The Guide

SCPI

2024 Edition

If you’re seeking a regular income, have you considered an SCPI?

An SCPI, or Société Civile de Placement Immobilier, allows you, the investor, to earn from rental yields without the hassle of buying a property and renting it.

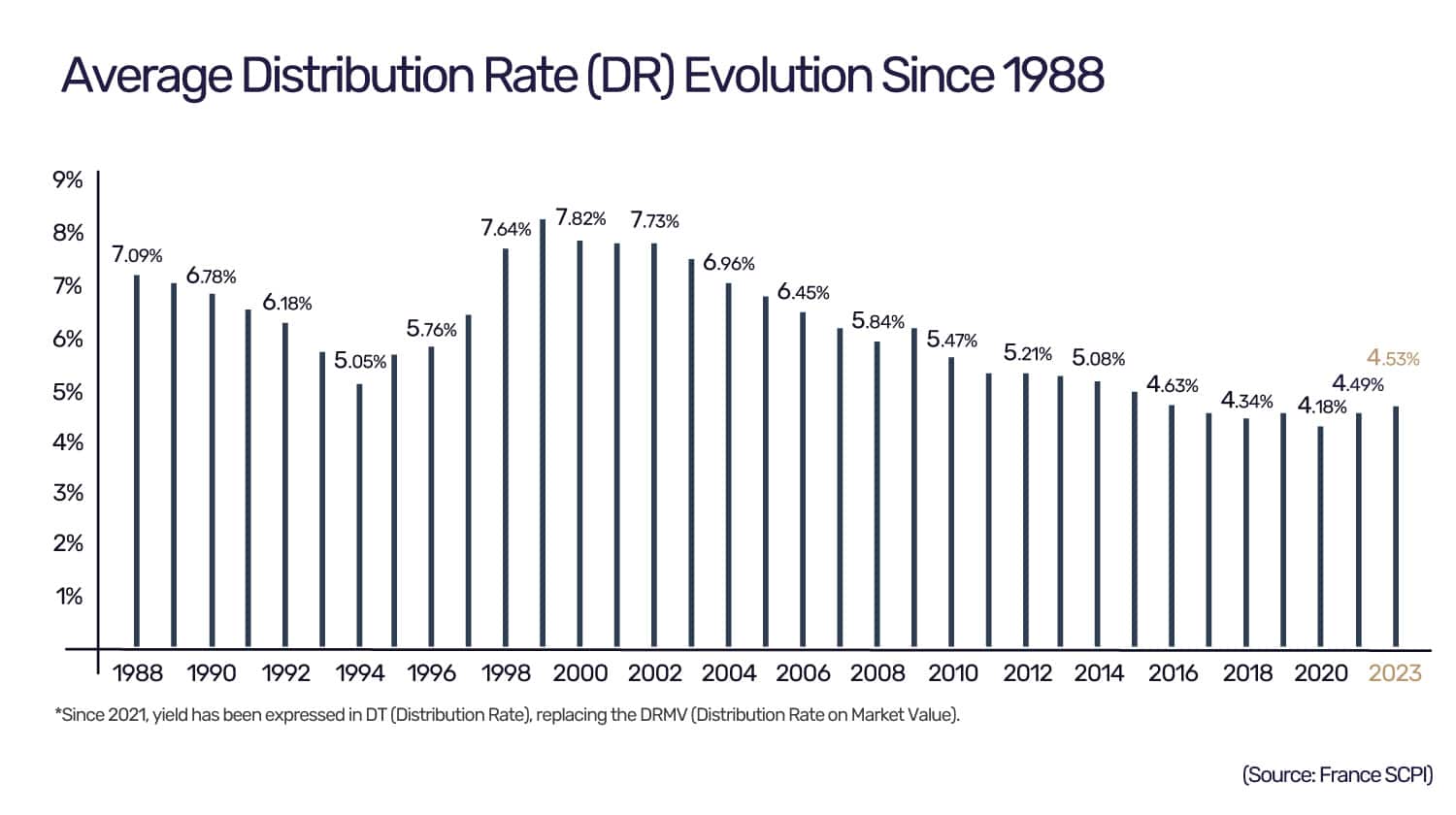

With the average distribution rate at 6% for the last 30 years, it’s the most stable investment on the market with an ideal model for expats seeking reliable, stress-free returns.

Whether you have €500 or €50K an SCPI can work for you.

All SCPIs are vetted by DTB Wealth Management, and our financial services are approved by both the Autorité des Marchés Financiers (AMF) in France plus the UK’s Financial Conduct Authority (FCA).

Furthermore, as we’re remunerated by the SCPI management companies it doesn’t cost anything to open an SCPI.

Our service is unique and tailored to expats in France.

If you would like to learn more about SCPI investments and how they could increase your income in France, reach out to book a complimentary consultation to discuss your personal financial goals.

All About SCPIs

What is an SCPI?

A long-term source of regular income with proven risk reliability, making it popular with expats, investors purchase shares in an SCPI management company which buys and manages property across sectors such as retail, healthcare and hospitality.

One of the most accessible ways to earn passive income over a 10-15 year period, the entry point can start at €300, although €50,000 sums are the average, making it a prospect for anyone seeking a long-term hassle-free income.

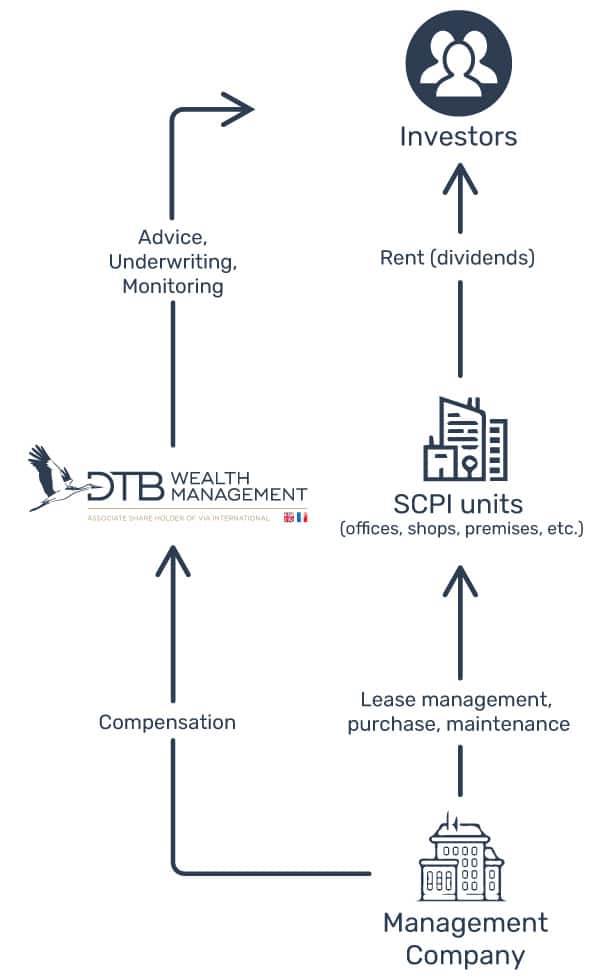

How do SCPI Investments work?

Expat investors buy SCPI units to become part owners in the SCPI’s assets. Regular payments are made to investors from the rental yields in the form of dividends.

DTB Wealth Management works on behalf of investors, our clients, at no cost. This is because our remuneration comes from the curated collection of SCPI management companies we have vetted for reliability and long-term investment success.

Management companies, which must be approved by the Autorité des Marchés Financiers (AMF), create the SCPI vehicle. They update investors with its activity, such as accounts and acquisitions, but manage everything. Investors don’t need to act, they simply receive information and income.

SCPIs in Figures

Average distribution rate at all times : 6%

205 > Number of SCPIs (approved by DTB Wealth Management’s due diligence)

49 > Management companies

€90m > Investment in SCPIs to date

€93.5b > Management company collection to date

€3,250 > Investor income

The average distribution on a €200K investment is €3,250 per quarter

Advantages Of SCPIs

SCPIs are easy to set up, reliable and open for investment at every level.

Accessible

While the average investment in France is €50,000 – with some reaching €150,000 – lump sums aren’t a prerequisite. Investors can buy one share for around €300 and even set up a monthly transfer. Available for almost anyone, it provides a no-risk approach to savings accruing up to 6% interest instead of the 2%-3% from the bank.

Profitable

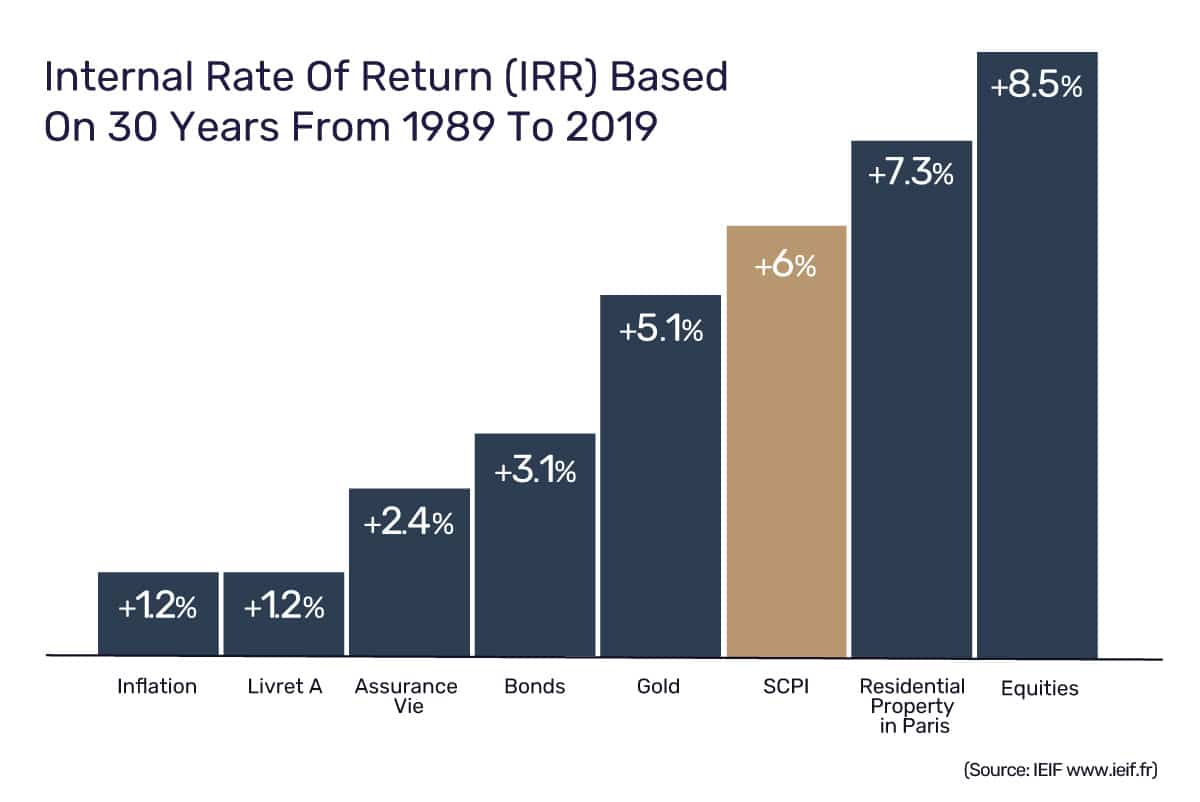

Hitting a 4%-8% rate over the last 30 years, SCPIs perform where other investments don’t, bringing peace of mind and profitability in one package.

Consistent

Income – paid in dividends – can be received monthly (depending on the SCPI), but usually quarterly, over a period of 10-15 years. It’s long-term passive income that you can rely on.

Hassle-free

As the management company is responsible for overseeing your investment, the only action you need to take is picking up your payments.

Regulated

Controlled by the Autorité des Marchés Financiers (AMF) and vetted by DTB Wealth Management, our SCPI companies are legally inspected for transparency and proper management.

Considerations For SCPIs

Duration

Investing is a long-term commitment and most SCPI agreements last 10-15 years. Investors wait four to six months before receiving income, this is a legal requirement that also makes financial sense as rental yields need to be generated. However, some SCPIs do offer income collection from two months.

Of note, an exit fee of around 8% is applicable if withdrawing from the investment within three years.

Income

While the evidence demonstrates market stability over the last 30 years, unwavered by the real estate and global financial crises, as well as the pandemic, like all investments income can’t be guaranteed.

Yields are linked directly to the rents received by the SCPI – and this is why DTB Wealth Management works with those showing strong performance histories.

Fluctuations

SCPIs have proven to be extremely resilient, but can be affected by liquidity and market fluctuations. Making savvy choices, such as investing with SCPI management companies with diverse portfolios, is one of many ways we protect our clients against such events.

How Do SCPIs Compare with Other Investments?

Client Testimonial

The professional and transparent management of the SCPI has been impressive. Detailed performance reports keep me informed about my investment’s progress without any hassle. Additionally, the tax advantages associated with this investment have been a significant benefit. Overall, my experience with yield SCPIs has been extremely positive, offering a reliable and sustainable investment option that I highly recommend to anyone looking to diversify their income sources and secure their financial future.

Sophie Turner, Marseille

The Different Types Of SCPI

There are three main types of SCPIs :

Performance SCPIs

Yield SCPIs are the most common, largely investing in retail and office premises, but also hotels, resorts and logistics.

Tax SCPIs

Made up from property assets eligible for tax relief schemes, such as the Pinel law, they focus on saving tax while building capital and generating income. The maximum tax deduction is 21% of the investment.

Capital Gains SCPI

Mostly consisting of Haussmanian-style buildings in Paris, they generate long-term capital gains on the resale of their buildings.

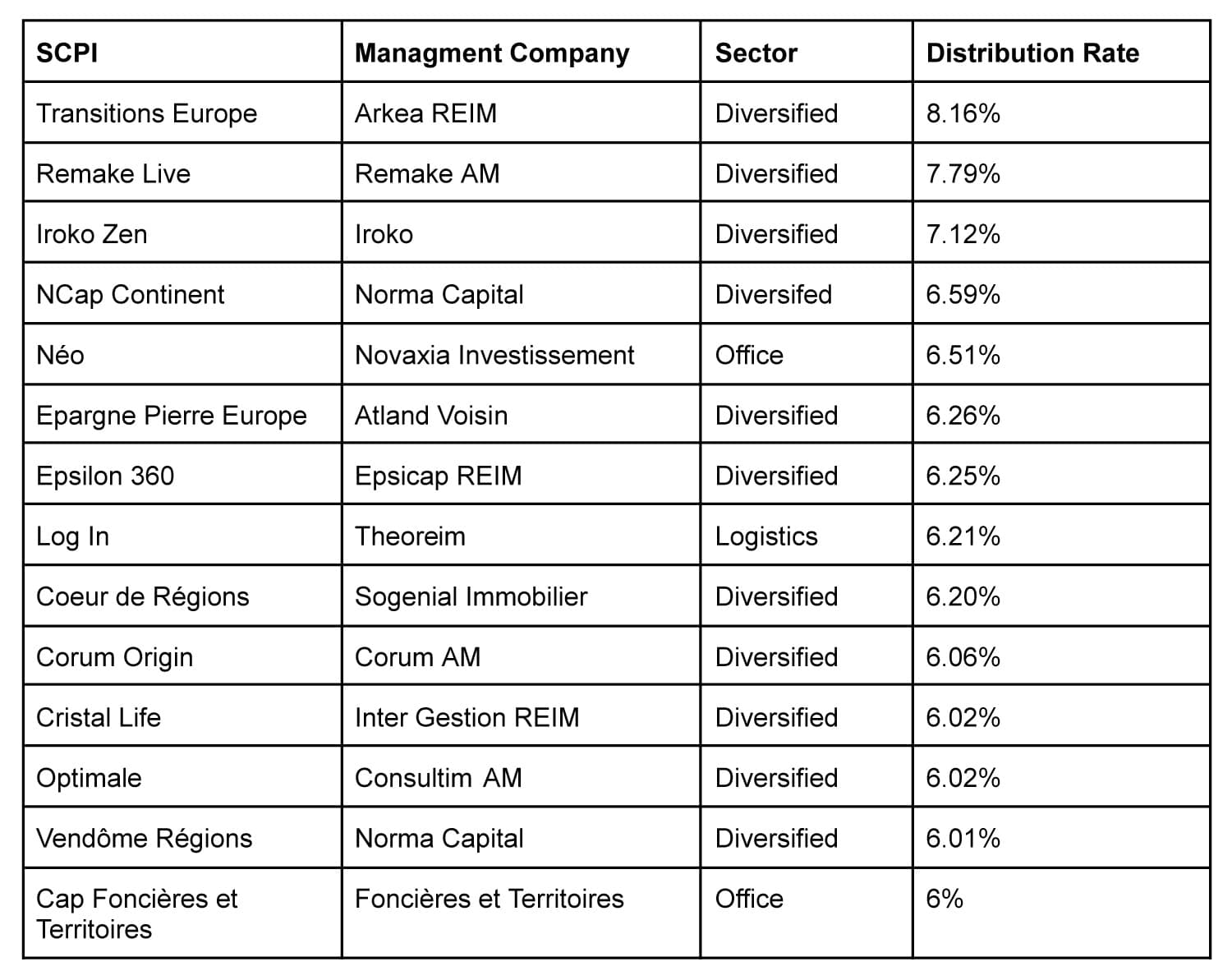

At DTB Wealth Management we pride ourselves on knowing our clients’ investment preferences. We work with the top SCPIs, listed on the following page, of which 11 are diversified (clinic, hospital, EHPAD, hotel, restaurant, warehouse, etc), two are office focused and one is in logistics.

SCPI Taxation

Income and capital gains generation from your SCPI investment is taxed in the same way as property held directly.

Tip: Expats wishing to reduce or cancel their income tax can do so through a real estate SCPI as it leverages double taxation agreements.

Let Us Complete Your Tax Returns

Every SCPI investor must fill in a separate SCPI tax return in addition to France’s annual income tax return.

Note that all policy holders at DTB Wealth Management automatically access our “all-in-one” financial service through which we’ll manage both, for no extra cost, keeping your financial investments stress free all year round.

The SCPIs With The Highest Distribution Rate

(Source: IEIF, pierrepapier.fr)

Completing Your Tax Return

Declaring SCPI Income

Property income from SCPI cash investments and rentals are subject to a progressive income tax scale after social security deductions. For the latter, if you invest on credit, your loan interest is deductible from your property income.

Tip: Investors can reduce tax payments using Europe-based SCPIs to benefit from double taxation agreements.

Financial income from SCPI cash investments is also subject to a progressive income tax scale after social security deductions.

How Do I Sell My Shares?

You can sell your SCPI shares partially or totally whenever you want to.

In the case of a variable capital SCPI – where the number of units varies as units are created or withdrawn – capital is returned by the mechanism of withdrawal requests being offset by new subscriptions and the SCPI’s liquid assets. If this is not enough, the SCPI can opt to sell properties in order to return capital.

Bear in mind that when removing shares, part of the capital value will reduce income. SCPIs are meant as a long-term investment, but can be withdrawn quickly in the case of an emergency.

What Are the Costs?

Purchasing real estate always involves costs such as notary and acquisition fees. Along the same lines, SCPIs require subscription costs, which are included in the price of the unit at the time of purchase. They range between 0% and 12%. We are now seeing a new generation of SCPI’s like Remake Live or Iroko Zen, which don’t apply subscription costs, ie, they are 0%.

Annual management fees are taken directly from the rent collected by the SCPI for the management company. Dividends paid to shareholders are net of annual management fees.

How Do I Invest In An SCPI?

An intelligent investment solution, SCPIs can secure additional income, build up assets and help retirement preparation. There are multiple ways to invest:

Cash

The most common type, it allows you to invest your savings and receive a direct return. Simple to carry out, it’s often described as an investment with all the advantages of property without the disadvantages.

Credit

Investing on credit means using your debt capacity to leverage your credit facility. The investor builds wealth through borrowing, rather than through cash. Purchasing shares on credit means loan interest can be deducted from taxable income, automatically reducing the tax base for rental income. As a guide, the borrowing rate is between 1.5% and 2.3% for a 15-year term.

Joint Ownership

An excellent way for married expats to share a continuous, long-term investment, it divides ownership rights into ownership and usufruct units. Simplifying succession planning, in the event of a death, the policy continues with no disturbance to the income being paid.

Eight Reasons Why An SCPI Could Be Ideal For You

1. Immediate income boost.

2. Invest savings you don’t need.

3. Optimisation of low-yield investments.

4. Expansion of property portfolio.

5. Better tax treatment of investment.

6. Provides deferred income.

7. Accessible in an emergency.

8. Can be opened in joint names.

Client Testimonial

Investing in a French SCPI that provides a yield has been a fantastic decision for me. From the very beginning, the team’s exceptional service made the entire process smooth and stress free. They were incredibly knowledgeable, providing clear and comprehensive information about the investment options and the benefits of SCPI.

The SCPI I invested in offers a diversified portfolio of commercial properties, which has given me confidence in the stability and potential growth of my investment. The quarterly income distributions have been consistent and substantial, significantly enhancing my financial security and providing a steady stream of passive income.

What stands out the most is the level of professionalism and support from the team. They have always been responsive to my queries, providing timely updates and detailed reports on the performance of my investment. This transparency has given me great peace of mind, knowing exactly how my investment is being managed and performing. I am thoroughly impressed with the consistent returns and the high-quality management of the properties within the SCPI.

Overall, my experience with this SCPI and the outstanding services provided by the team have been overwhelmingly positive. I would highly recommend this investment to anyone looking to diversify their portfolio, enjoy regular income distributions, and benefit from professional management.

Mary Springfield, Lyon

Why Invest With DTB Wealth Management?

DTB Wealth Management is qualified and experienced at providing a deeply knowledgeable and all-encompassing financial advice service to expats.

We want to grow our clients’ wealth and make investment as easy as possible by working with reliable management companies for long-term gains.

We’re proud of our affiliations and our ability to transform clients’ financial outcomes:

- Shareholders of esteemed VIA International network, a CGP (“profession libérale”) exercised by notaires, chartered accountants, lawyers and real estate agents.

- Members of Association National des Conseils Financiers (Anacofi), approved by the Autorité des Marchés Financiers (AMF), for our financial services.

- Members of the Autorité de Contrôle Prudentiel et de Résolution (ACPR) for our insurance activities.

- Advice covered by French professional indemnity (PI) insurance.

- Holders of CJA (Compétence Juridique Appropriée).

- Referenced by the UK’s Financial Conduct Authority (FCA).

Why We Make SCPI Investment Simple

COMPREHENSIVE CHOICE

We offer you a broad selection of the best-performing SCPIs on the market.

ADVICE TAILORED TO EXPAT LIFE

From organising joint ownership for smooth succession planning to making investment entry more accessible with monthly transfers, we are here to help our expat clients find the most suitable policy.

ONLINE SUBSCRIPTION

Sign up online via our website at any time – no printing necessary with all the support you need.

TRACKING FACILITY

On taking out an SCPI, you can track the performance of your units online through your personalised customer area containing the latest details.

What Does Investing With DTB Wealth Management Cost?

DTB Wealth Management will support you through the SCPI investment process free of charge because we are remunerated by the management companies. As part of our all-in-one financial service we also complete your SCPI return and annual French income tax documentation.

Case Study Examples

SCPI Joint Invesment

John and Jenny Moore, 65 and 60 years old respectively, are retired French tax residents and want to supplement their retirement pension with an income. They have €90,000 in capital.

Deciding to jointly invest in an SCPI with SCPI Remake Live, managed by Remake, they receive €1,752 in income per quarter, an estimated return of 7.79% (net of fees). Should anything happen to either of them, the SCPI and income remain, removing any worry

and hassle.

The flexibility of SCPI is such that their capital remains available in case of emergency and they can stop taking the income which will accumulate inside the SCPI.

If John and Jenny ever decide to go back to the UK, the SCPI will simply continue distributing its income without requiring any paperwork or action to be taken.

(Source: www.pierrepaper.fr)

SCPI Bare Ownership

If you are a high tax payer and don’t need to receive an income, bare ownership is a good way of growing your capital tax free. The income accumulates over a three, five, or ten-year period and is added tax free to your account at the end of the term. A full owner of the SCPI at that point, you can start taking an income.

For example, Jess has €100,000, but doesn’t need the income for five years. She can buy the bare ownership SCPI, receive no income and pay no tax for five years.

Once the policy is complete, the SCPI management company will immediately add the 25% (which was agreed in this case) to her capital. In 2029, therefore, Jess will have full ownership of a €125,000 SCPI because she received the €25,000 tax free.

From 2029 onwards, Jess receives a quarterly income, for as long as she likes, based on €125,000, when she originally invested €100,000 in 2024.

CONTACT

Discover the simplest and smartest way to invest in SCPIs by contacting us on:

Office: +33 (0)970 440 049

Mobile: +33 (0)6 72 34 48 50

WARNINGS

This SCPI guide is provided for information purposes only and does not constitute financial investment advice. All the information contained in this guide is non-contractual, provided for information purposes only and may be subject to change.

Investors must take into account their personal situation and objectives before making any investment and be aware that the purchase of SCPI units is a long-term investment. While shorter periods are possible a minimum of 10 years is recommended.

Note that the capital invested, the change in the unit price and the income or yield on units (known as the TD for Distribution Rate) are all relative concepts, and are in no way guaranteed. Past performance is no guarantee of future performance. Subscribers must take into account the subscription charges specific to each SCPI. These differ depending on whether you are investing in a variable capital or fixed capital SCPI. You should also take into account possible changes in your personal tax situation, which may change as a result of legislation.

HELPLINE:

HELPLINE: