VALUATION CONCERN BRINGS PROFIT-TAKING IN TECH LEADERS

The tide turned for the Magnificent Seven stocks during July as a disappointing start to the tech stock earnings season saw Alphabet, Tesla, and Microsoft share prices slide. This prompted the Nasdaq to fall 10% from its high and enter technical correction territory.

The turn in fortunes in July was underpinned by concerns about the high valuations of these shares. The lack of breadth of this year’s stock market rally was becoming more extreme and described by one analyst as a market with “bad breadth”!

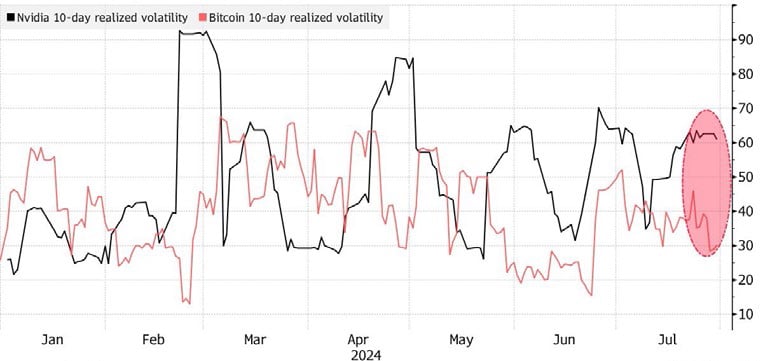

Nvidia’s share price not only sold off but was volatile, evident in the fact that its 10- day realised volatility was double that of Bitcoin’s.

"SMALL CAPS WERE THE PRIMARY BENEFICIARY OF THE RENEWED INVESTOR APPETITE FOR SHARES OUTSIDE THE AI REALM"Volatility mismatch Nvidia’s 10-day realised volatility is twice that of Bitcoin

Source: Bloomberg

The S&P 500 in July effectively moved sideways, while the Nasdaq dropped 2%. European stock markets also failed to generate significant gains, but the UK FTSE 250 Index of mid-cap stocks rose 7%, reversing a prolonged period of underperformance and signalling investors have at last regained their appetite for UK stocks.

The interest rate outlook shifted towards markets expecting two interest rate cuts before the end of the year and bond prices registered gains, particularly at longer duration. Commodity prices weakened on slowing economic growth data with falls in energy prices, industrial metals and agricultural commodities leading to a 4% decline in the Bloomberg Commodity Index.

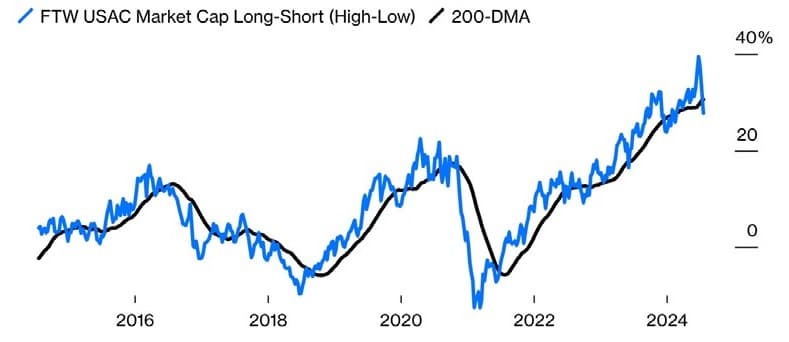

Investors are now debating whether the downturn in mega-cap tech stocks signals a technical correction or a more profound rotation out of the sector into other sectors set to benefit from the anticipated decline in interest rates later this year. Small caps were the primary beneficiary of the renewed investor appetite for shares outside the AI realm. As a result, there was a 10% rally in the US Russell 2000 Index of smaller companies.

“INVESTORS ARE NOW DEBATING WHETHER THE DOWNTURN IN MEGA-CAP TECH STOCKS SIGNALS A TECHNICAL CORRECTION OR A MORE PROFOUND ROTATION OUT OF THE SECTOR”

Cut back down to size

In context, the rotation to small caps looks like a needed correction

Source: Bloomberg Factors To Watch

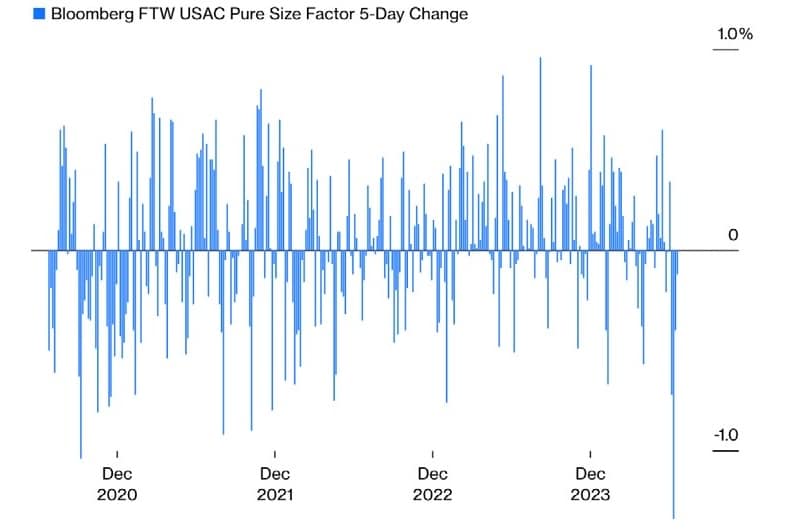

Big caps’ shocking week

US investors inflicted the biggest move out of large caps since the pandemic

Source: Bloomberg Factors To Watch

US Investment Bank Morgan Stanley believes large-cap“cyclical” names exposed to global markets will benefit from falling interest rates and a potentially weaker US dollar. In contrast, it highlights that smaller stocks face profitability issues, and that analysts are cutting estimates of future performance.

“A REPUBLICAN PRESIDENTIAL WIN IS EXPECTED TO USHER IN HIGHER TARIFFS, BUSINESS FRIENDLY DEREGULATION, AND TAX CUTS”

A clear choice for voters in the US

Turning to the forthcoming US election, most forecasts still favour a Republican presidential win, notwithstanding the new Democratic presidential nominee, Kamala Harris, entering the race after Joe Biden stepped down. Recent polls show that Harris has closed the polling gap quickly and the ultimate outcome remains uncertain.

A Republican presidential win is expected to usher in higher tariffs, business-friendly deregulation, and tax cuts. Trump’s policy priorities are expected to put upward pressure on inflation and the already huge government deficit. That could result in political pressure being put on the Fed to become more growth-friendly or adopt higher-for-longer interest rates.

An Oxford Economics model found that under a second Trump administration in which tariffs on imports are increased by 10% across the board (with even higher rates levied on Chinese products), inflation (excluding food and energy prices) would peak between 0.3 and 0.6 percentage points higher than currently expected. The deportation of undocumented workers would also prove inflationary by pushing wages up as the labour market supply contracts. Such a move could prove damaging for the economy and stock market.

Harris is expected to continue with Biden’s economic policies, which include investing in infrastructure and manufacturing, clean energy, and expanding job opportunities. Tax increases would likely be on the agenda for companies and wealthy Americans, and social security along with healthcare will be priorities. Additional spending here would put upward pressure on the already uncomfortable budget deficit.

France in limbo

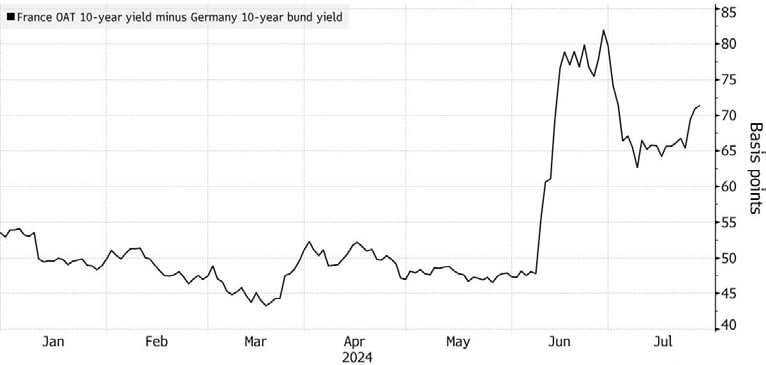

France’s elections, which resulted in a hung parliament that could persist for some time, have made it challenging for investors to ascertain the country’s economic and financial future. Investors don’t like uncertainty and, with no outright majority and a lame-duck presidency likely until presidential elections in 2027, the outlook for French assets looks unfavourable. This is reflected in confidence indicators and bond risk premiums. The former have declined to Covid levels, and the latter are trading above 70 basis points compared with about 50 basis points before the election.

French spreads come under renewed pressure

Bond risk premium has risen on political uncertainty, risk-off mood

“THERE IS INSUFFICIENT FISCAL ROOM TO IMPLEMENT THE TAX AND SPENDING PROMISES MADE BY BOTH THE LEFT AND THE RIGHT”

Source: Bloomberg

The French majoritarian electoral system was supposed to have prevented the hung parliament but tactical voting in the two rounds resulted in deadlock and a fragmented parliament divided into three main blocs of similar size. The largest coalition, the NPF, claims the mandate to govern, despite not having a majority and receiving only 26.3% of the vote.

Like the UK, France has suffered from a steady decline in political influence and economic prosperity since the end of its empire. As support for populist parties threatens stability, some see the protection of democracy through stable legislative majorities as more important than electoral ‘fairness’.

On the policy front, there is insufficient fiscal room to implement the tax and spending promises made by both the left and the right. Policymakers will need to address a growth rate of only 3.3% over the past four years along with falling productivity. Supply-side reforms, including increasing labour supply, lifting investment, and stimulating productivity may be the best answer.

GLOBAL MARKET RETURNS JULY 2024

HELPLINE:

HELPLINE: