TARIFF TENSIONS AND GLOBAL INVESTMENT SHIFTS

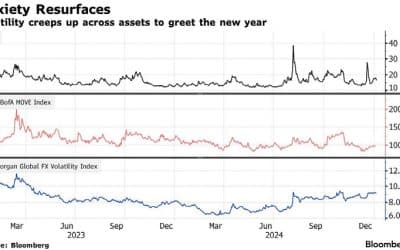

It was a tumultuous first quarter for global markets and investors. President Trump signed a stream of executive orders that signalled that the US was moving into a vastly different political, economic, and administrative realm.

“THE PRESIDENT’S LATEST ANNOUNCEMENT THAT TARIFFS WOULD “ESSENTIALLY COVER ALL COUNTRIES” TRIGGERED A GLOBAL MARKET TAILSPIN”

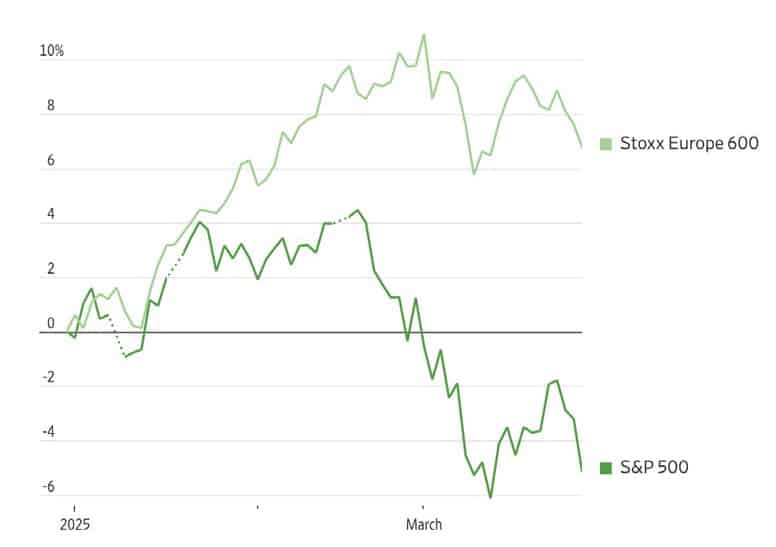

Expanding tariff policies fuelled investor anxiety and prompted capital flight from US equities. The S&P 500 fell 5.6% for the month and closed down 4.3% for the first quarter, while the tech-heavy Nasdaq tumbled 7.6% in March, ending Q1 8.1% lower.

The initial optimism buoying US markets following Trump’s January inauguration has dissipated in the face of what the New York Times described as a “haphazard rollout” of the administration’s “America First” trade policy. The President’s latest announcement that tariffs would “essentially cover all countries” triggered a global market tailspin in the final days of the quarter, with Japan’s Nikkei plunging 4.1% to a six-month low on the last trading day in March.

S&P 500 performance since Election Day

Source: Factset

European and UK markets have been relative bright spots, with MSCI Europe (ex UK) gaining 6.3% and the FTSE All Share rising 4.5% in Q1. However, both indices retreated -4.2% and -2.3% in March as concerns mounted about hefty reciprocal and auto tariffs and their potentially damaging economic impact.

“EUROPEAN AND UK MARKETS HAVE BEEN RELATIVE BRIGHT SPOTS”

Index performance in 2025 Most Sectors will benefit from Trump policies, with a few exceptions

Source: Factset

Investors moved away from US equities toward European markets during the first quarter. Bank of America’s March Global Fund Manager Survey recorded a record rotation out of US stocks, leaving a net 23% of respondents underweight American companies. Factors driving this investment shift include:

- European defence spending increases, which is expected to provide a much-needed boost to economic growth in the region.

- Concerns about America’s economic outlook amid tariff uncertainties.

- The sharp pullback in the US tech giants, with Nvidia falling 19% this year, Tesla 36%, and Alphabet (Google) 18%.

However, many analysts remain sceptical that this preference for European assets will be long-lasting and believe that appetite for US assets will return.

As equity volatility increased during time high of $3,115 per ounce. US 10-year the quarter, investors sought refuge in Treasury yields fell to 4.2% from 4.6% at traditional safe havens. Gold continued year-end, reflecting strong demand. its upward trajectory, reaching an all

“BOTH CONSUMER AND BUSINESS CONFIDENCE HAVE FALLEN, WITH CONSUMER CONFIDENCE AT ITS LOWEST LEVEL SINCE JANUARY 2021”

Gold futures price

Source: Factset

Economists have markedly increased their US recession probabilities, with Goldman Sachs raising its recession odds from 20% to 35%. JPMorgan increased its recession probability to 40%. Both consumer and business confidence have fallen, with consumer confidence at its lowest level since January 2021. There are also concerns that there are preliminary signs of stagflation. Core PCE inflation in the US accelerated to 2.8% year-over-year, while consumer inflation expectations jumped to 5% yearly.

The uncertainty of Trump’s next moves has weighed on consumer and business confidence because of the difficulty in making spending and investment decisions when the future is largely unknown.

Oil prices have fallen despite geopolitical tensions, with Brent crude slipping to $74 per barrel, reflecting concerns about global demand weakness outweighing Trump’s threat of secondary sanctions on Russian oil.

Seismic change in German fiscal policy

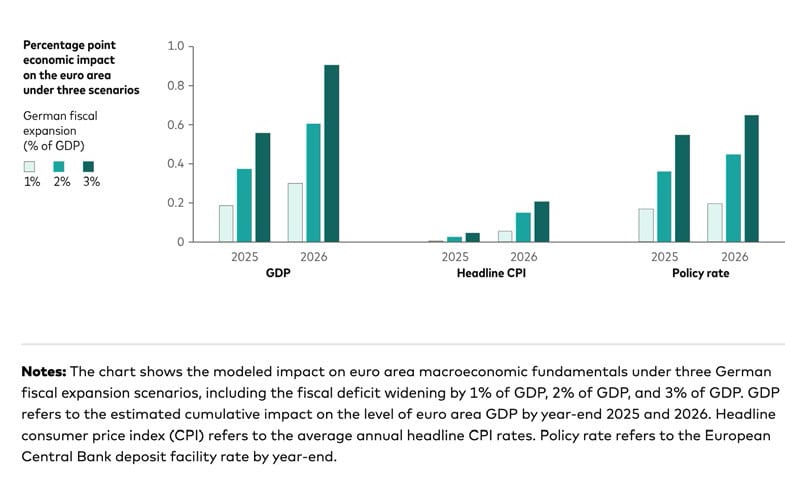

Germany’s parliament has approved a landmark spending bill which represents a dramatic reversal in the country’s fiscal policy. This reform effectively loosened the constraints of the constitutional “debt brake” introduced in 2009, which capped the government’s deficit at 0.35% of GDP and enforced fiscal austerity for over a decade.

“THOUGH WELL RECEIVED BY INVESTORS, GERMANY’S FISCAL EXPANSION WILL LIKELY PUT UPWARD PRESSURE ON INTEREST RATES”

The comprehensive package establishes a €500 billion special fund for infrastructure investment to be deployed over the next 12 years. It also exempts defence spending above 1% of GDP (approximately €45 billion) from the debt brake rule, with no upper limit.

This policy change is intended to boost economic activity and address the deteriorating security situation in Europe and the US’s unwillingness to continue to be the region’s security backstop.

Though well-received by investors, Germany’s fiscal expansion will likely put upward pressure on interest rates for several reasons. First, financing this unprecedented spending increase will require significant new government debt issuance. This surge in the supply of German bonds has already triggered market volatility, with the 10-year German bond yield experiencing its biggest weekly increase in nearly 35 years following the announcement. It jumped 43 basis points to 2.84%.

Second, increased government spending could stimulate economic growth and potentially fuel inflation. Vanguard’s analysis suggests that if the German fiscal deficit widens by 1.5% of GDP over 2025-2026, it could boost euro area GDP by 0.4 to 0.5 percentage points by the end of 2026. This economic stimulus might put pressure on the European Central Bank to reduce its planned rate-cutting cycle to two cuts in 2025, rather than the three previously anticipated, to manage inflation risks.

Third, Germany’s bond market is a benchmark for European sovereign debt. This ripple effect could create challenging conditions for nations with already stretched budgets.

Germany’s fiscal easing could have a significant impact on euro area growth, inflation, and monetary policy

Source: Vanguard; Bloomberg and Oxford Economics

“THE SEMICONDUCTOR SECTOR FORWARD P/E RATIO OF 19 IS LOWER THAN THAT OF THE S&P500”

The German DAX index initially rallied on the news and briefly reached record highs, but the longer-term outlook is uncertain.

The spectre of significantly higher US tariffs complicates the outlook, with calculations suggesting that an extended 25% tariff on EU goods could offset the expected economic gains from Germany’s expansionary fiscal policy in 2025 and 2026.

Is value emerging in technology shares after sell-off?

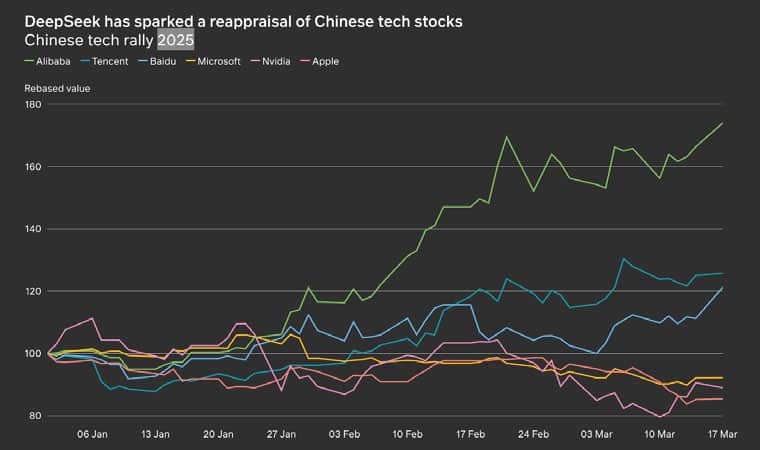

After two strong years for mega-cap technology stocks in 2023 and 2024, the US technology sector has experienced a notable correction this year and underperformed the broader market.

The sell-off was triggered by the expectations that drove tech valuations emergence of DeepSeek, a Chinese AI platform reportedly developed at lower cost and with reduced energy requirements compared to American counterparts. This raised questions about whether the competitive moats created by U.S. tech giants are sufficient and whether previous growth higher were overly optimistic.

DeepSeek has sparked a reappraisal of Chinese tech stocks Chinese tech rally 2025

Source: M&G

The market decline to quarter end has mainly impacted expensive stocks with the highest P/E ratios. After any further declines, the cloud computing, semiconductors and cybersecurity sectors could start to present opportunities, supported by attractive valuations and strong growth potential.

- The semiconductor sector forward P/E ratio of 19 is lower than that of the S&P500, despite higher projected earnings growth (19% vs 12%).

- Cybersecurity stocks maintain a forward P/E ratio of 24, with projected growth 20% higher than the S&P 500. Rising global threats and advancement in AI bolster the sector outlook.

- Cloud computing stocks have corrected 25% from highs, with similar historical corrections being followed by gains of over 40% annualised over three years.

- Nivida’s forward P/E ratio of 25 is supported by 40% annualised earnings per share growth estimated over the next three to five years.

- Amazon’s forward P/E ratio has fallen below 30 for the first time in a decade.

- Alphabet’s forward P/E ratio of 17 is back close to the November 2022 low.

Many technology companies have strong competitive positions, robust balance sheets, and substantial long-term growth potential. The fundamental drivers of growth—AI development, cloud computing, corporate digital transformation, and productivity enhancement—are expected to continue.

Historically, technology innovation cycles have typically experienced periods of exuberance followed by reality checks, when long-term investors, looking beyond short-term volatility, have taken advantage of a more reasonable entry point into the sector.

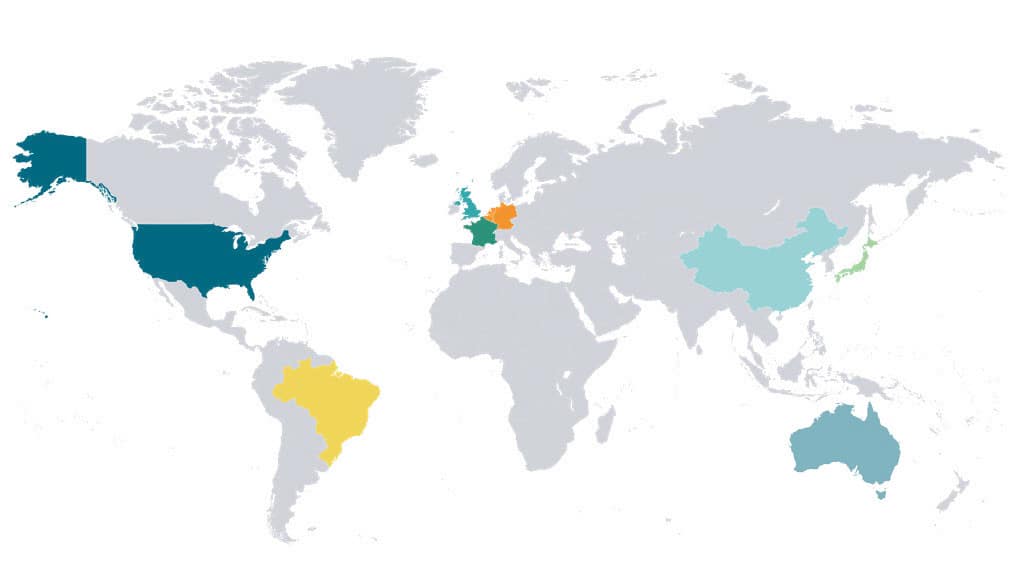

GLOBAL MARKET RETURNS Q1 2025

HELPLINE:

HELPLINE: