MARKETS TURN HIGHER ON SOFTER INFLATION DATA

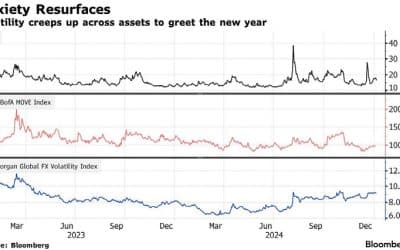

Investor sentiment suddenly became positive in November, based on expectations that central banks are winning their fight against inflation and are likely to start reducing interest rates as early as the second quarter of next year.

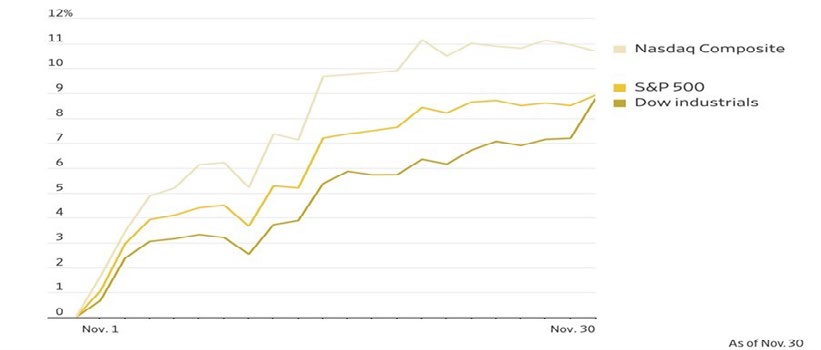

The tech-heavy Nasdaq led the charge, breaking a three-month losing streak with a 10.8% advance, making it the strongest month this year.

Index performance

Source: Factset

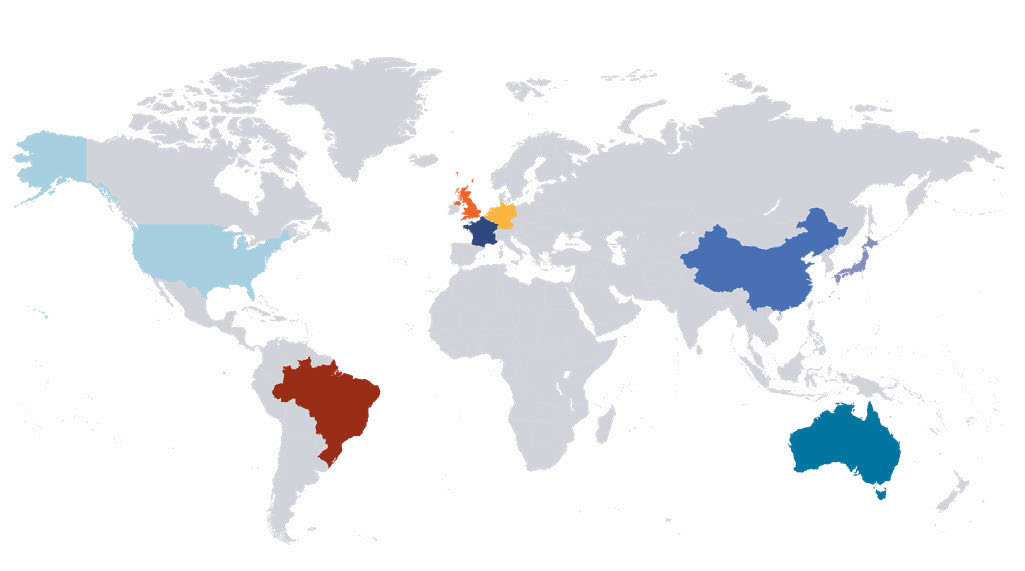

European stocks also registered strong gains on evidence that inflation is steadily retreating. The FTSE 100 Index, impacted by a stronger pound, the UK’s persistently high inflation and an intense cost-of-living crisis, continued to lag its developed market counterparts although its gain of 2.3% brought it back into positive territory for the year.

In Asia, the Nikkei Index increased 8.5% during the month. Investors are increasingly turning their attention to the Japanese equity market for the first time in decades amid rising inflation and shifting monetary policy imperatives.

China continued to swim against the tide, with the CSI 300 Index declining 2.4% during the month, which takes the decline this year to 10.5%. Ongoing property sector woes are severely undermining the government’s efforts to get the broader economy back on track and win back investor favour.

Bonds also enjoyed a stronger month and issues maturing within ten years are now showing a positive return year to date. The gold price edged higher while Brent Crude oil retreated a further 5.2% after the early October gains.

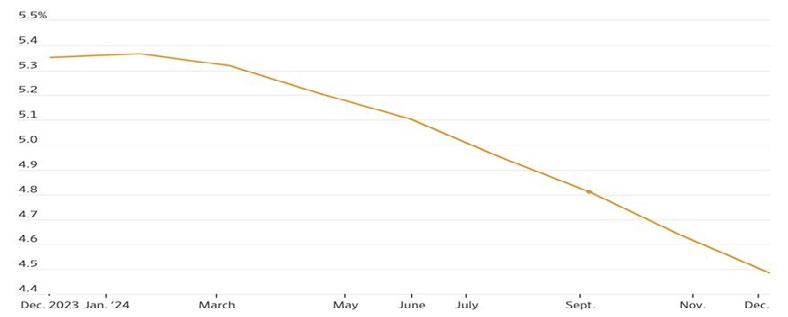

Assessing interest rate expectations

The driving factor behind the positive performance of both equities and bonds was growing investor confidence that interest rates may come down as early as the start of the second quarter of next year. There are, however, some concerns that market participants may be getting ahead of themselves as central bankers continue to emphasise their commitment to bringing inflation back within their target ranges and cautioning against over optimism.

The market is pricing an interest rate cut in both the US and Europe as a near certainty by May, and a 50% chance of a cut in the US as early as March. For the year, markets are anticipating more than a 1% decline in rates (100 basis points) in both the US and Europe.

Rate expectations

Source: Tradeweb

The most recent economic data in the US has provided further impetus to the declining rate narrative in the market with US growth cooling, the labour market easing at last

and consumer spending still holding up. Household disposable incomes do, however, remain under pressure.

Controversy at COP 28 as investors focus impact of measures

COP 28 got off to a troublesome start when leaked briefing documents revealed the UAE’s intention to discuss fossil fuel deals, emphasising the irony of Dubai hosting the event given the region’s heavy reliance on fossil fuels.

The conference agenda unveiled three priorities for achieving the goals of the Paris Agreement in “holding the increase in global average temperature to well below 2°C” and pursuing efforts “to limit the temperature increase to 1.5°C above pre-industrial levels”:

- Accelerating emissions cuts

- Enhancing climate resilience; and

- Providing necessary support and finance

An agriculture, food and climate action declaration was also announced along with $2.5bn in funding for food systems innovation.

The Global Stocktake highlighted how far countries have deviated from the trajectory necessary to limit global warming. The

alarming reality of 2023 being the hottest year on record, with temperatures 1.32° above the pre-industrial baseline, added urgency. The Intergovernmental Panel on Climate Change reported a substantial gap in reaching targets, with a 43% reduction in greenhouse gas emissions required to meet Paris Agreement goals.

The phasing out of fossil fuels presents a significant challenge given past resistance. COP 28’s success hinges on decisive action which comes with financial repercussions. Priorities include:

- Finalising structures and finances to compensate emerging markets for climate change impacts based on an effective loss and damage fund

- Keeping 1.5°C within reach; and

- Financial resources for adaptation

It is increasingly apparent that investment managers need to factor environmental risks into their investment decisions as,

if these become systemic risks, they will weigh on broad markets while throwing up idiosyncratic opportunities.

HELPLINE:

HELPLINE: