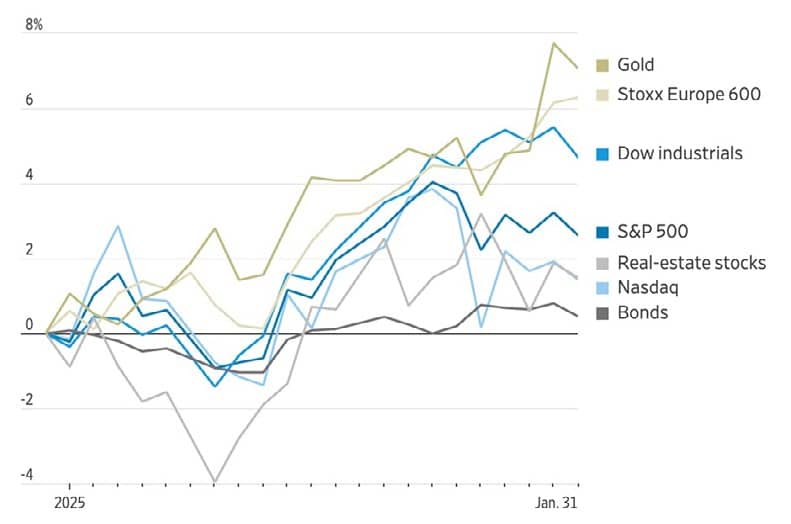

FURTHER GAINS FOR GLOBAL MARKETS WITH EUROPE LEADING THE WAY

Stock markets experienced solid gains in January, despite late-month volatility. The Dow Jones Industrial Average rose by 4.7%, the S&P 500 advanced by 2.8%, and the Nasdaq Composite gained 1.6%. European markets outperformed their US counterparts, with the Stoxx Europe 600 surging 6.3% to reach record highs.

Germany’s DAX rose by 9.2%, and the UK’s FTSE All Share increased by 5.5%. The primary exception was Japan’s Nikkei 225, which declined by 0.8%. Gold saw a significant rise, climbing 7% in January—its biggest monthly gain since August 2011—driven by ongoing safe haven demand.

“EUROPEAN MARKETS OUTPERFORMED THEIR US COUNTERPARTS, WITH THE STOXX EUROPE 600 SURGING 6.3% TO REACH RECORD HIGHS”

January price performance

Source: FactSet

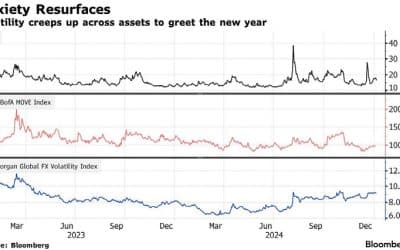

Investor sentiment in the US was shaped by trade policy developments and monetary policy considerations. The Federal Reserve kept its benchmark rate steady, signalling a wait-and-see approach to future cuts.

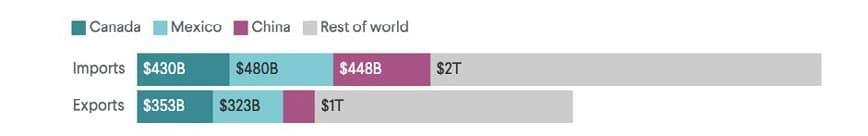

Corporate earnings remained robust, with over 75% of S&P 500 companies surpassing analyst expectations. However, market sentiment softened in late January pending new tariffs on key trading partners.

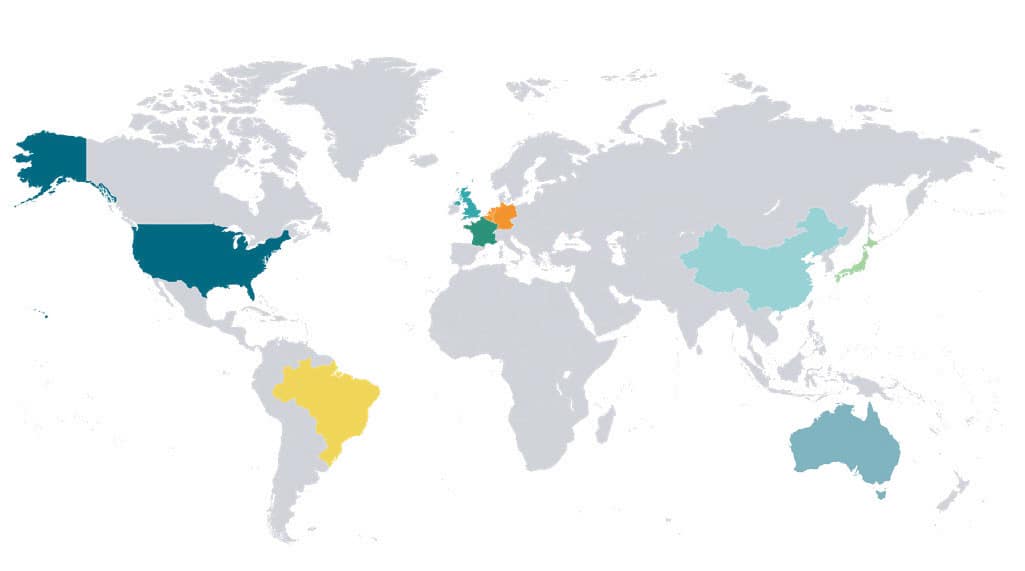

Canada, Mexico, and China make up nearly half of U.S. trade U.S. trade in goods, 2023

Source: UN Comtrade

In Europe, the outperformance was driven by the European Central Bank’s accommodative stance, the Euro’s relative weakness against the dollar, and lower exposure to technology stocks, which benefitted the region after disruptions in the AI sector. The shifting of Trump’s focus to Mexico and Canada for the initial round of tariffs further boosted investment sentiment.

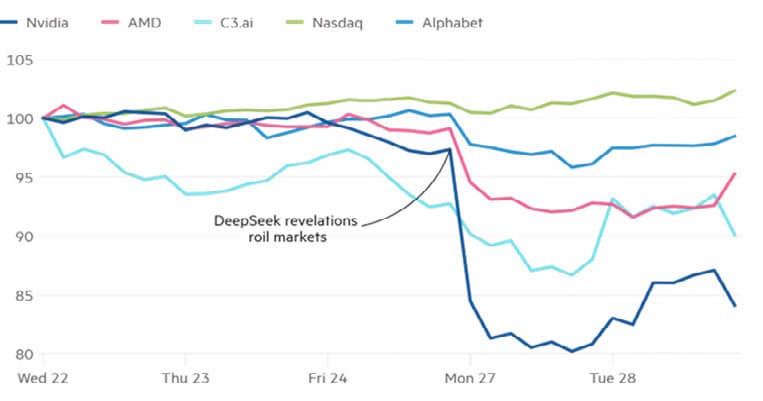

In China, the rise of AI model DeepSeek sent shockwaves through global tech markets, wiping $1 trillion off the US stock market in one day. This development highlighted China’s growing technological strength and the impact of trade restrictions driving domestic innovation.

“CORPORATE EARNINGS REMAINED ROBUST, WITH OVER 75% OF S&P 500 COMPANIES SURPASSING ANALYST EXPECTATIONS”

AI-linked stocks hit hard by DeepSeek breakthrough Share prices rebased

Source: LSEG via markets.ft.com

2025 Infrastructure and Industrials Outlook:

A Renaissance Under Trump?

The return of Donald Trump to the White House signals a transformative period for US infrastructure and industrial sectors. Key drivers include manufacturing momentum, rising power demand driven by AI, and deregulation efforts.

US manufacturing shows signs of recovery, with industrial production rising by 0.9% in December 2024, the largest monthly gain since February.

Manufacturing output increased by 0.6%, its strongest since August 2024. The Philadelphia Fed Manufacturing Index surged to 44.3 in January 2025, its highest since April 2021. Positive trends in production data align with Trump’s focus on a “manufacturing renaissance,” aiming to attract both domestic and foreign companies through low taxes and reduced regulation.

Despite concerns about the fate of the previous administration’s infrastructure programmes, several factors indicate continued strong investment in the sector:

- $294 billion in funding remains available from the Infrastructure Investment and Jobs Act (IIJA), including $87.2 billion in competitive grants.

- The administration’s emphasis on roads, bridges, and rural development.

- Expansion of public-private partnerships (P3s) to leverage private sector investment.

- A proposed streamlining of permitting processes to accelerate project delivery.

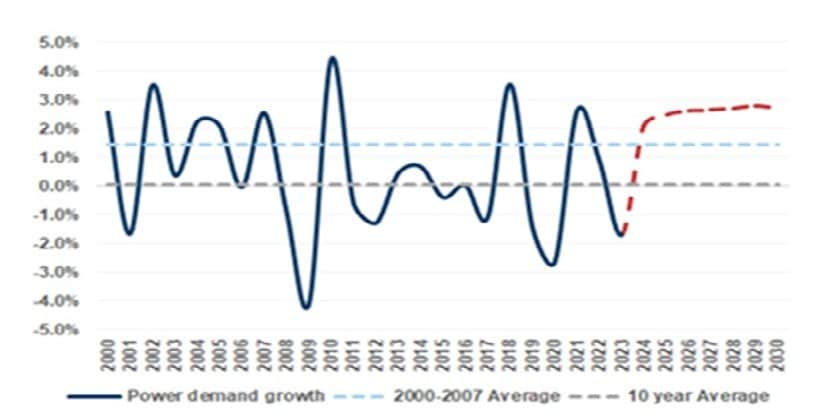

Demand for power infrastructure is soaring, driven by the growth of AI and data centres. Global data centre power consumption is expected to more than triple by 2034, while US power consumption is projected to grow at a 3.1% annual rate from 2020 to 2040. Additionally, the Stargate Project—a $500 billion AI infrastructure initiative— will further drive power demand. Trump’s regulatory focus could significantly accelerate infrastructure development.

“POSITIVE TRENDS IN PRODUCTION DATA ALIGN WITH TRUMP’S FOCUS ON A MANUFACTURING RENAISSANCE”

Source: EIA, Goldman Sachs Investment Research. For illustrative purposes only.

Infrastructure stocks have underperformed global equities by over 40% in the past five years, suggesting strong potential for mean reversion. The ongoing rise in power demand and bipartisan support for US manufacturing strengthens the case for investing in the power and utility sectors.

While federal policy may shift away from explicit climate goals, several factors support continued investment in clean energy:

- Renewables remain the most cost-effective form of new power generation.

- Corporate demand for renewable energy through Power Purchase Agreements (PPAs) is growing.

- The surge in demand for power from AI and data centres is driving new generation capacity, with renewables offering fast deployment times.

Despite policy changes, market forces and economic fundamentals will continue to support clean energy infrastructure investment.

“INFRASTRUCTURE STOCKS HAVE UNDERPERFORMED GLOBAL EQUITIES BY OVER 40% IN THE PAST FIVE YEARS”

GLOBAL MARKET RETURNS JANUARY 2025

HELPLINE:

HELPLINE: