It’s been a rough start to the year. Geopolitical tensions between the US and Russia have become increasingly acute but it is nervous anticipation of the US Federal Reserve withdrawing monetary policy support that has been the main cause of a spike in financial market volatility.

After a bumper 2021, stock markets ended the first month of the year in the red. The Nasdaq index was 15% lower at one point, on a rotation from the growth stocks that form most of the index into value stocks. The S&P500 ended down 5%, China’s SSE Composite was down by 6% and the Japan Nikkei 225 by 7%. The UK FTSE100 Index was one of the only developed markets not to end lower but the mid-cap index was down by 7%.

Bond prices also suffered and the price of long-dated indices registered declines of up to 7%. Within New Horizon strategies bond exposure has been reduced and is generally short-dated and/or inflation-linked to minimise interest rate sensitivity, increasing other risk factors to generate returns.

The gold price has remained steady while the index of a broad basket of commodities (incorporated in the New Horizon strategy) added a further 9% as the oil price soared.

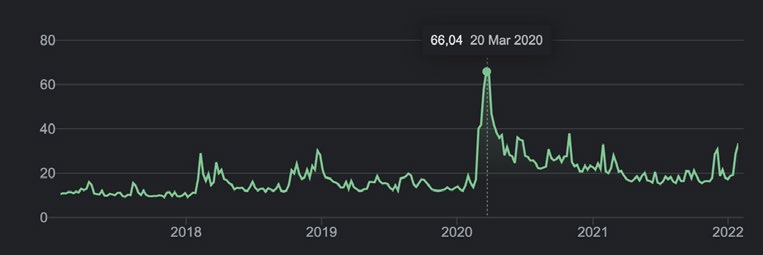

The world’s so-called fear gauge, the CBOE VIX, climbed to last January’s high of 33 during the month but remains much lower than its peak of 66 when the market experienced its Covid 19-related bear market crash in March 2020.

CBOE VIX Index

Source: CNBC

The jury is still out as to how many interest rate rises we can expect from the Fed this year but the number implied by derivative markets has increased steadily from two last year to three and then four. Now, post the first Fed meeting, investors envisage a scenario in which there are five successive rate hikes, coming at each Fed meeting from March.

Interest rates will rise as quickly as expected if inflation remains sticky – a situation that will depend on whether…

- Demand continues to rise unabated

- Supply constraints remain an ongoing challenge; and

- Labour costs continue increasing, setting in motion a wage-price spiral that poses great risk to inflation expectations.

At the first meeting of the year, Federal Reserve chair Jerome Powell was careful to emphasise that there was no pre-set course for rate hikes this year and that the Fed would respond nimbly, “led by the incoming data and the evolving outlook”.

What is clear is that the Fed doesn’t want a repeat of the 2013 taper tantrum. It is going to tread carefully so as not to derail financial markets or the global economic recovery by moving too fast – the outcome financial markets are most jittery about at the outset of 2022.

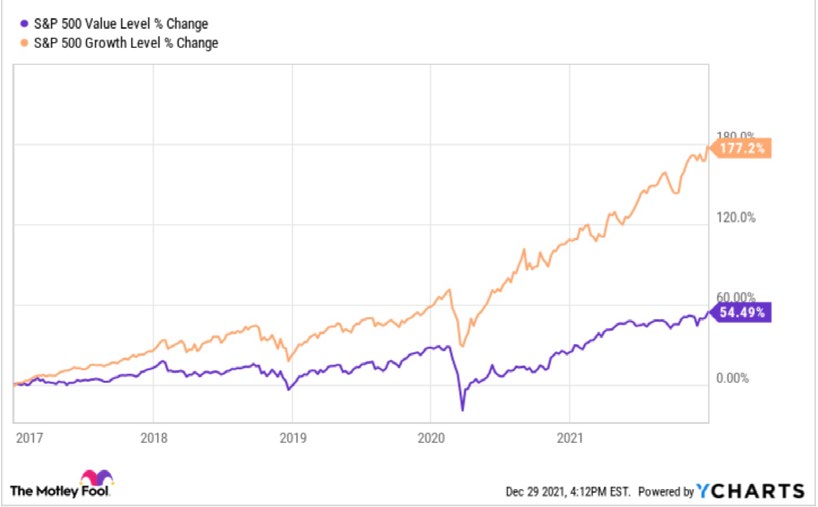

Rotation from growth stocks into the Covid laggards

Rising interest rates are seen as favouring stocks that offer value based on their net assets over those exhibiting strong growth. This is because many investors and analysts use net-present-value models to value stocks. The rationale is that growth stocks look less attractive on this measure when interest rates rise because their expected earnings are in the distant future and therefore worth less. In this scenario, higher inflation is positive for value strategies because growth companies may benefit less from price hikes, while value companies that have actual earnings can boost profit margins by raising prices.

However, rising interest rates have not been shown to have a long-term effect on equity prices, arguably because a higher

discount rate is counter-balanced by a stronger growth rate in cash flows. There is no historical correlation between rate rises and equity market performance and there have been many periods of buoyant stock markets with rising rates. Investors seem nervous now because many have only ever witnessed low rates and strong returns.

We anticipate further volatility in growth stocks in the short term but the trends accelerated by Covid remain very much in place and when the dust settles there will certainly be opportunities. This is particularly true of some small cap growth themes and New Horizon strategies are becoming increasingly focused here rather than the US tech titans.

S&P Value vs Growth

Source: Y Charts

Financial markets and the real economy don’t always move in tandem. It is likely 2022 will continue to produce volatile markets as investors fret about whether central banks will remove stimulus too slowly or too quickly, whether inflation will remain too high or fall quickly towards deflation, and whether China will be able to reach an economic glide path without too much turbulence.

However, investors may have underestimated the earnings power of many companies who have responded to Covid and supply disruptions with improved delivery of their products and services. Consumers are sitting on piles of cash from fiscal stimulus and capital expenditure is strong. Decent profit growth and undemanding valuations in many areas should enable swathes of the equity market to produce positive total returns.

The New Horizon strategies remain diversified over a broad range of asset classes and regions and are positioned to capitalise on strong long-term trends rather than chasing what may prove to be a transitory spike in performance from the laggards of 2020.

HELPLINE:

HELPLINE: