US EQUITIES AND CRYPTO ASSETS SURGE ON TRUMP VICTORY

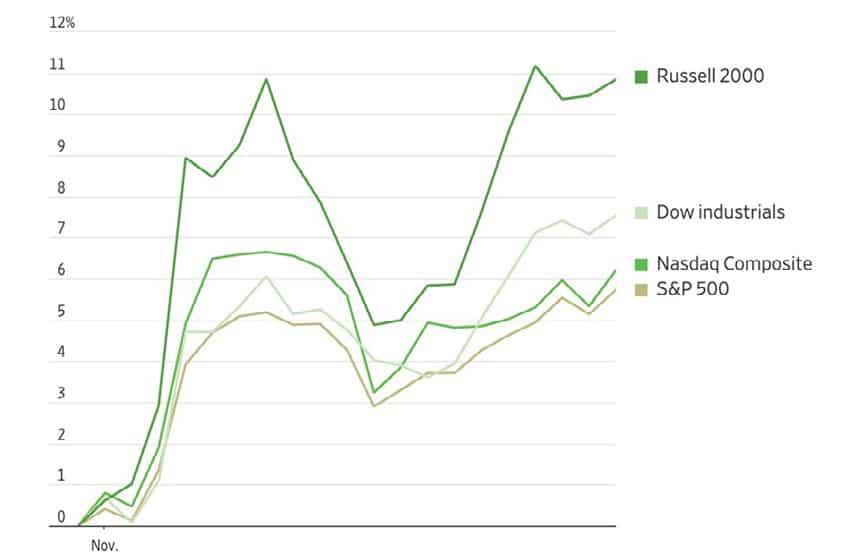

US equity markets continued to rally in November, with the S&P 500 posting its strongest monthly performance this year, gaining 5.7% and surpassing the 6,000 index level. The rally was fuelled by several developments, including Donald Trump’s election victory and continued optimism around Federal Reserve interest rate policy.

The market enthusiasm was particularly evident in technology and semiconductor stocks, with companies like Nvidia, Applied Materials, and Lam Research leading the market gains. This surge was partially attributed to reports suggesting that planned restrictions on US chip sales to China may be less severe than initially feared.

“THE JAPANESE YEN STRENGTHENED AGAINST THE DOLLAR FOLLOWING UNEXPECTEDLY HIGH TOKYO INFLATION DATA”

Nasdaq gained 6.2% during the month while the small-cap Russell 2000 index gained almost 11%. The market rally broadened, with nine out of eleven S&P 500 sectors closing higher by month’s end.

Index performance this month

In fixed-income markets, the 10-year Treasury yield retreated to 4.17%, reflecting growing investor confidence in the Fed’s policy trajectory. Markets are pricing in a greater than 50% probability of another quarter-point rate cut in December.

“ALTERNATIVE MANUFACTURING LOCATIONS STAND TO GAIN SIGNIFICANTLY AS COMPANIES SEEK TO DIVERSIFY AWAY FROM CHINA”

European markets faced challenges as the eurozone saw accelerating inflation in November, but analysts still expect ECB interest rate cuts due to anaemic demand in the economy. For the month, the German Dax finished 2.9% ahead but markets in France, Spain and Italy were all lower. The Euro Stoxx 50 index eased 0.5%, leaving it 6.8% ahead for the year to date.

The UK FTSE All-Share index reversed recent declines and ended the month 2.5% up. Chinese stocks finished broadly flat, but the FTSE emerging market index was 3.0% lower while Japan’s Nikkei 225 Index declined by 2.2%. The Japanese yen strengthened against the dollar following unexpectedly high Tokyo inflation data, which increased speculation about potential Bank of Japan rate hikes.

Bond yields ended the month slightly lower while the gold price succumbed to profit taking and ended 4.1% lower.

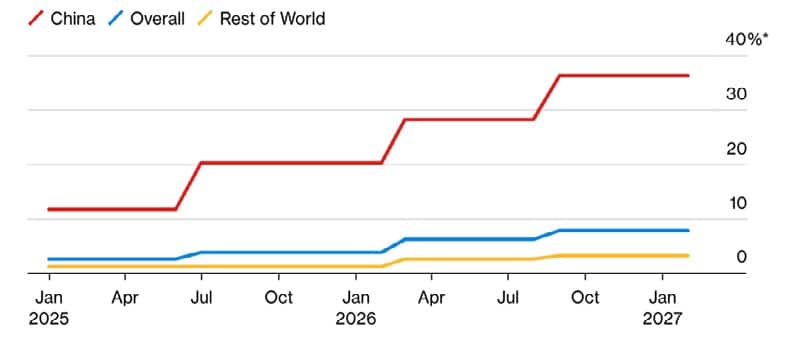

Higher tariffs are coming

A concern for most major markets is the potential imposition of increased US tariffs. A Bloomberg baseline case is that President Trump is using tariffs as leverage for negotiations rather than purely punitive measures and will begin with targeted 15% tariff increases on consumer goods from China in mid-2025.

Bloomberg economics’ baseline tariff scenario

China faces the most severe increases over the next two years

Source: USITC, UNSD-BEC, USTR, Bloomberg Economics

Rather than across-the-board escalation, many commentators believe tariffs may be strategically deployed in waves, giving trading partners opportunities to negotiate between each phase. The initial focus will likely be on products where American buyers have ready alternatives.

In this scenario, average tariffs may rise to around 8% (as opposed to the 20% proposed in campaigning) and overall US trade would decrease by around 10% rather than the 60% projected under maximum tariffs. Bloomberg reports that revenue generation would reach approximately $250 billion, helping offset tax cut costs.

Alternative manufacturing locations stand to gain significantly as companies seek to diversify away from China. Domestic US manufacturers in protected sectors would gain a substantial competitive advantage as US-made products would become relatively more affordable. This would be particularly impactful in consumer goods, where China currently has a strong presence in the US market.

“THE CURRENT ECONOMIC CONTEXT DIFFERS FROM PREVIOUS TARIFF IMPLEMENTATIONS, PARTICULARLY GIVEN RECENT INFLATION HISTORY”

Countries that could absorb Chinese manufacturing overflow would benefit from China’s need to find new markets. While this would create competitive pressures in these markets, it could also increase economic activity and investment in these countries.

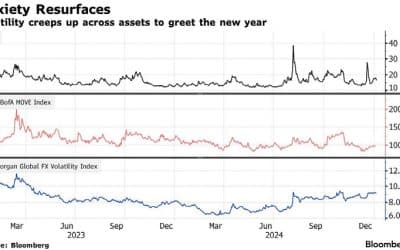

Financial markets will likely be volatile in the face of significant uncertainty around implementation and responses. Fed Chair Jerome Powell noted that the current economic context differs from previous tariff implementations, particularly given recent inflation history. The impact could be more severe than during Trump’s first term, as these proposed tariffs would more directly affect consumer goods rather than just industrial inputs.

What next for crypto assets?

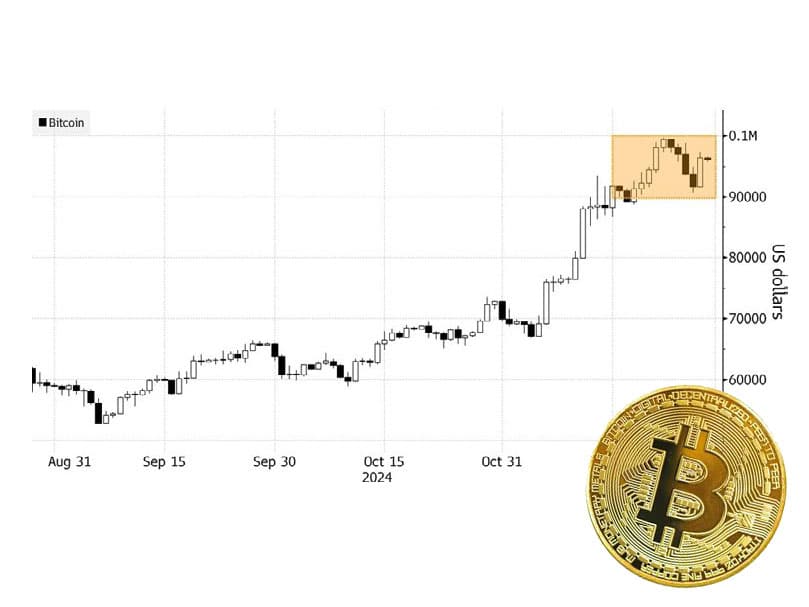

A Trump administration is seen as much more constructive for Bitcoin, and crypto markets in general, and prices rallied sharply on the election result.

With Bitcoin now hovering near the $100,000 mark, several key factors are shaping its immediate future:

Political Tailwinds: The incoming Trump administration represents a significant shift in crypto regulation. Trump’s pledge to make the US the “crypto capital of the planet” and create a national Bitcoin stockpile marks a stark departure from the Biden administration’s stricter approach. The likely appointment of crypto-friendly regulators at both the Securities Exchange Commission (SEC) and Commodities Future Trading Commission (CFTC) could fundamentally reshape the regulatory environment. However, the current rally, which has seen Bitcoin surge nearly 37% since the election, may experience a correction as initial excitement fades.

“THE LIKELY APPOINTMENT OF CRYPTOFRIENDLY REGULATORS AT BOTH THE SECURITIES EXCHANGE COMMISSION (SEC) AND COMMODITIES FUTURE TRADING COMMISSION (CFTC) COULD FUNDAMENTALLY RESHAPE THE REGULATORY ENVIRONMENT”

Mainstream Acceptance: Approximately $6.9 billion has flowed into US Bitcoin ETFs (exchange-traded funds) post-election. Total assets in these ETFs now stand at around $100 billion, indicating growing mainstream acceptance. This institutional

involvement provides a more stable foundation for crypto markets than in previous cycles. However, recent outflows of $438 million, representing the third highest outflow, highlight the volatility investors can expect when they take short-term

profits after Bitcoin nears record highs.

Risk Factors: Several potential headwinds could affect crypto’s trajectory:

• Global events and macroeconomic trends continue to influence crypto prices significantly.

• Trump may not prioritise or deliver on his crypto-related promises quickly enough.

• Reduced regulatory oversight potentially risks enabling fraudulent projects.

• The market is notoriously volatile, as evidenced by previous crashes.

The current rally differs from previous ones due to better-developed market infrastructure and clearer regulatory frameworks, but Bitcoin’s high volatility makes it questionable as a reliable store of value.

Bitcoin traders look up toward $100,000 again

Source: Bloomberg

The longer-term outlook will depend heavily on the actual implementation of policy changes and the broader economic environment. The key to sustainable growth will be fostering innovation while maintaining adequate investor protections.

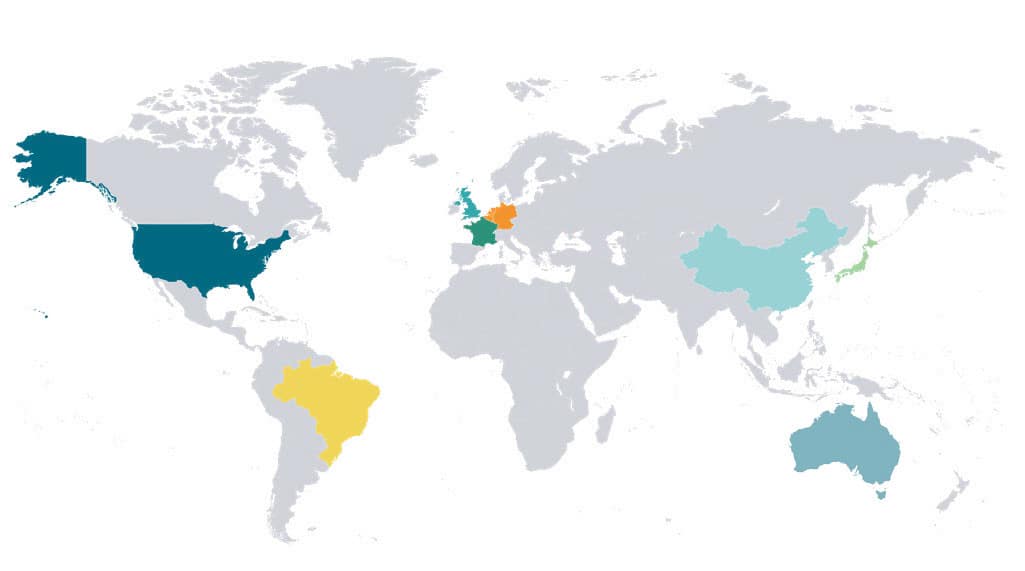

GLOBAL MARKET RETURNS NOVEMBER 2024

HELPLINE:

HELPLINE: