Now that spring has sprung, there is a palpable sense of optimism that global growth will surprise on the upside this year, buoyed by the promising pace of vaccine rollouts and economies opening up. The seasonality is no coincidence since the dark days of winter perfectly encapsulated what will hopefully prove to be the peak of the Covid-19 pandemic in the US and Europe.

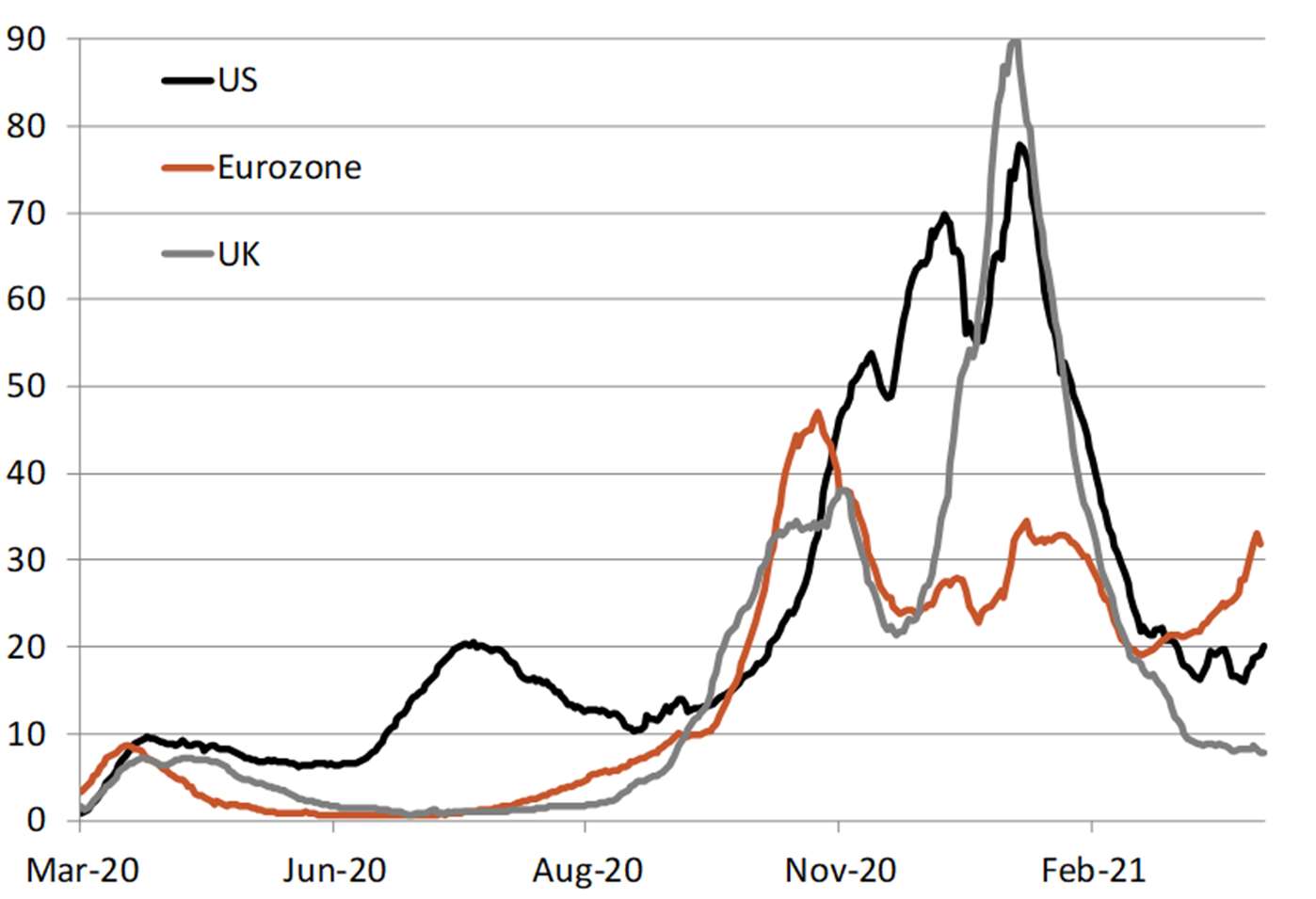

A new wave in the Eurozone – confirmed infections per 100.000 people

Daily confirmed infections per 100.000 people, seven-day averages. Source: JHU

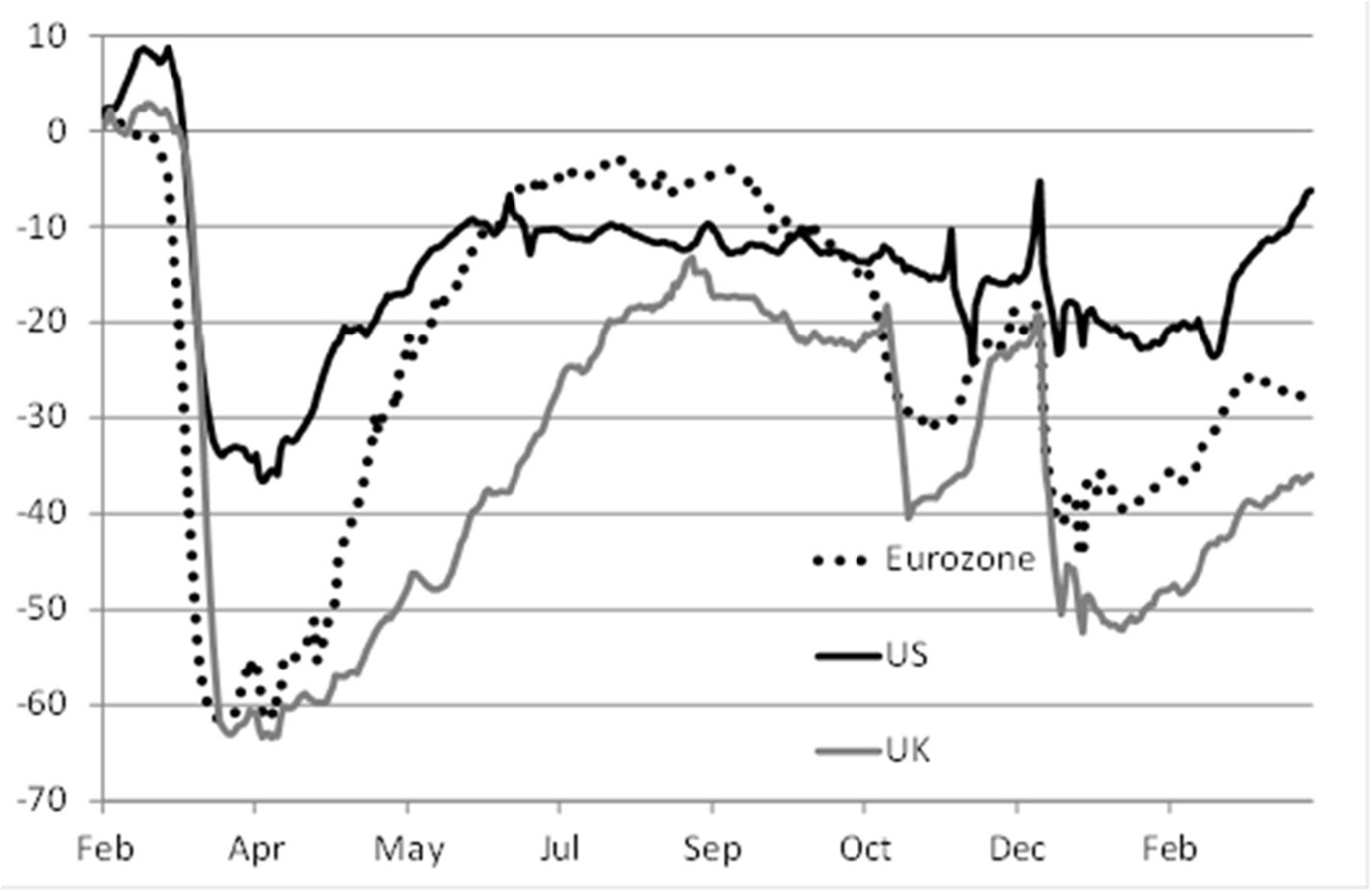

Going out again? Retail & recreation footfall in advanced economies

Seven-day moving average. Percentage change relative to median value of 3 January – 6 February 2020 baseline. Weighted footfall changes for Retail & Recreation and Grocery & Pharmacy 2:1. Not seasonally adjusted. Source: Google

As usual, the stock and bond markets have been way ahead of the mood in the daily press. Despite the devastating impact to the economy, the US stock market has staged a full recovery and continues to hit new highs. Even the FTSE 100, hindered by a large financial sector and lingering worries about Brexit, has recovered to within 10% of the level it began last year.

Cyclical stocks that were hardest hit by the pandemic last year, as well as emerging market assets, have been the primary beneficiaries of the reflation trade that has prevailed during the quarter. The cyclically adjusted price-earnings ratio is now the second highest it has ever been which could be evidence of a speculative bubble.

However, it is usually pre-emptive tightening of monetary policy that bursts a bubble and there is no sign of that coming any time soon.

That markets climb a wall of worry is nothing new. A chart of the US stock market recovery from the Great Financial Crisis in 2008 looks like one continuous worry-free bull market. Even the eurozone crisis of 2012 barely registers more than a blip. But in reality we know that throughout that decade things certainly didn’t feel like that at all. Looking back, there was always a long list of dreads demanding the attention of financial pundits, investors and global asset allocators.

Some of these concerns mattered. Most did not. Indeed, throughout most of the recovery, sovereign yield curves were firmly positive, forecasting a rise in interest rates that never came. Instead, they fell further to nearly zero, providing fuel for the rising stock, bond and property markets.

The prospect of inflation that so bugged investors actually came in the form of rising asset prices rather than in the cost of living. The gold price doubled in the years following the Great Financial Crisis and while there has been some profit taking since the US election, the metal retains many attractions from being a potential inflation hedge to a safe-haven. We retain direct exposure to the gold price as well as to silver, platinum and palladium. Indeed, inflation, rather than Covid-19, appears once again to have been investors’ main concern since the start of the year. Consequently, we are adding broader commodity exposure to include energy, industrial metals and agriculture – all of which provide an element of inflation protection.

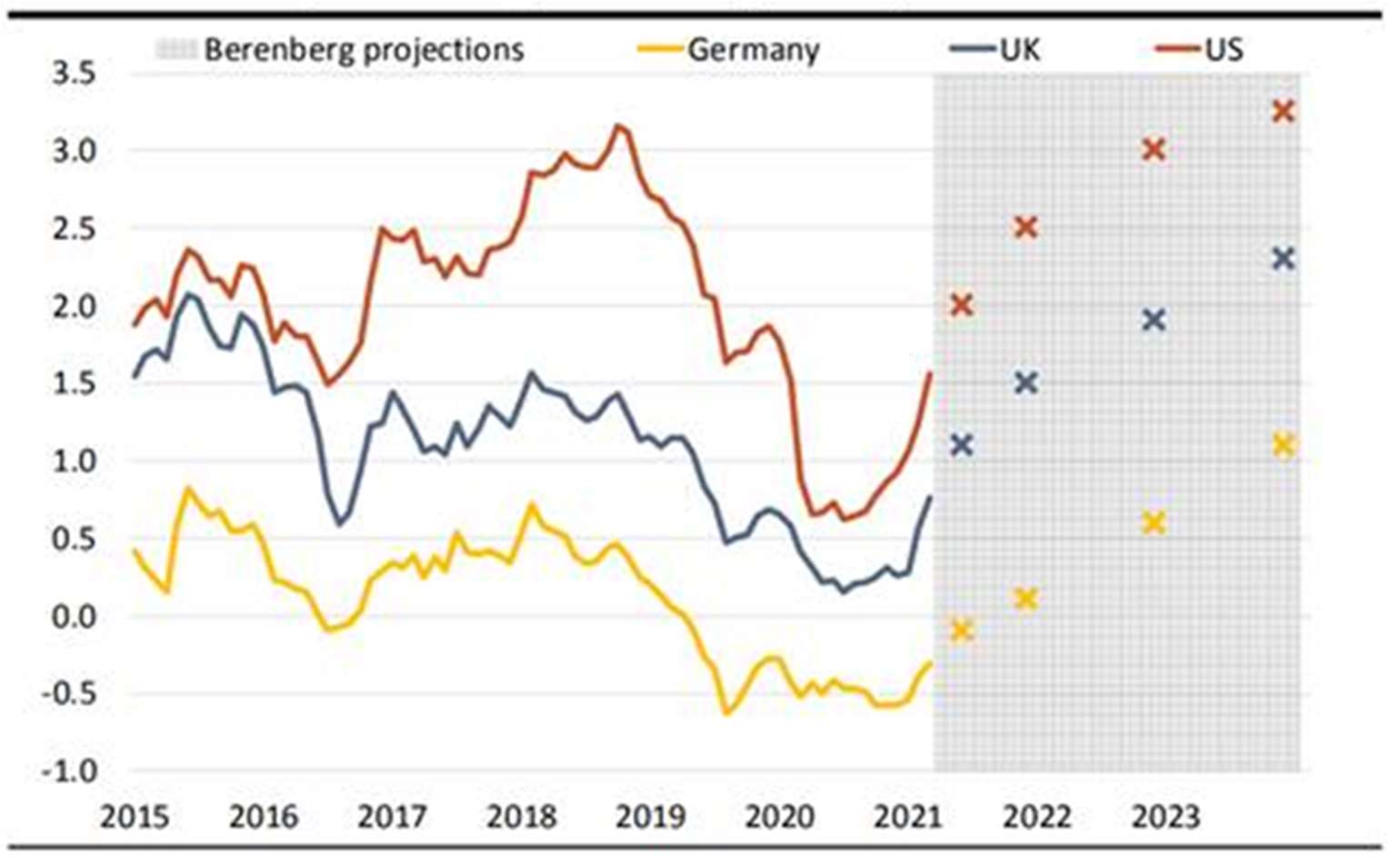

In the US, UK and even Germany, bond yields have risen to where they were in January 2020. The direction of travel has been similar across all developed markets. But that is where the similarity ends. The US 10-year Treasury now yields 1.7% whereas the UK 10-year Gilt yields less than half that. The German bond is still in negative territory, yielding -0.3%. This is a big difference and, combined with the continued strength of the US dollar, some analysts believe treasuries could yet again prove to be a tempting target for asset allocators. Many, such as Berenberg, are forecasting the rise in treasury yields to continue but not to an extent that would have a detrimental effect on equities. Few are anticipating the rise in yields to directly precipitate a bear market. After a decade of over-predicting inflation, central banks will require strong evidence of wage growth before reducing stimulus this time.

The rise is not yet over: 10-year sovereign bond yields

Source: Haver Analytics, Berenberg forecast US forecasts supplied by Berenberg Capital Markets

Inflows from the rest of the world would ultimately act to put upward pressure on the US dollar. This, in turn, would alleviate inflationary pressures in the US – which is what everyone seems to be worrying about. Perhaps this explains why the US Federal Reserve appears to be so sanguine about its own inflation targets?

The European Central Bank, perhaps fearing a selloff in its own government bonds, has stepped up its bond-buying program to keep yields down. While the US can seemingly prosper with relatively higher borrowing costs, clearly the concern of the ECB is that the eurozone cannot.

In addition, because rising 10-year yields push up expectations of future rate rises, the UK could also have a problem with its sensitivity to rising base rates. This is because the payments for UK mortgage borrowers are linked to short rates in a way that those of US borrowers, linked to 25-year rates, are not. The Federal Reserve may be reluctant to raise base rates back up to 1.5%, but for the Bank of England it is almost unthinkable.

For now, the relative attraction of US assets appears to be underpinned by the rate of its economic recovery, ability to withstand higher bond yields and the corresponding strength of the US dollar.

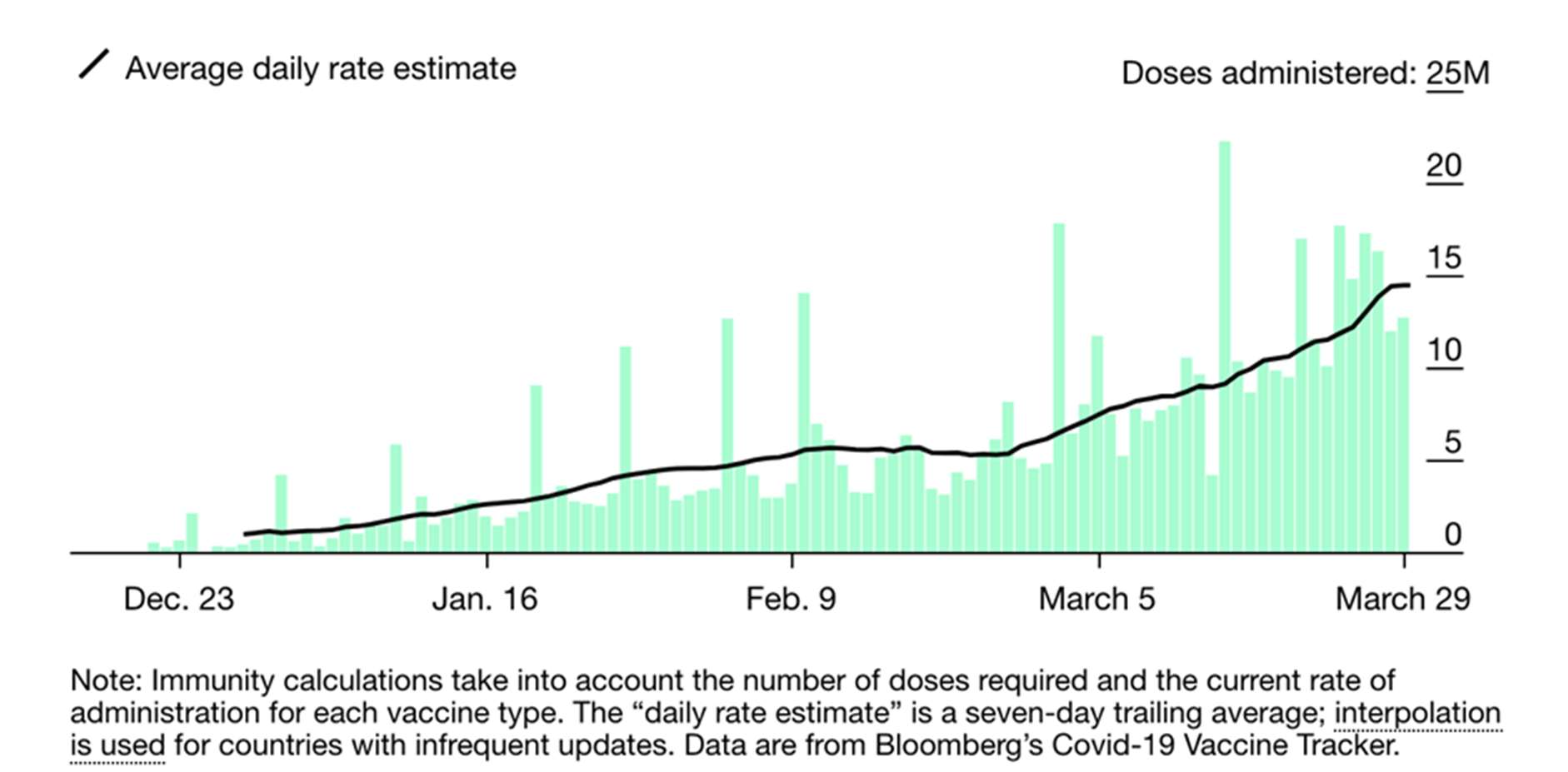

Vaccination roll-outs

The race to administer vaccines to curb spiralling infections and, in particular, hospital admissions was a feature of the quarter. Globally 15 million doses have been administered daily but most countries have barely started. According to Bloomberg’s Vaccine Tracker, at this pace, it would take another 2.1 years to cover 75% of the population. Global attempts to bring the pandemic under control have brought a rise in vaccine component protectionism. The European Commission, worried about the volumes of vaccines that are being distributed to other countries, announced its intention to halt all vaccine exports, including to the UK, which sources the bulk of its vaccines from the continent.

Meanwhile, the US has indicated it will distribute vaccine supplies to countries in need only when all of its citizens have been vaccinated and it has accumulated sufficient vaccines to vaccinate its youth.

Global vaccine doses administered

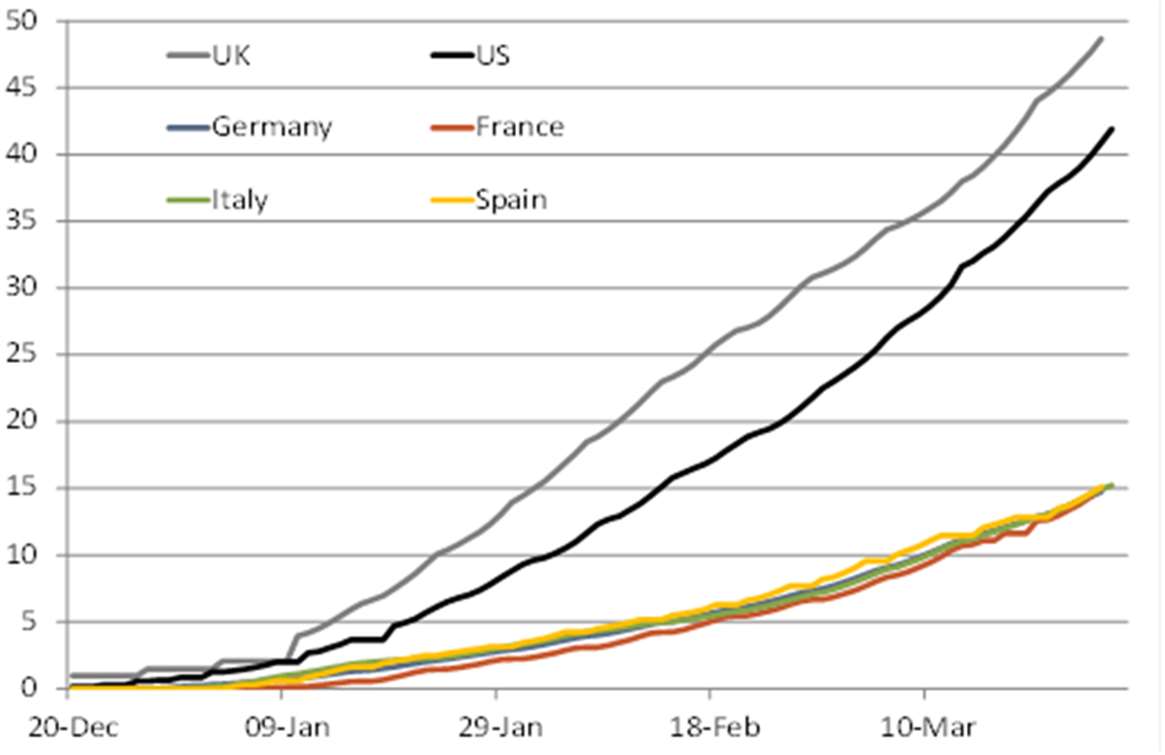

Nonetheless, the US and the UK have seen infection rates coming down strongly. President Biden has further upped the pace of vaccination, recently announcing his “90-90” plan, in which 90% of adults will be eligible for a vaccine shot by April 19 and 90% of the US population will live within five miles of a vaccination site. To achieve this, the administration is doubling the number of pharmacies that will offer vaccine shots.

Progress in the EU has been slower. The region is battling to roll out vaccine programmes fast enough and infections are rising steeply again, particularly in France where hospitals are filled to capacity.

Total number of COVID-19 vaccinations administered, per 100 people

Irrespective of regional differences, it is clear that the global impact of the pandemic will continue to impact daily life for some time yet. Even as economies open up, medical experts continue to issue warnings of further waves of infections and of the risks posed by new variants.

Constructive views on second-quarter economy and stock markets

Looking at the prospects for financial markets, economically-sensitive stocks should continue to perform well, albeit susceptible to bouts of volatility sparked by movements in bond yields. The portfolio’s Dividend Aristocrat exposure is set to benefit if the recent recovery in financial and defensive sectors is sustained in the US and repeated in Europe. The $1.9 trillion US fiscal package, continued monetary policy support, rising vaccine supply and distribution and significant amounts of corporate and consumer cash waiting to be deployed are all supportive of equity values.

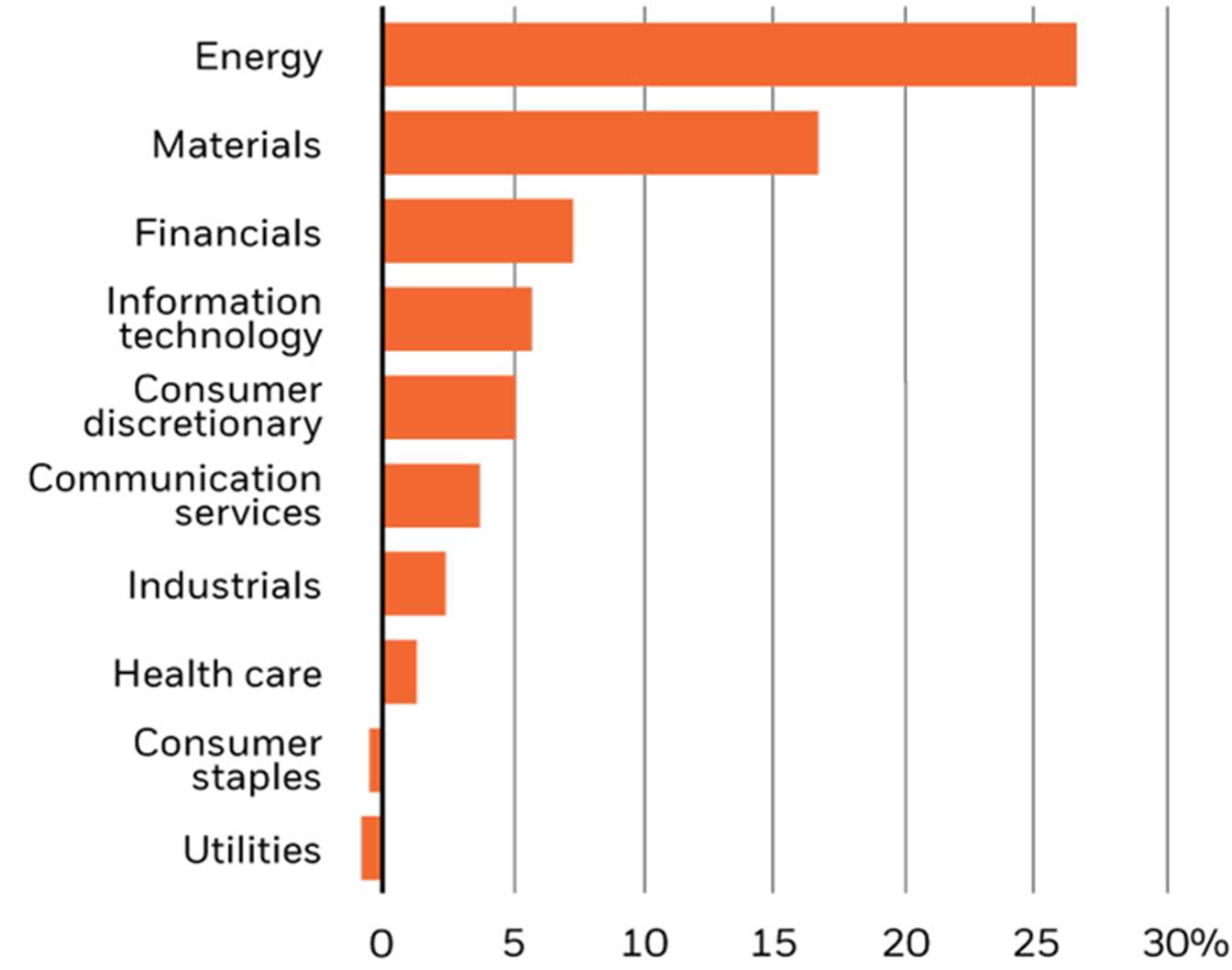

Earnings continue to beat consensus analyst estimates and conservative company guidance with earnings momentum in the energy, materials, financials and information technology the greatest. Technology remains within the top five earnings momentum plays, even though mega-cap technology stocks were the most affected by the reflation trade and rise in bond yields during the first quarter. Economically-sensitive sectors, including cyclical stocks and reopening plays, could surprise further to the upside.

Three-month change in analyst earnings estimates (%)

Source: Refinitiv Datastream, MSCI, BlackRock Investment Institute based on percentage change in analyst estimates over the past three months for the representative MSCI World sector indices.

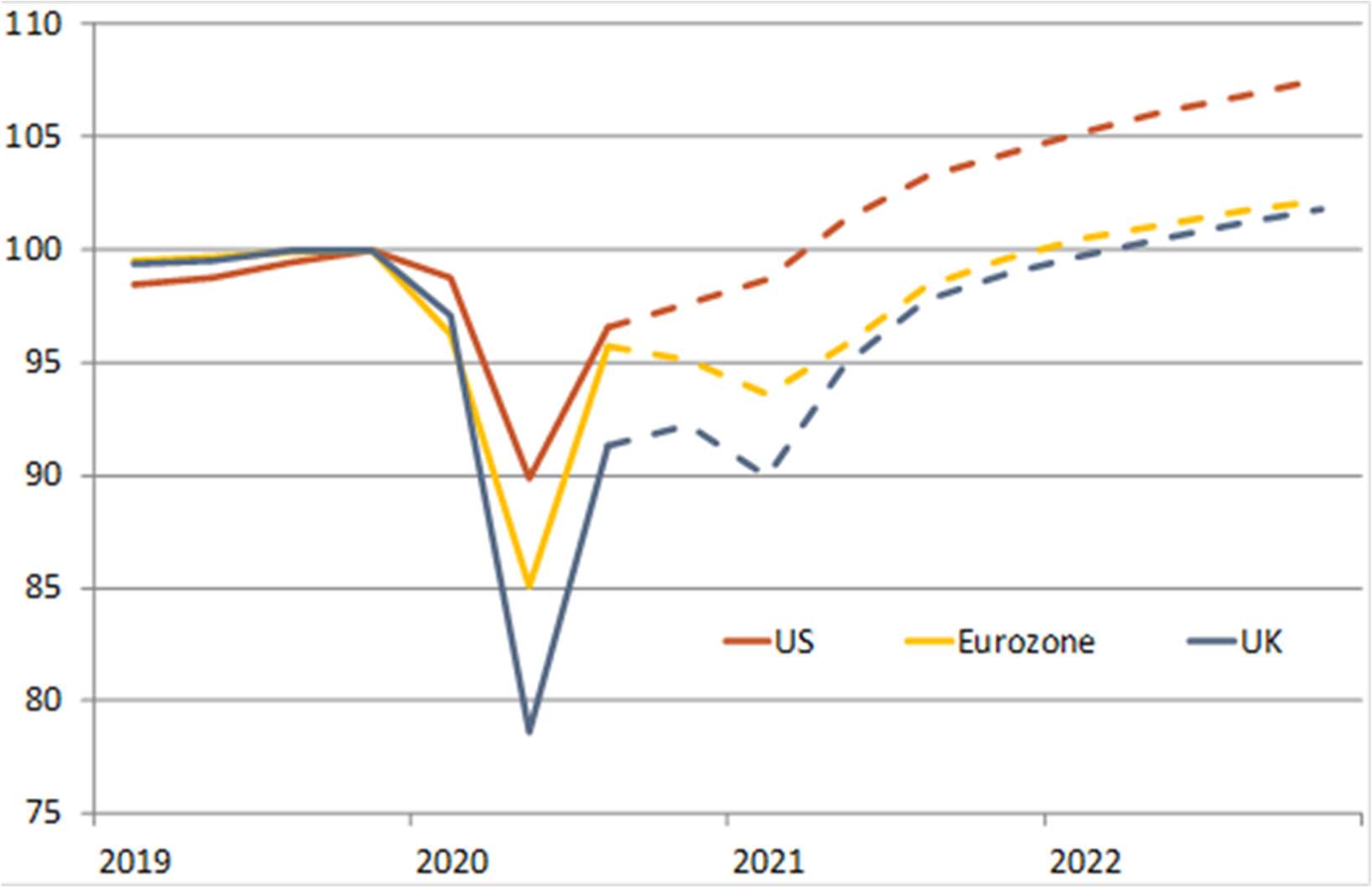

Diverging economic fortunes

Although overall growth looks positive, many analysts are anticipating a divergence between the US and Europe with Europe lagging due to the pandemic not yet coming under control and with a more restrained stimulus package. We too have moderated our exposure to the region over recent months. Nonetheless, the latest European Purchasing Manager’s Index (PMI) increased above the 50 level in March, indicating a growing economy, and the IHS Markit’s flash composite PMI also showed that European factories ramped up output at their fastest monthly pace in over 23 years. As stock specific opportunities arise over the coming weeks we will be looking to capitalise on any shift in sentiment.

Outlook for real GDP in advanced economies

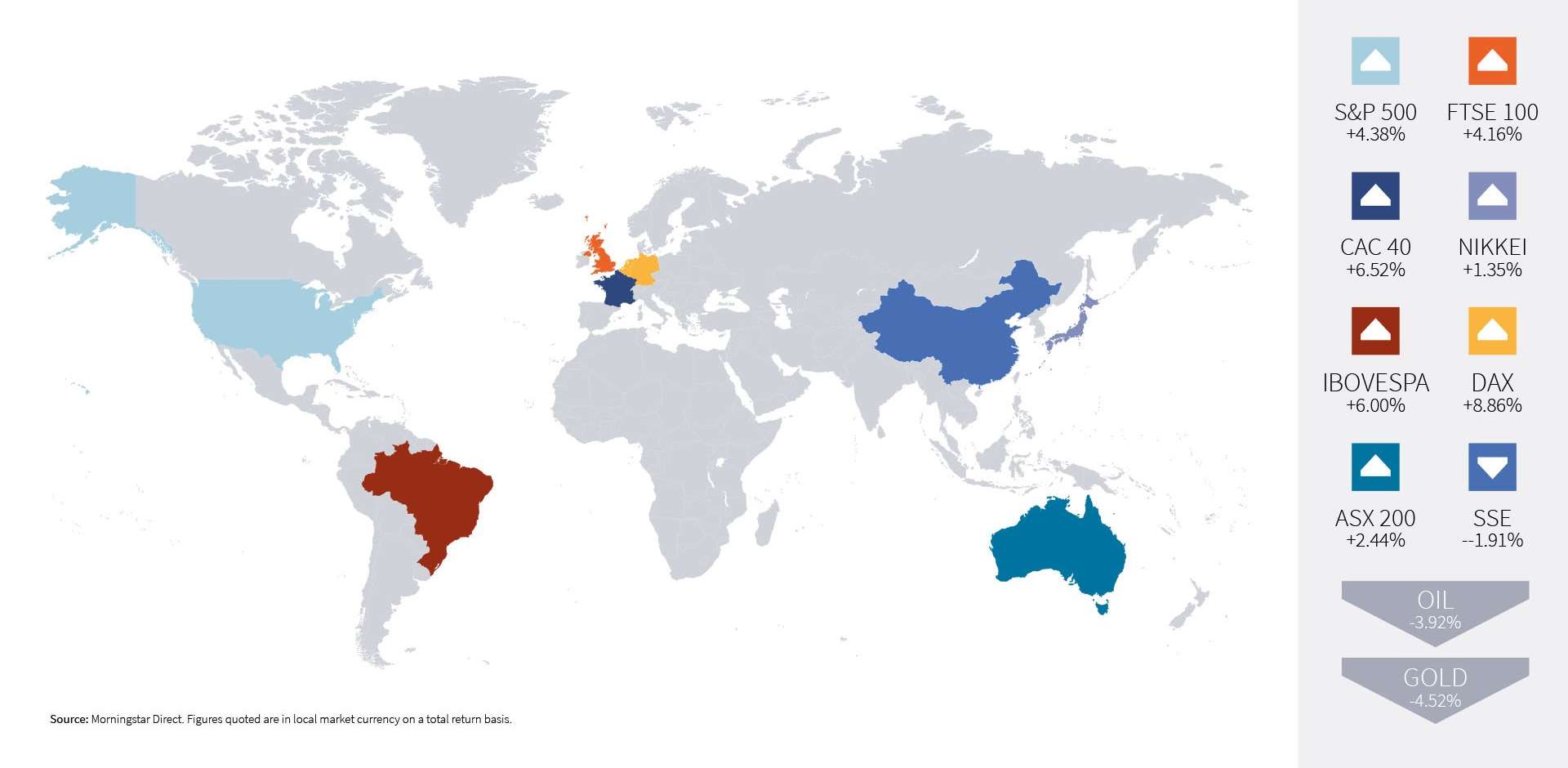

Global Market Returns (March 2021)

HELPLINE:

HELPLINE: