especially once its weaker currency was accounted for. The recovery of bond prices in the final quarter meant that, in most cases, investors were rewarded with small gains for the year despite the volatility. Although the gold price rose, broad commodity indices ended the year around 10% lower due to large declines in other precious metals and oil.

S&P 500 rallies past bearish forecasts

Analysts went into the year with gloomy outlook for US stocks

Source: Bloomberg

There are concerns that investors are being overly optimistic about the extent of rate cuts likely to happen in 2024. The fact that the driver of the stock market rally is no longer solely the Magnificent Seven tech stocks — which accounted for 52% of the market return for the year as opposed to 75% at the end of June — gives some comfort.

Economist views on 2024

Bullish sentiment largely predominates among the leading economists and investment houses as we head into 2024, with the majority believing that the Fed will lead the way with some six interest rate cuts over the year, beginning around May, in response to the progress made in bringing inflation down towards central bank target ranges of around 2%. These interest rate cuts are expected to buoy the economy and underpin an ongoing rally in stock markets.

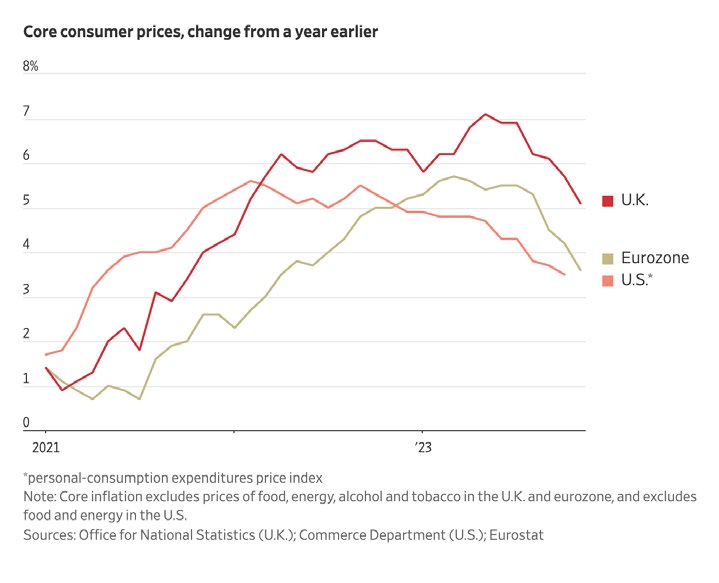

Core consumer prices, change from a year earlier

Source: Office for National Statistics (U.K.); Commerce Department (U.S.); Eurostat

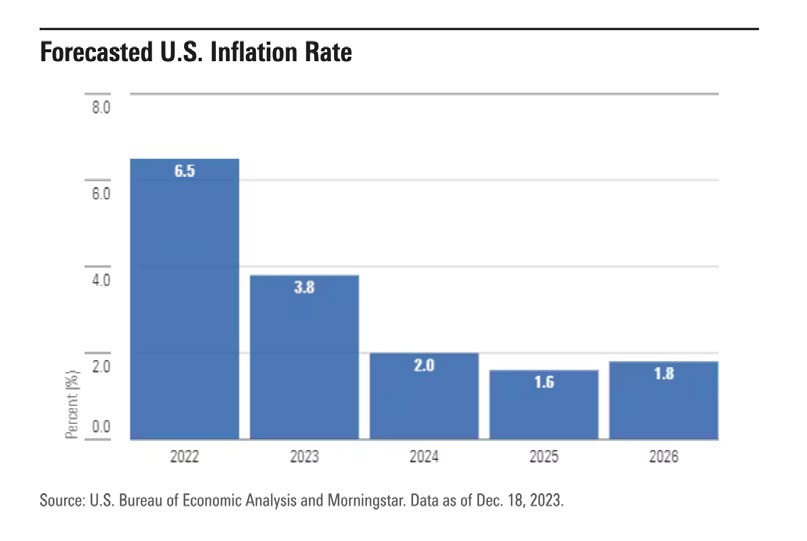

Inflation has slowed faster than many expected. Goldman Sachs economists estimate that core inflation came in at a 2.2% annualised rate over the three months to the end of November with subsequent lower interest benefiting companies, prompting a shift from cash to stocks. Certainly, moderating inflation and interest rate cuts will provide a tailwind for most stocks. Oxford Economics sees inflation reaching 1.3% in the fourth quarter of next year in the euro area, 2.7% in the UK and US inflation at 2.2% as measured by the Federal Reserve’s preferred Personal Consumption Expenditures price index.

Forecasted U.S. inflation rate

Source: U.S. Bureau of Economic Analysis; Morningstar

U.S. interest-rate forecast

Source: Morningstar

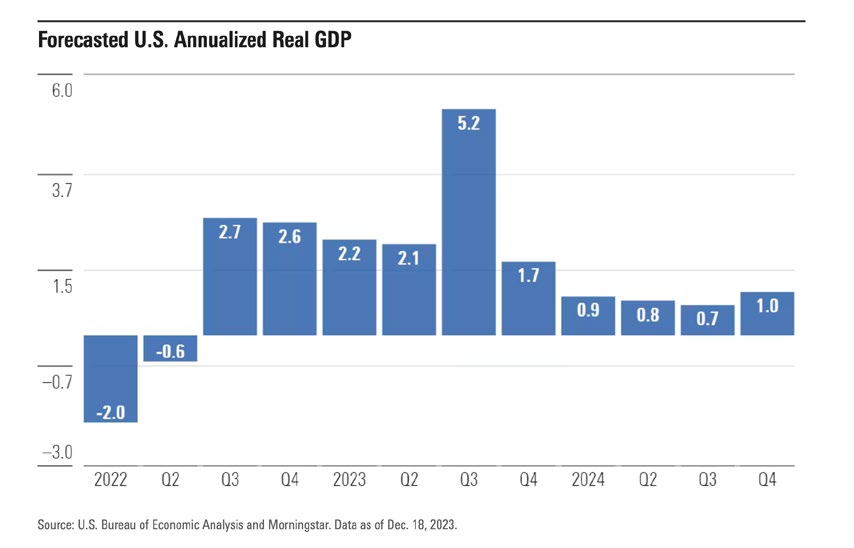

However, some economists predict a challenging year ahead with concerns about potential recession, geopolitical tensions, and depleted consumer savings impacting commodity prices and global growth. Many economists still expect US annual real GDP to remain at or below 1% in each of the four quarters this year. Invesco anticipates a ‘bumpy landing’ for the US economy, citing ongoing inflationary pressures and increased bankruptcies.

Forecasted U.S. annualised real GDP

Source: U.S. Bureau of Economic Analysis; Morningstar

The consensus, as produced by Bloomberg, suggests a manageable economic slowdown and easing interest rates paving the way for

a rally as the year progresses, with volatility in individual asset classes emphasising the benefit of diversification.

Review of our 2023 crystal ball

Following our cautionary outlook for 2022, we were more bullish for 2023, particularly for US equities and gold (which both enjoyed strong rallies) and emerging markets (which — with few exceptions — didn’t). A year ago, we put forward the following scenarios for 2023 to be reviewed with red biro:

1. All the major central banks will reverse policy

Like straws in the wind, economic damage did indeed become evident in Q1 2023 and was partly responsible for the price of crude oil falling from $85 to the year-low of $70 (see point 2). As always, the language used in the forward-looking guidance of the Federal Reserve, Bank of England and European Central Bank was more important than the base rate and, only recently, the Federal Reserve unexpectedly reversed its policy and signalled a 0.75% cut to US interest rates in 2024. The other central banks have not been in lockstep throughout the rate hike cycle, but a glance at the 10-year yields for all three tells you which way the wind is blowing if the policy reversal is to be trusted. From their 2023 highs to today:

- US 10-year Treasury 5% to 3.9%

- UK 10-year Gilt 4.7% to 3.7%; and

- German 10-year Bund 3% to 2%

The reversal has come a little later than anticipated by many but is clearly in place. (1/2 point)

2. Crude oil (Brent) is limited to around $75 per barrel

The tail did not wag the dog. This is rather satisfying because, despite gloomy predictions over Ukraine and OPEC agreeing in June and July to cut production by 4.6% until the end of 2024, the price of Brent crude fell from a peak of $94 in September to $75 today. The economic outlook clearly does not support higher prices, let alone $126 per barrel we saw in 2022. (1 point)

3. The S&P 500 outperforms the FTSE 100

The S&P 500 rose over 20% and the FTSE 100 only 8%. The differing composition of both indexes, the dominance of tech in the S&P 500 and the too-little-too-late strength of sterling all played their part in getting this right. (1 point)

4. ECB and Christine Lagarde at risk of a major policy error hitting European bonds

The sense of crisis didn’t creep into European bond markets until early October when, it needs to be remembered, the Federal Reserve was intimating a further interest rate hike. The overly hawkish warnings coming from ECB President Christine Lagarde helped to push German 10-year yields to briefly brush 3% but it was Italy, one of the weakest links in the EU economic chain, where yields rose to 5%, raising Italy’s debt servicing costs by an additional €10 billion. The main factor driving the crisis was the very real fear that ECB policymakers would step up their quantitative tightening when signs of economic stagnation were already evident. The risk left policymakers staring into the abyss and it was the spike in yields to unsustainable levels that stopped them from stepping into it. (1 point)

5. Japanese stock and bond market has a mini-meltdown

The BoJ still likes to keep markets guessing by refusing to follow the Fed but, as we saw, they did eventually throw in the towel to common sense. The Japanese 10-year yield rose from 0.4% last year to 0.97% in early November. The speed of the fall in the Japanese bond market caught many by surprise but the unique way in which 70% of Japanese government bonds are owned by the Bank of Japan and closely affiliated banks and trust funds meant the news didn’t travel far. The more than doubling of the yield only really looks impressive when you consider the 10-year yield was trapped in a range of -0.25% to 0.15% from 2016 to 2022. With continued extreme yen weakness, Japanese stocks held up, but challenges remain. (1/2 point)

6. Putin removed from power and a Ukrainian peace deal

The unwinnable stalemate and rising opposition to the war are undeniably present but Putin is still there. Political forecasting is fraught with difficulty and perhaps those with greater access behind the Kremlin curtain know better. (0 points)

7. The UK housing market falls far more than the US

This happened, but both property markets vary regionally and no single index captures the main story. By September, the UK’s national price index was down a few points before recovering to flat. Colchester fared worst — down 4% — but London, it will come as no surprise, fell 1.2% this year with much larger discounts — over 5% — on asking prices. Demand appears to be picking up and potential mortgagees sense the end of the rate hike cycle but UK prices were down across the board. By contrast, the US property market rose 5.6% nationally and the reasons for it are generally credited with the difference in the two countries’ mortgage markets. (1 point)

8. Emerging markets stage a big recovery

The MSCI Index did rise 5.7% this year but was held back by the massive 28% weighting of the index to the Chinese market, which fell

13%. The US dollar weakened against the major currencies as interest rate forecasts were reversed, but not enough to put a much more thrilling gloss on the fortunes of emerging economies which typically have a lot of US-dollar denominated debt. It was a reasonable return, with bright pockets here and there. Overall, except for fears of war, risks appear to have diminished. A decent recovery from last year but not the re-rating hoped for. (0 points)

9. Gold to recapture last year’s high of $2,050

Gold started the year at $1,825, recaptured $2,050, as forecast, on 1 December, and ended the year a little higher again. (1 point)

10. China drops the yuan peg to the US dollar

The yuan was allowed to weaken throughout the year from 6.92 to 7.35 in early September, a 16-year low. It has since settled at 7.14. Much of the weakness was attributed to the slowing of the Chinese economy but, although there was no headline-grabbing policy announcement regarding a dropping of the peg, it will also have reflected central policy. Lending costs were cut to avoid more pain, especially in the beleaguered property market. Countering this, however, was an unexpectedly strong intervention by the People’s Bank of China to stop excessive weakness which could lead to capital flight. (½ point)

So, there it is for another year. 6.5/10 is not quite as good as achieved with the 2022 predictions but economic and market moves anticipated were mainly correct. As far as Russian politics is concerned, could do better!

- The themes were reflected in different aspects of the New Horizon strategies which were positioned so that:

- Some longer dated fixed income exposure was retained and then added in anticipation of the central bank policy reversal (1)

- Commodity exposure was weighted to gold and carbon credits more than oil (2,9)

- UK equity exposure was reduced in favour of US stocks, especially those giving exposure to the domestic US economy (3)

- European bond exposure was reduced and minimised (4)

- Japan equity and bond exposure was reduced but currency exposure maintained (5)

- UK property exposure was significantly reduced (7)

- Emerging market exposure was overweight, with an emphasis on India (which performed well) and China technology at the most attractive valuations for two decades (8,10)

The dominance of large-cap US tech after the collapse of Silicon Valley bank along with the sudden focus on AI did not provide the boost to the broadly diversified New Horizon Fund that was enjoyed by some large-cap equity peers. However, the fund performed well in the final quarter

as market performance broadened which meant that in 2023, the New Horizon strategies again performed better than peers and benchmarks across most risk levels and currencies. As detailed below, we anticipate the recent trend of increased market breadth continuing into 2024.

Ten predictions for 2024

Below we list another ten scenarios for the coming year, again some a little leftfield and many away from consensus. Referring to AI and politics, Elon Musk believes that this year is “gonna be more crazy”. But for stock, bond and currency markets, there are reasons to believe that it could be remarkably stable. Of course, geopolitics could upset things in the short-term, as it usually does. But with central bank policy likely to be more predictable, the prospect of a ‘new normal’ of stable interest rates and lower inflation could prove to be a favourable environment for good returns and provide justification for staying invested in a diversified portfolio.

1. Sterling will end the year unchanged against the US dollar at $1.26

This is controversial since there is expected to be a yawning gap between stronger GDP growth in the USA and the Federal Reserve leading the way on interest rate cuts. However, whereas the Bank of England was cautious in following the Fed on the way up in the rate hiking cycle, due mostly to the exposure of domestic UK mortgage holders, it has form when it comes to cutting them at the same pace on the way down. Furthermore, the pace at which UK 2-year fixed mortgages are coming up for renewal has not been as bad as expected and, whilst some will face a doubling of new 2-year fixed rates, that rate has already fallen below 4%.

2. The Federal Reserve will not cut interest rates before the autumn

The prospect of a soft landing for the US economy will remove the need for any short- term stimulus. The US consumer is in good health and, historically, corporate profits can grow perfectly well with interest rates around 5%.

3. Oil rises to $100 per barrel

OPEC have implemented their production quotas for all of 2024 and these are unlikely to change amid ongoing trouble in the Middle East, which could worsen significantly. A buoyant US economy will tolerate and support a higher oil price.

4. FTSE 100 outperforms the S&P 500

This is more of a forecast for the broader indexes than a call on the big tech US stocks which dominated US benchmarks in 2022/23. Value stocks in both markets are more attractively priced while financial and energy stocks, which are more heavily represented in the FTSE 100, could perform better if inflation remains above the 2% target for their respective central banks.

5. Gold will finish the year almost unchanged at close to $2,000 per troy ounce

Gold staged an impressive recovery in the last quarter, rising from $1,850 to $2,060. However, the factors influencing gold go beyond inflation, which is falling anyway. If interest rates do stay higher for longer, in spite of falling inflation, yields available on cash, bonds and stocks will remain relatively attractive. Furthermore, if the US dollar holds up against the basket of major currencies, a return to the record high of

$2,135 seems unlikely.

6. Donald Trump wins the 2024 Presidential election

As a binary call, and with the bookies pricing him as favourite to win, this isn’t exactly long odds. However, the US economy typically does well in election years and markets may well take the result favourably, as they did in 2016. A bigger call would be to predict that President Biden stands down before the election, for any number of reasons. This would create a lot of uncertainty for markets, as well as short-term volatility, although one might expect them to recover by year-end. So as this is supposed to be a year-end prediction, the forecast is that the US presidential election will either be neutral or positive for the S&P 500 and the US dollar.

7. Small and mid-caps outperform large cap stocks

Small caps in the US have already staged a 25%-plus recovery from the lows in late October but, taken over the year, it was a volatile and unrewarding one for small-cap investors waiting to be rewarded for taking a bet on large discounts on price-to-book and price-to-earnings ratios. As markets digest the prospect of interest rates remaining higher for longer, a soft-landing for the US economy and falling inflation will combine to be supportive of this forecast.

8. A member of the EU will announce a referendum on exiting the bloc in 2025

This is a bold prediction because whatever the serious political battles between the EU and the likes of Poland, Hungary and — increasingly — Italy, the unhappy and fragile union survives for fear of something worse. If the UK, with its own currency, found it so difficult to Brexit, imagine the nightmare of a euro-adopted EU member trying the same? However, it’s not hard to imagine Poland or Hungary using a referendum as leverage in its ongoing battles with an immovable EU. If it is announced, it may never get to a vote. But it would have a profound effect on the long-term political prospects for the union and could prompt a new vision to unify member states.

9. Another difficult year for Chinese markets

The performance of the MSCI Emerging Market Index was severely curtailed last year by the 13% fall in Chinese stocks which make up 28% of the index. The yuan weakened throughout the year and the Chinese authorities did their best to manage the decline whilst also trying to cut borrowing costs. Balancing support for the beleaguered property sector while resisting bail outs and simultaneously avoiding capital flight is likely to be another major challenge in 2024, and one they may fail to achieve.

And finally… at number 10 we afford ourselves an outlier

Cryptocurrencies have not yet become a core asset class typically implemented in portfolios. Yet instead of forecasting that a major cryptocurrency will blow up, this year it is possible that growing fears of the introduction of a Central Bank Digital Currency (CBDC) could create confusion, uncertainty and threaten the future of cash and bank deposits in the minds of the wider public. Paradoxically, this could stoke greater interest in an established cryptocurrency like Bitcoin rather than a new CBDC introduced by a government or large bank/corporate. Last year’s bull run in Bitcoin saw the price rise 250%, which would normally prompt many to take profits. But crypto is anything but normal and talk of a CBDC could attract renewed interest among hitherto sceptical investors.

The final two of these scenarios could produce volatility and are reflected within the New Horizon Fund. There is certainly deep value in many large-cap Chinese technology stocks which are yet to benefit from the advances made with AI. However, Indian technology and IPOs now make for an even more exciting growth opportunity and Fund exposure is being added there incrementally. Finally, although we have no direct exposure to cryptocurrencies, fund exposure has been gradually added in recent months to areas where there has been a clear, indirect positive impact from Q4 strength in these assets. Such exposure will never constitute more than a per cent of the overall portfolio but, along with alternative income sources, infrastructure and a range of commodities including grains, it broadens diversification to reduce risk.

Wishing you a healthy and prosperous 2024!

GLOBAL MARKET RETURNS Q4 2023

HELPLINE:

HELPLINE: